The cryptocurrency market, notorious for its unpredictable nature, presents a complex picture for XRP. While the past week saw a positive surge of 15% in its value, whispers of a potential correction and the recent actions of major investors add another layer of intrigue.

However, the daily chart paints a contrasting picture, with a slight decrease of 0.5% at the time of writing. This mixed performance, coupled with XRP’s current market capitalization of over $35.2 billion, highlights the token’s volatile nature.

XRP: A Tale Of Two Charts And Conflicting Signals

XRP’s weekly chart reflects a steady climb, suggesting a long-term bullish trend. However, the daily chart, dipped in crimson, hints at a potential short-term price decline. This conflicting data leaves investors uncertain about the token’s next move.

Technical Outlook: Bullish

Technical analysts offer divergent perspectives. Some, like World of Charts, see a bullish triangle pattern forming, predicting a potential price surge of up to three times its current value. Others point to indicators like Bollinger Bands and Chaikin Money Flow, suggesting a possible pullback.

$Xrp#Xrp Finally Breaking Very Long Consolidation Of Symmetrical Triangle In 3 Days Timeframe Expecting Successful Breakout Soon Incase Of Successful Breakout Expecting 2-3x Bullish Wave In Midterm#Crypto pic.twitter.com/kGZTUpOReX

— World Of Charts (@WorldOfCharts1) March 5, 2024

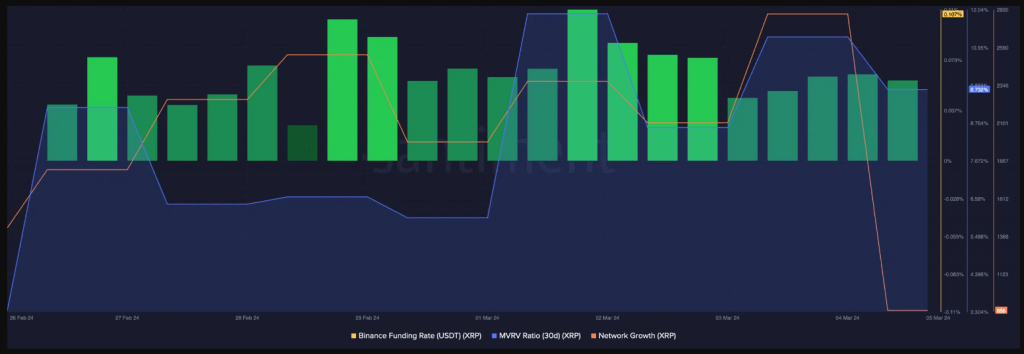

Beyond The Chart: Network Growth And Investor Sentiment

Looking beyond the technical jargon, some fundamental factors offer cautious optimism. The token’s network is experiencing significant growth, with new addresses joining the ecosystem at an impressive rate. Additionally, the positive sentiment surrounding XRP, reflected in its weighted sentiment metric, indicates that many investors remain bullish on its long-term prospects.

The Whale Stirs The Waters

The recent transfer of a massive chunk of XRP by a “whale,” a term used for large investors, has sent ripples through the crypto community. This significant movement, valued at over $27 million, serves as a reminder of the whales’ potential to influence market sentiment and price fluctuations.

Legal Pressures

Predicting the future of any cryptocurrency, especially a volatile one like XRP, remains a challenging endeavor. The current situation presents a complex picture, with bullish and bearish signals vying for dominance, and recent price fluctuations adding another layer of uncertainty.

Meanwhile, the court has granted the US Securities and Exchange Commission’s request to extend specific deadlines in the ongoing legal battle between Ripple Labs and the regulator.

This ruling has far-reaching consequences for the litigation, including things like when Ripple can submit its response and when remedies-related briefings are due. Each side needs more time to read and react to relevant legal papers and arguments, which is why these extensions are necessary.

Featured image from Pexels, chart from TradingView