Solana’s SOL has surged to a new all-time high of 0.05797 against Ethereum, according to Tradingview data.

This price performance follows its recent surge above the $200 mark for the first time since November 2021, coinciding with the blockchain record-breaking network activity.

The price uptick has propelled Solana’s market capitalization to an unprecedented high of more than $91 billion, cementing its position as the fourth-largest digital asset by market cap.

As of press time, Solana was trading for $207, according to CryptoSlate’s data.

Solana DEX volume

Solana’s surge in value finds its roots in robust network activity, driven notably by the prevailing memecoin fervor.

DeFillama data reveals that Solana’s decentralized exchanges (DEX) trading volume stood at approximately $2.8 billion during the past day. This figure dwarfs the number recorded by Ethereum-based DEX during the same time frame.

This is not the first time Solana’s DEX trading volume has surpassed Ethereum’s in recent months.

Meanwhile, the top three DEXs in volume across all chains—Raydium, Jupiter, and Orca—are Solana-based, collectively commanding over 40% of the market share. Data from Dex Screener, an analytics platform monitoring decentralized exchange trading, also show that the top 35 assets by volume in the preceding 24 hours were memecoins based on Solana, including Snap, Book of Meme, Wen, dogwifhat, and Nostalgia.

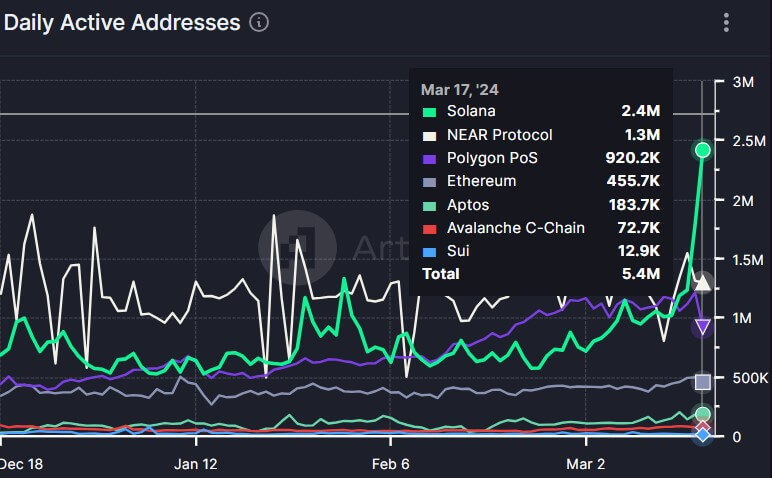

In addition, the network has outperformed every other chain in daily active addresses, with more than 2 million addresses interacting with the blockchain during the reporting period, according to Artemis data.

Solana Fees Remain Low

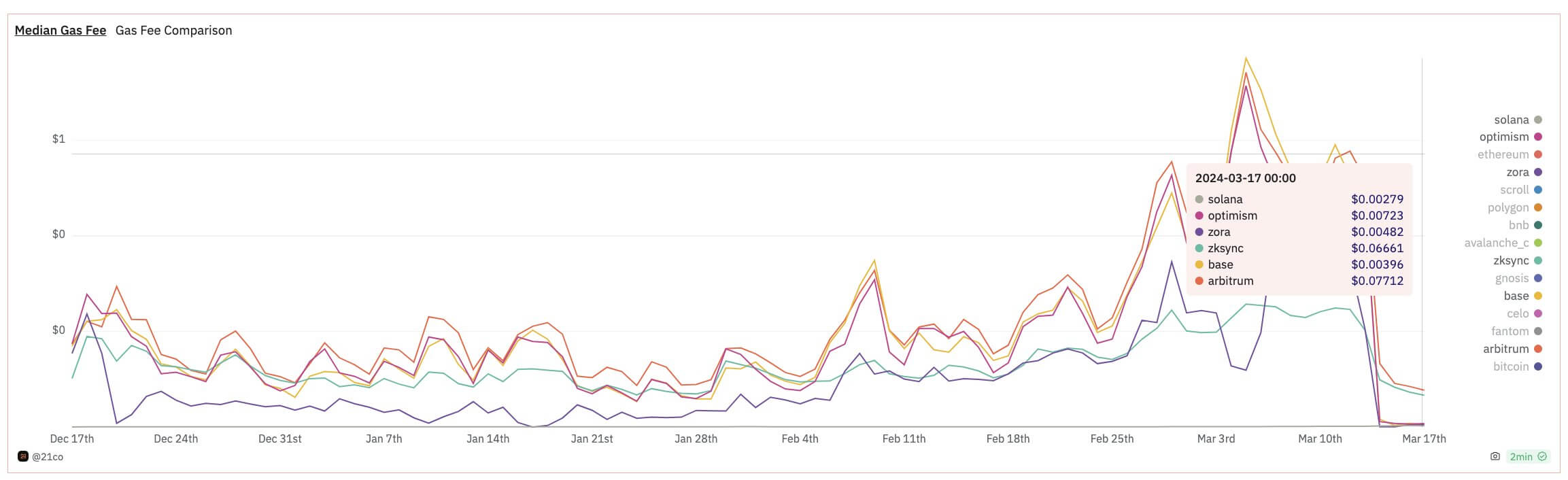

Despite the significant network activity, Solana has maintained its meager network fees compared to Ethereum and its layer-2 networks utilizing Blobs.

According to Tom Wan, an analyst at 21 Shares, the median gas fee on Solana stands at $0.0028, notably cheaper than the $0.004 to $0.077 range recorded on Ethereum’s layer-2 networks following the Dencun Upgrade integration.

Last week, Ethereum recently concluded the Dencun upgrade to reduce transaction fees drastically. While the upgrade did result in fee reductions, Solana’s fees remain substantially lower.

Market observers suggest that these minimal fees could position Solana-based projects as viable alternatives to those on Ethereum.

The post Solana establishes new all-time high against Ethereum with robust DEX trading activity appeared first on CryptoSlate.