Quick Take

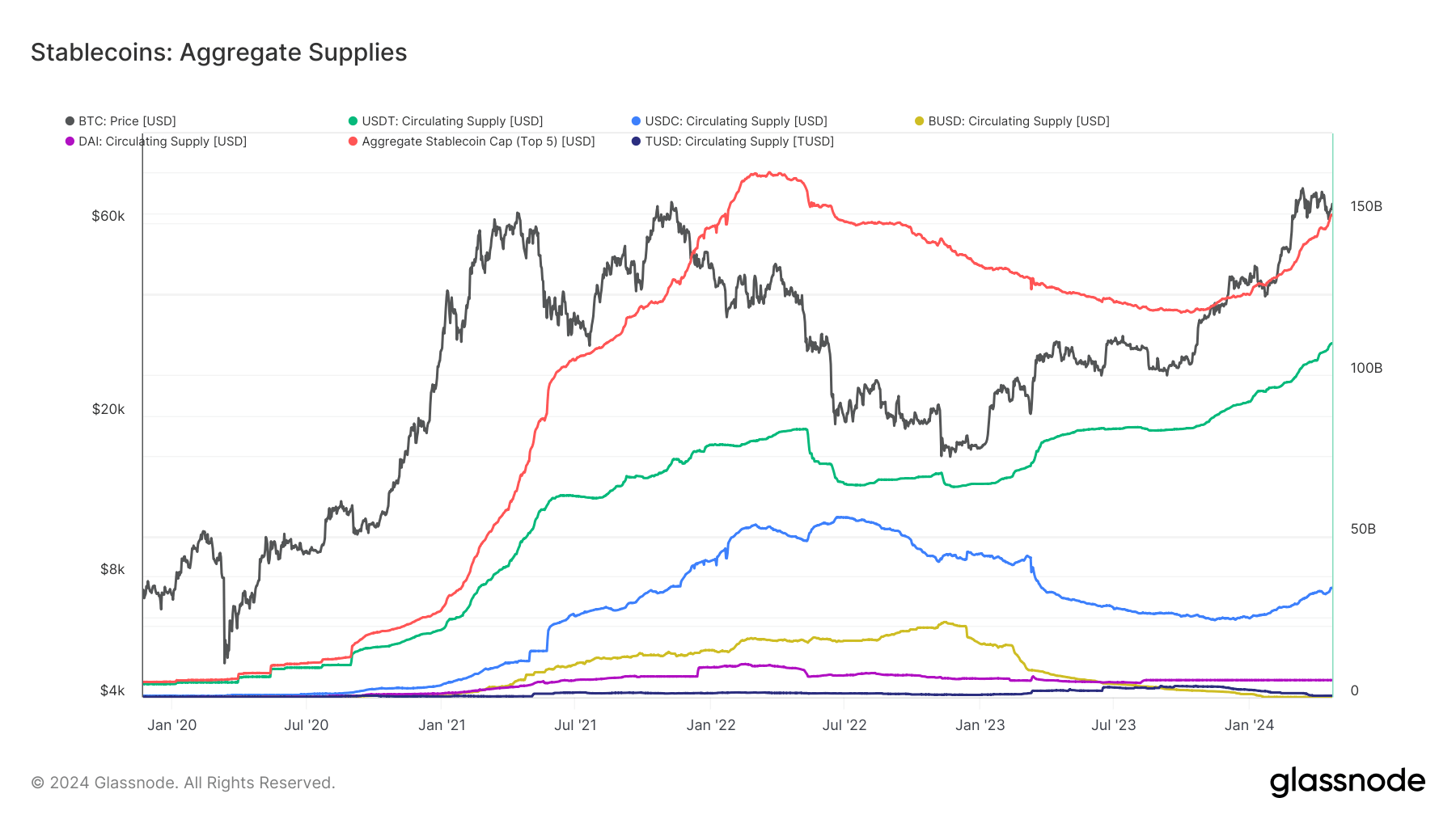

The aggregate supply of the top five stablecoins has reached $150 billion in market capitalization, with USDT (Tether) and USDC (USD Coin) leading the pack at $110 billion and $34 billion, respectively. BUSD, DAI, and TUSD make up the remaining $6 billion, with DAI at around $5.3 billion.

Since the start of the Bitcoin bull run in October 2023, the leading digital asset has seen a roughly 140% increase in value, while the aggregate stablecoin market cap has grown from $120 billion to $150 billion, just $10 billion shy of its all-time high. USDT alone has experienced an increase from $83 billion to $110 billion.

