On-chain data shows that Ethereum transaction fees have dropped to their lowest level since January, a sign that a bottom could be close.

Ethereum Transfer Fees Has Plunged As Network Has Gone Cold

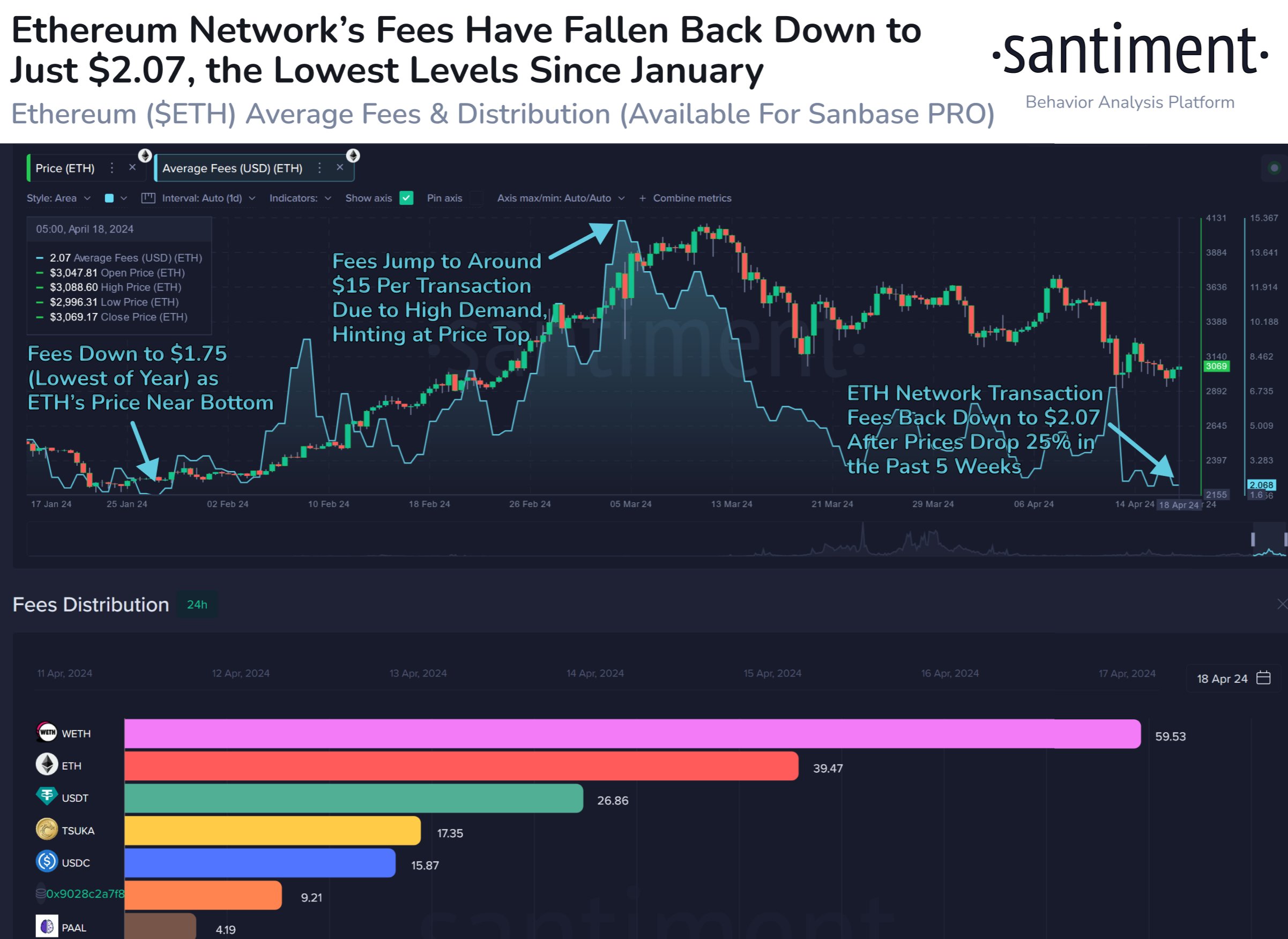

According to data from the on-chain analytics firm Santiment, Ethereum transaction fees have taken a notable hit recently. The “transaction fees” here refer to the average fees (in USD) that senders on the ETH network are currently attaching to their transfers.

This metric’s value generally reflects the traffic conditions the blockchain is witnessing. When many users are making moves on the network, the average fees tend to go up.

This is a result of the blockchain’s limited capacity to process transactions, which can cause the network to get clogged during periods of high activity and cause transactions to wait for a while.

Users who don’t want to deal with the wait times attach a high fee to their transfers, allowing the validators to prioritize their moves. As many senders compete against each other like this, the average can quickly blow up, and blockspace can become more precious.

When the Ethereum blockchain is observing little activity, though, the transaction fees may remain low, as the users wouldn’t have much incentive to go for any significant fees.

Now, here is a chart that shows the trend in the Ethereum average fees over the last few months:

As displayed in the above graph, Ethereum transaction fees have slumped recently and hit a low of just $2.07. This is the lowest value that the metric has touched since January of this year.

This cooldown in fees would imply that the network activity for cryptocurrency has dissipated. Traffic is usually interlinked with the mood around the asset; as Santiment explains:

The market historically moves between sentimental cycles of feeling that crypto is going “To the Moon” or feeling that “Crypto is Dead”, which will very often be observed through transaction fees.

A lack of activity on the network suggests the investors may not be too interested in the coin at the moment. This, however, may not be bad news for the asset’s price.

According to the analytics firm, low average fees tend to coincide with bottoms in Ethereum, while peaks of the metric may occur alongside top formations.

As the chart shows, ETH’s price was near a bottom in January when the fees last hit a low of $1.75. Similarly, the indicator spiked to $15 in the leadup to the top last month.

It now remains to be seen if a similar pattern will play out this time around, and whether Ethereum will now approach a bottom.

ETH Price

Ethereum had plunged under $2,900 earlier, but the asset seems to have rebounded as its price recovered to $3,100.