On-chain data shows the Dogecoin volume and whale activity have plummeted recently, a possible indication that investors no longer have interest in the memecoin.

Dogecoin Transaction Volume And Whale Transaction Count Have Declined

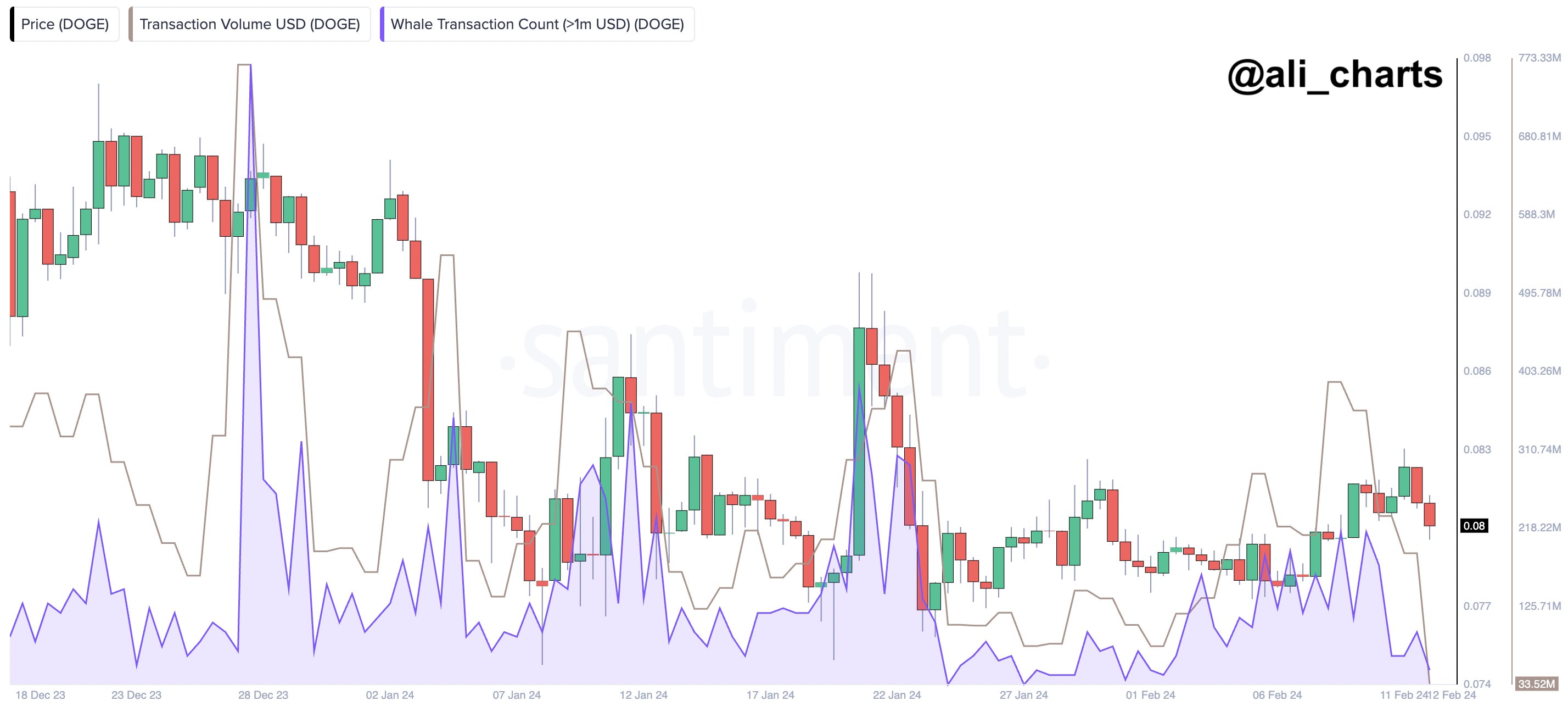

As pointed out by analyst Ali in a new post on X, DOGE trading activity has become lower recently. There are two on-chain metrics of relevance here: the Transaction Volume and Whale Transaction Count.

The former keeps track of the total amount of Dogecoin (in USD) involved in daily transaction activity on the network. A high value of this metric usually suggests that trading interest in the asset is high right now.

On the other hand, the low metric implies not many traders are paying attention to the memecoin currently as little volume is transacted on the blockchain.

The other metric of interest here, the “Whale Transaction Count,” measures the total number of transfers on the network that are at least $1 million.

Unlike the Transaction Volume, which provides information about the network in general, the Whale Transaction Count specifically tells us about the activity being displayed by the whales.

The whales are the largest entities on the chain, so they can hold some influence in the market. As such, their activity can affect cryptocurrency in one way or another.

Now, here is a chart that shows the trend in the Dogecoin Transaction Volume and Whale Transaction Count over the last few months:

As displayed in the above graph, both the Dogecoin Transaction Volume and Whale Transaction Count have recently seen a drawdown towards relatively low levels. This would imply that interest in the asset from both the whales and retail investors may have waned in the memecoin.

Generally, when buying and selling activity is high, DOGE is likelier to display some volatility. The chart shows that the volatile moves the coin has observed recently all saw the metrics register spikes.

Since Dogecoin isn’t observing that many transactions at the moment, it’s possible that the cryptocurrency’s price will continue to range in the coming days.

Any ignitions in the indicators can be to look out for, however, as they may be a predictor for a sharp move in the price. As these metrics only track whether trading activity is occurring rather than if buying or selling is taking place, any volatility arising from these spikes can take the price in either direction.

DOGE Price

While Bitcoin and other top digital assets have enjoyed profits recently, Dogecoin has slumped sideways, with returns standing utterly flat in the past week.

Currently, DOGE is trading around the $0.08 level, as the chart below shows.

Due to Dogecoin’s recent poor performance, it lost its spot in the top 10 cryptocurrencies by market cap list to Chainlink (LINK). If the coin’s struggle continues, it might slip further down the list, as Tron (TRX) is lurking just behind the asset now.