According to on-chain data analysis by Glassnode, Bitcoin is at a critical juncture. When BTC soared to $73,800 in March 2024, printing new all-time highs, the Bitcoin market reached a statistically significant level regarding on-chain unrealized profits, according to the Market Value to Realized Value (MVRV) ratio.

Bitcoin MVRV Ratio At Historically Significant Level: Time To Hold Or Take Profit?

The analytics platform notes that, historically, such levels have coincided with periods of market resistance. Therein, some holders often choose to take profits by exiting their positions.

It remains to be seen whether the same will be replicated, and prices fall as holders make a profit. However, according to MVRV, this will likely happen if past performance guides.

Simply put, the MVRV ratio shows how expensive the coin is relative to historical prices. It is a tool for gauging whether Bitcoin, as it is at spot rates, is under or overvalued. When the ratio is above 1, it suggests that it is overvalued.

When BTC rose to approximately $74,000, the MVRV ratio rose above 3. However, it should be noted that it was way lower than historical levels when Bitcoin registered new all-time highs. When BTC rose to $69,000 in 2021, the MVRV ratio was over 5. At the 2017 peak, this value was over 4.8, which is the highest it has been.

BTC Has Been Under Pressure, Will Prices Recover?

Recently, Bitcoin has struggled to edge higher, looking at price action in the daily chart. The coin remains below all-time highs of $73,800. Even though bulls shook off selling pressure over the weekend, pushing strongly above resistance levels, the follow-through has not been impressive.

Any breakout above $74,000 from the candlestick arrangement will thrust the coin into new territory. Some analysts speculate the coin might float to as high as $100,000 in 2024, especially after the network halves its miner rewards in April 2024.

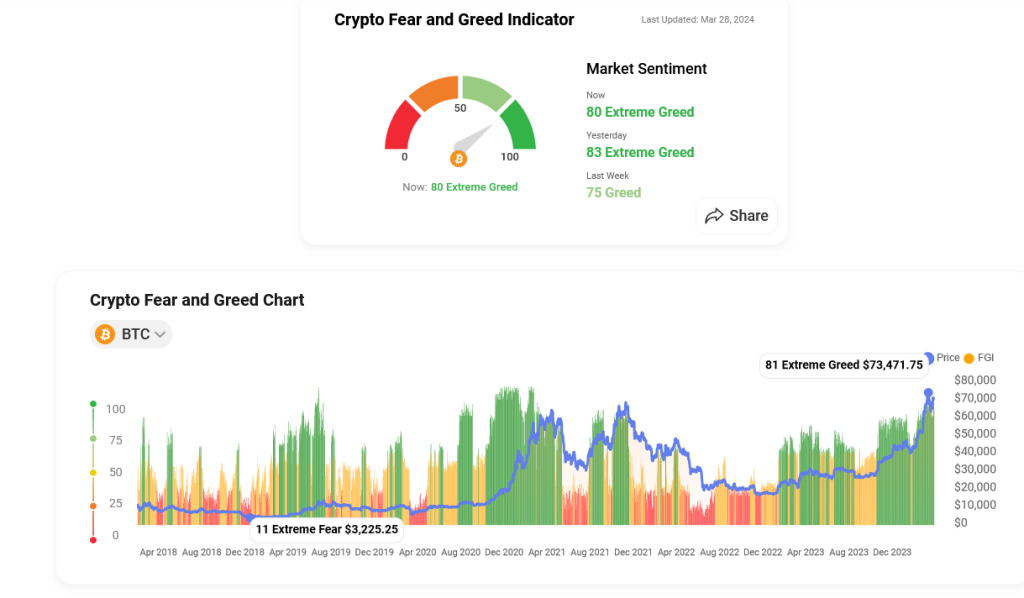

Despite the recent sell-off pushing prices to around $62,000, the overall market sentiment remains bullish. The CoinStats Fear and Greed Index, a gauge of investor sentiment, still reads “Extreme Greed” at 80.

Additionally, interest is back after days of outflows from spot Bitcoin exchange-traded funds (ETFs). By March 27, Lookonchain data shows that Fidelity added added 4,001 BTC. In total, and factoring in GBTC’s outflow, all spot Bitcoin ETF issuers added 3,469 BTC.