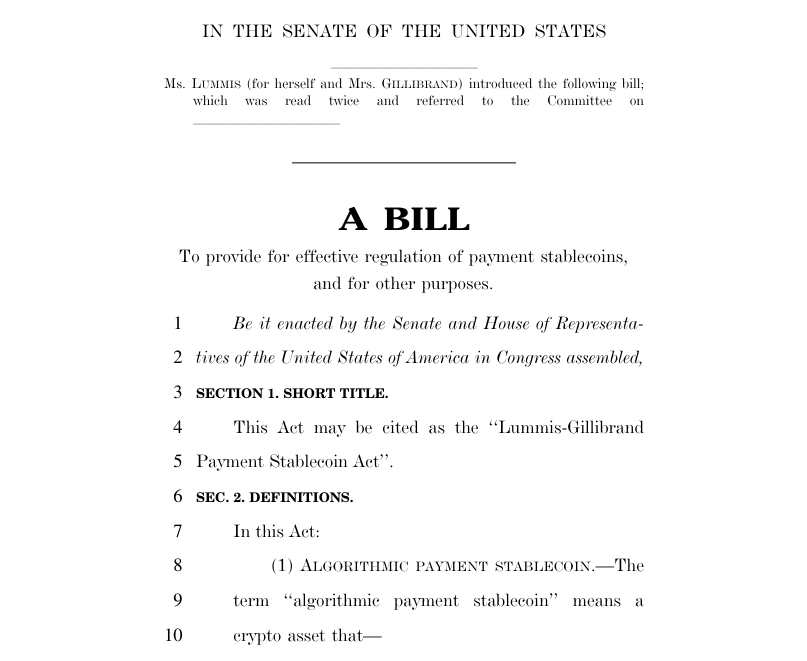

In a landmark move aimed at bringing stability and oversight to the rapidly expanding world of digital finance, US Senators Kirsten Gillibrand and Cynthia Lummis have unveiled the Lummis-Gillibrand Payment Stablecoin Act. The legislation, which has been in the works for months, seeks to establish a comprehensive regulatory framework for payment stablecoins, addressing concerns surrounding their use and potential risks.

Bipartisan Effort To Tackle Stablecoin Regulation

The introduction of the Lummis-Gillibrand Payment Stablecoin Act marks a significant bipartisan effort to address the regulatory challenges posed by stablecoins. With senators from both sides of the aisle coming together, there is a clear recognition of the need to strike a balance between fostering innovation in the digital finance space and ensuring adequate safeguards are in place to protect consumers and maintain the stability of the US dollar.

Promoting Responsible Innovation And Protecting Consumers

Central to the proposed legislation is the aim to promote responsible innovation while safeguarding the interests of consumers. By requiring one-to-one reserves for stablecoin issuers and establishing state and federal regulatory regimes, the bill seeks to create a transparent and accountable environment for stablecoin operations. This move is expected to instill confidence among users and investors while mitigating the potential risks associated with unbacked or algorithmic stablecoins.

I’m proud to join @SenLummis to introduce the Payment Stablecoin Act.

Passing a regulatory framework for stablecoins is critical to protecting consumers, promoting responsible innovation, and cracking down on money laundering and illicit finance. https://t.co/UP9pk0uQkt pic.twitter.com/lIqA3rwQXN

— Sen. Kirsten Gillibrand (@gillibrandny) April 17, 2024

The legislation also addresses concerns surrounding illicit activities and money laundering, with provisions aimed at preventing such activities within the stablecoin ecosystem. Senator Gillibrand emphasized the importance of passing a regulatory framework to crack down on illicit finance and maintain the dominance of the U.S. dollar in the global financial landscape.

Incorporating Stakeholders And Ensuring Proper Custody Practices

One notable aspect of the Lummis-Gillibrand Payment Stablecoin Act is its inclusion of various stakeholders in the regulatory process. State non-depository trust companies and authorized institutions would be allowed to issue stablecoins under specified conditions, promoting diversity and competition within the industry while ensuring adherence to regulatory standards.

Stablecoins: Addressing Concerns And Building Consensus

While the introduction of the Lummis-Gillibrand Payment Stablecoin Act represents a significant step forward in the regulation of stablecoins, challenges remain. Concerns from lawmakers, such as Senator Sherrod Brown, underscore the need to address various issues and build consensus within the legislative process.

Nevertheless, the unveiling of this legislation signals a growing acknowledgment of the importance of stablecoin regulation in the United States. As discussions continue and stakeholders engage in dialogue, the aim remains clear: to create a regulatory framework that promotes innovation, protects consumers, and ensures the stability and integrity of the financial system in the digital age.

Featured image from Xank, chart from TradingView