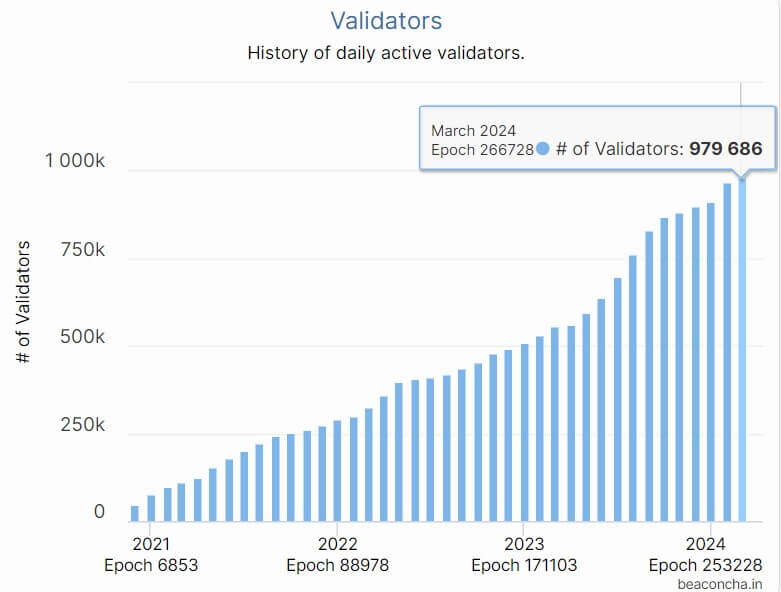

The Ethereum network has witnessed a surge in validator numbers, with the count nearing one million.

On-chain data from Beacon Chain and Ethereum’s Validator Queue show an active validator count of 979,686. However, a Dune Analytics dashboard curated by Dragonfly analyst Hildobby places the total number on the network above the one million mark.

These validators have collectively staked 31.36 million ETH, constituting approximately 26% of the digital asset’s total supply.

Notably, according to Nansen data, most of these validators staked their assets through the liquid staking platform Lido, which accounts for around 30% of the staked ETH.

Ethereum validators play a critical role in maintaining the network’s security through its proof-of-stake mechanism. To participate, they stake a minimum of 32 ETH and, in return, are rewarded with a portion of ETH.

Consequently, an increasing number of validators signifies a bolstered network and reflects the blockchain’s enhanced security.

Meanwhile, this milestone is particularly significant amid a surge in validator interest, evidenced by a growing queue of over 10,000 validators awaiting network entry—the highest seen this year. This waitlist represents over 320,000 ETH, equivalent to $1.1 billion, and is anticipated to clear within the next seven days.

Decentralized staking

Vitalik Buterin, the co-founder of Ethereum, recently put forth a proposal aimed at improving the network’s staking mechanism.

In his blog post, Buterin outlined a plan to impose penalties on validators in proportion to their average failure rates. This move addresses the inherent advantage larger ETH stakes possess over smaller ones.

Additionally, Buterin recommended stricter penalties for failures occurring simultaneously among several validators controlled by one entity.

According to him:

“One tactic for incentivizing better decentralization in a protocol is to penalize correlations. That is, if one actor misbehaves (including accidentally), the penalty that they receive would be greater the more other actors (as measured by total ETH) misbehave at the same time as them.”

Buterin argued that these measures would encourage larger entities to diversify their operations, thus lowering the likelihood of widespread network failures.

The post Ethereum nears 1 million active validators as network surge strengthens security appeared first on CryptoSlate.