Quick Take

Bitcoin has experienced a notable downturn in recent days. It is currently trading around $63,000, approximately 15% below its all-time high. The past five days have seen a 10% decline, causing concern among investors.

Various factors, such as the US Consumer Price Index (CPI) surpassing expectations and escalating geopolitical tensions in the Middle East, have propelled US yields across the curve and pushed the DXY index above 106.

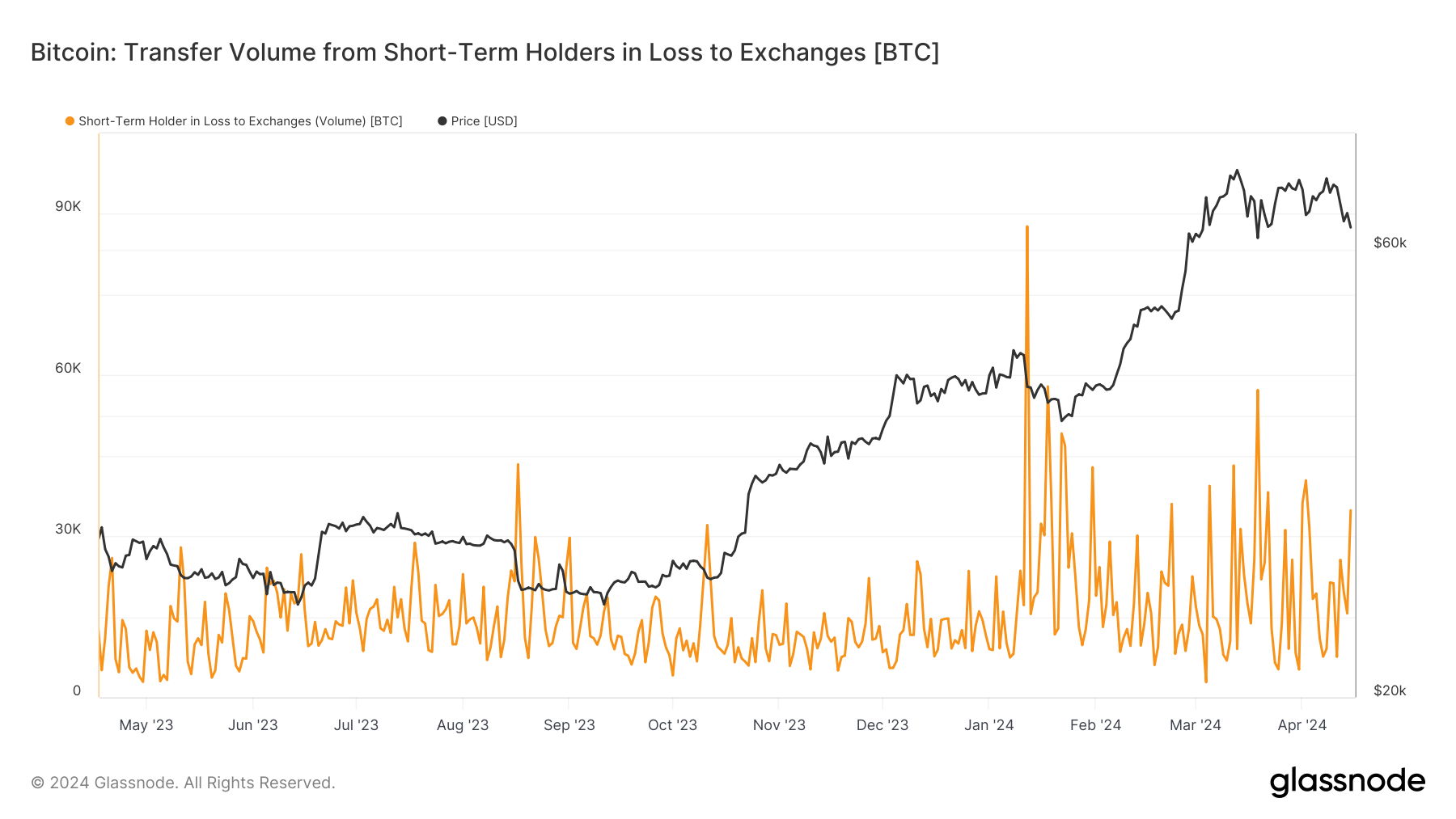

During this drawdown, the market has witnessed high liquidations, particularly on the long side, in addition to coins flowing back onto exchanges. Short-term holders (STHs), defined as investors who have held Bitcoin for less than 155 days, have been selling at a loss due to fear of price declines.

