Bitcoin (BTC) reached a new all-time high of $73,760 today, surpassing the previous record set just yesterday at $73,600. However, the top digital asset declined below $70,000 before rebounding to around $71,200 as of press time.

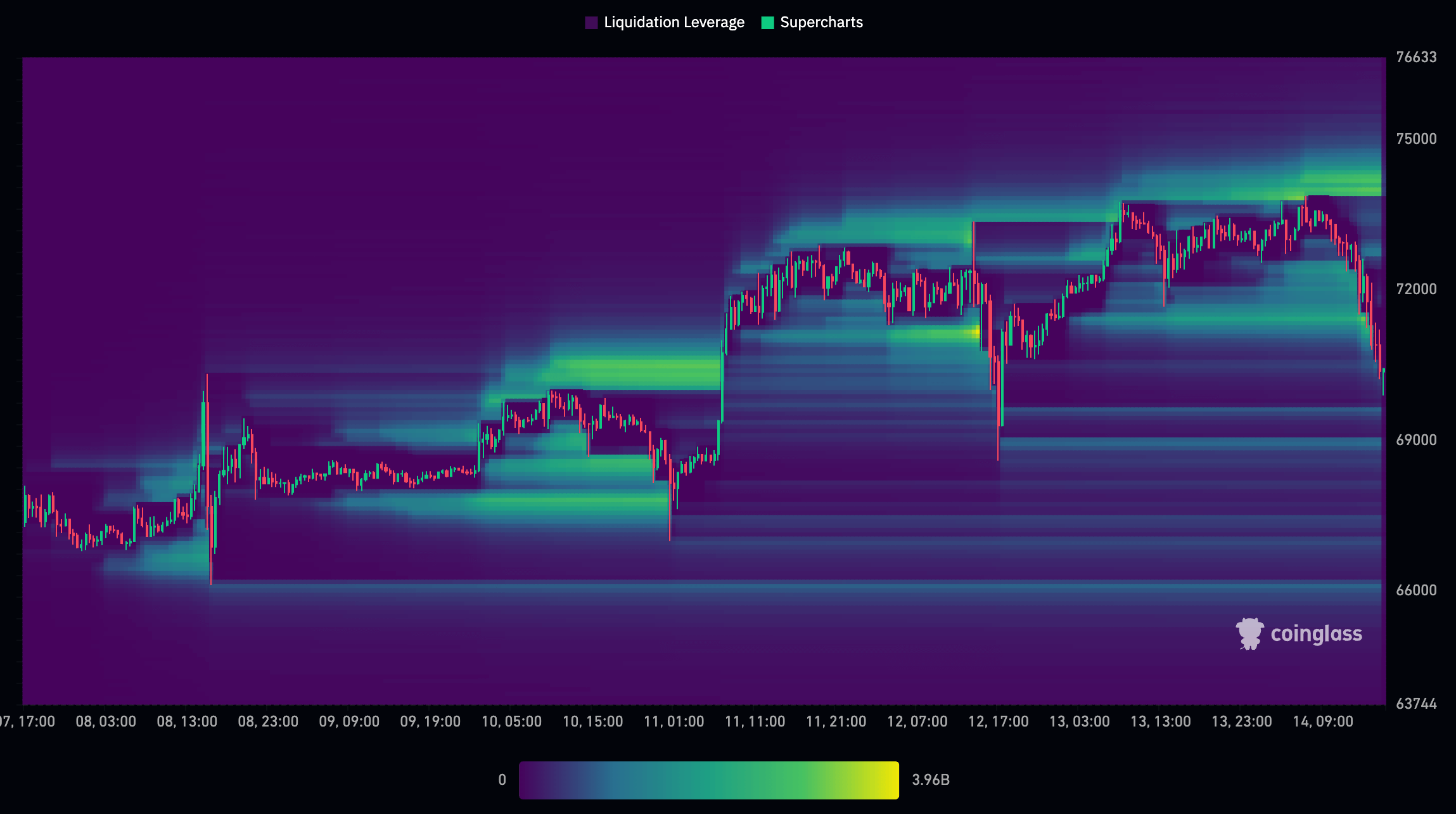

Notably, a significant amount of leverage is being flushed out on crypto exchanges like Binance and OKX, where traders can use up to 100x leverage. Per Coinglass, approximately $3 billion in leverage positions are open at the $74,000 price level, with an additional $2.8 billion at $73,900. Every $100 increment above $74,000 shows between $1-2 billion in open interest, suggesting a total of around $30 billion in notional leveraged short positions that could face liquidation if the price rebounds to this morning’s levels and pushes slightly higher.

It’s important to note that the actual collateral staked by traders is a fraction of the notional value, as leverage allows traders to open positions much larger than their initial investment. For example, a trader using 100x leverage could open a $100,000 position with just $1,000 in collateral.

In the past 24 hours, total crypto liquidations have reached $306.52 million, with $210.94 million in long positions and $95.58 million in short positions being forced to close. While this may seem small compared to the billions in notional leverage, it represents a significant amount of actual collateral being liquidated.

The high degree of leverage in the market indicates heightened volatility and risk as traders speculate on Bitcoin’s new price discovery phase. Similar swings have been identified recently, aligning with the US Market Open each time. As the digital asset continues to trade near record highs, the potential for substantial liquidations on either side of the market remains a key factor to monitor.

The post Over $300 million liquidated as $30 billion in leveraged shorts now cluster near $74k appeared first on CryptoSlate.