On-chain data shows the number of big money investors has gone up for XRP recently, something that could be bullish for the coin’s price.

XRP Holders With At Least 1 Million Tokens Are Back Near All-Time High

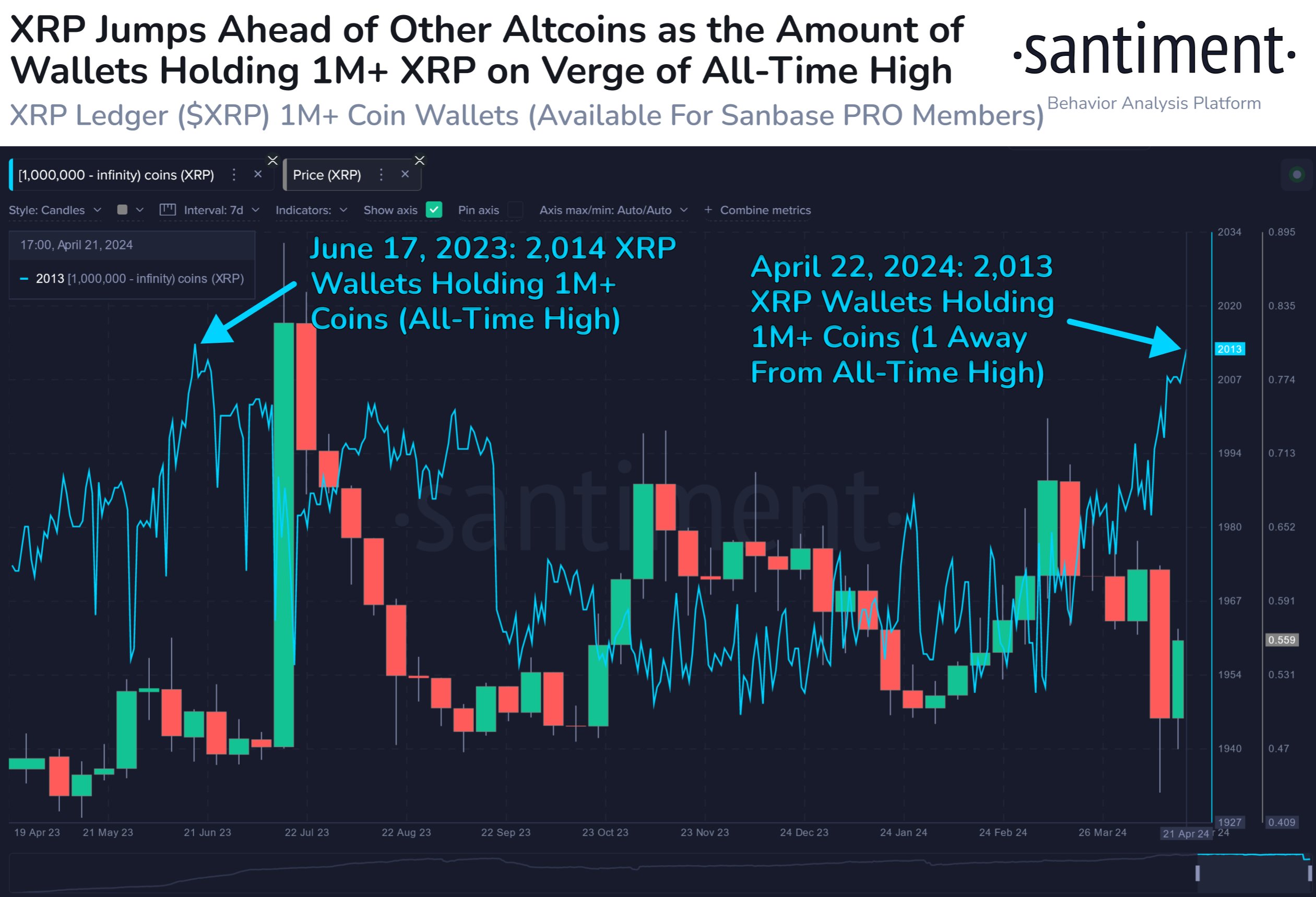

According to data from the on-chain analytics firm Santiment, the amount of XRP wallets carrying at least 1 million coins has been surging recently. The indicator of interest here is the “Supply Distribution,” which keeps track of the total number of addresses that belong to the different wallet groups.

The addresses are divided into these cohorts based on the amount of the asset that they are carrying in their balance right now. The 1 to 10 coins group, for instance, includes all investors who own between 1 and 10 XRP.

In the context of the current discussion, the addresses holding 1 million or more coins are of interest (with the upper limit being infinity). At the current exchange rate, this lower limit is worth around $544,300, so the investors belonging to this group would be those with some significant holdings. The whales, as well as the larger of the sharks, would fall into this range.

The below chart shows how the Supply Distribution for addresses in this range has changed over the past year:

As displayed in the above graph, the XRP addresses carrying at least 1 million tokens have seen their count rise over the last few weeks. There are now 2,013 wallets that fall into this range, just 1 shy of the all-time high value set back in June.

The fact that the indicator’s value has been going up recently suggests that some big money has been entering into the cryptocurrency. Naturally, this could be a constructive sign for the coin’s price.

The trend of big money accumulation is also visible from another angle: the total amount of holdings held by the whales. As the chart shared by analyst Ali in an X post shows, these entities carrying between 10 million and 100 million XRP have been buying recently.

From the graph, it’s visible that a lot of this accumulation has come after the recent plunge in the cryptocurrency’s price, suggesting that these humongous investors have been buying the dip.

In just the past week alone, the XRP whales have loaded up 31 million tokens, worth almost $17 million. Since these latest buys have come, the asset’s price has registered some recovery, implying that the accumulation may already be paying off for some of these giants.

It now remains to be seen if this recovery would lead towards a proper return for the rally, given the buying push the whales have been applying recently.

XRP Price

At the time of writing, XRP is floating around $0.54, up over 11% in the past seven days.