Data from Glassnode shows that on April 15, roughly 35,000 Bitcoin ($2.3 billion) were sent to exchanges at a loss by STHs, marking the largest amount since April 2. This spike in fear-driven selling often indicates a local bottom.

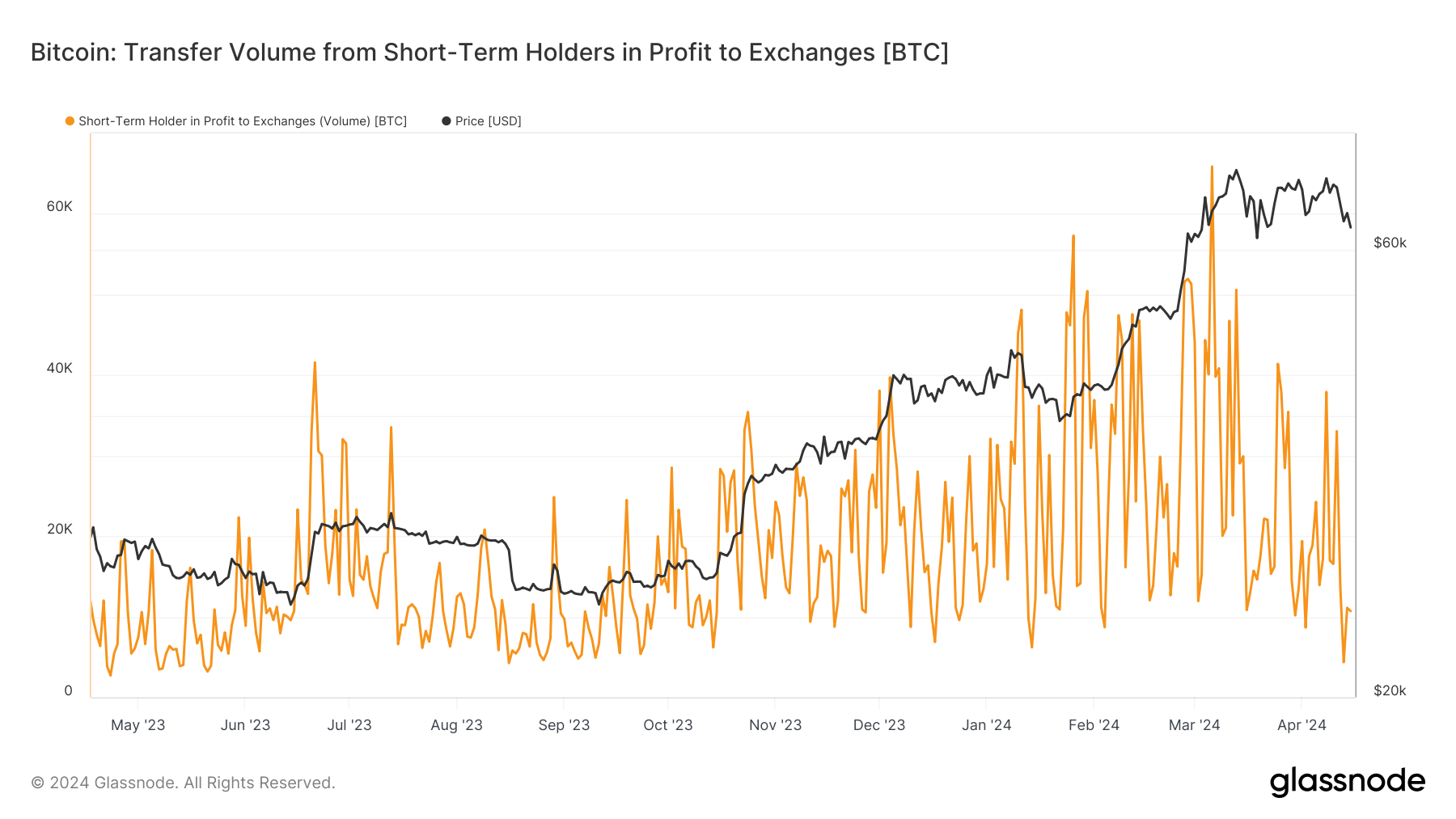

Moreover, the number of STHs in profit almost hit a one-year low over the weekend, with only 4,400 Bitcoin ($290 million) remaining profitable. This suggests that STHs are not in a position to take profits and are instead experiencing significant losses.

The post Short-term holders spark Bitcoin sell-off: Over $2 billion shed at loss to exchanges appeared first on CryptoSlate.