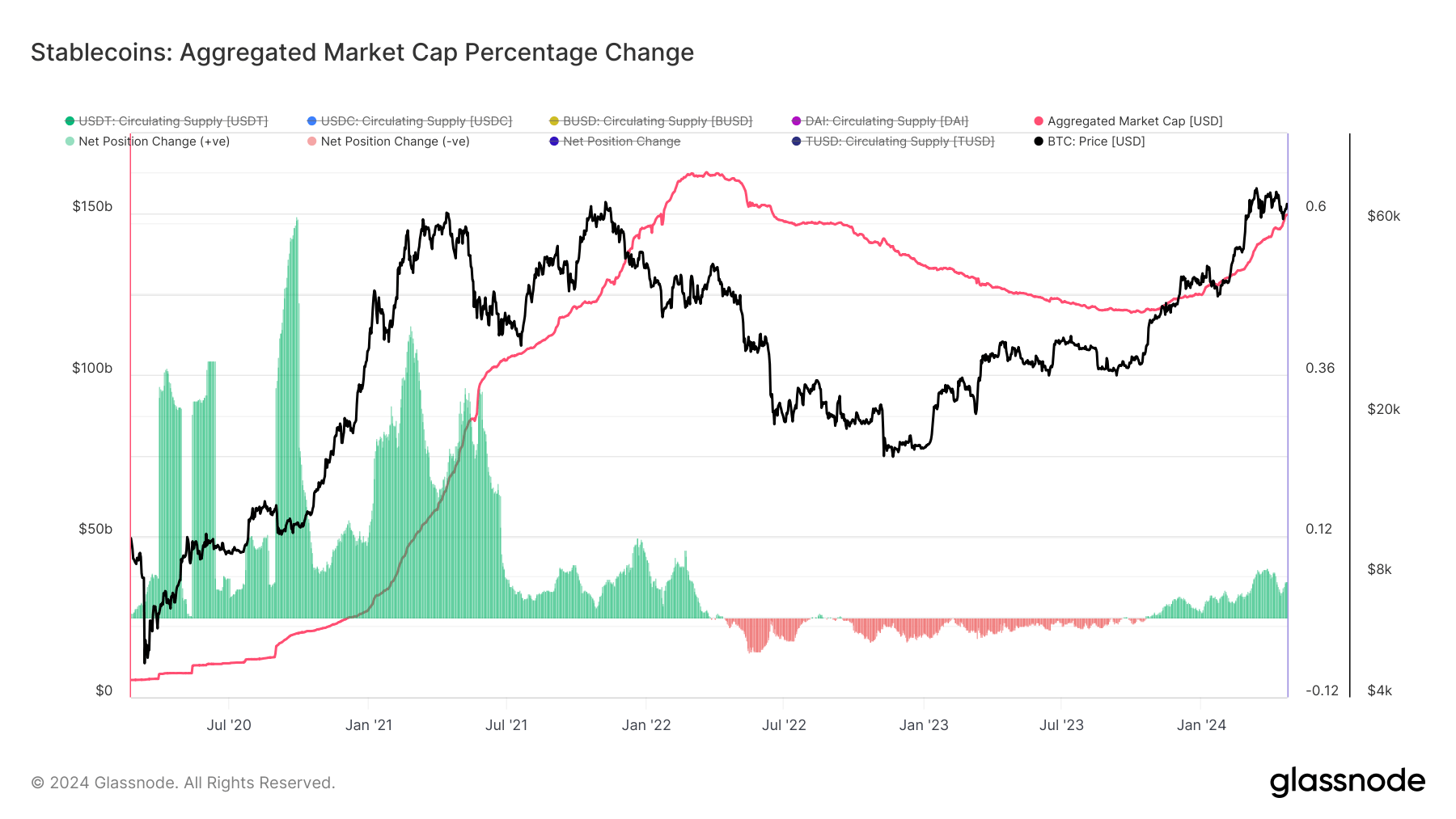

In the past 30 days, the top five stablecoins have witnessed a 5% increase in supply, slightly lower than the March high of 7%. Compared to the 2021 bull run, where Bitcoin rose from $10,000 to $64,000 between Q4 2020 and April 2021, the stablecoin supply increased by 40 billion in six months.

The ongoing bull run since October 2023 has seen a notable surge in stablecoin market capitalization by $30 billion. However, this increase has been more moderate than the previous run, which experienced a 30-day rise of 40% on multiple occasions.

The post Top five stablecoins near all-time high with $150 billion market cap appeared first on CryptoSlate.