On-chain data shows that Bitcoin and Dogecoin have managed to top the charts regarding holder profitability. Here’s what the ranking looks like.

Bitcoin & Dogecoin Are Among Coins With Highest Investor Profitability Ratio

In a new post on X, the market intelligence platform IntoTheBlock talked about how holder profitability compares between some of the top layer-1 networks in the sector.

Here, holder profitability refers to the total percentage of investors or addresses on a given cryptocurrency network that are currently carrying some net unrealized gains.

This metric works by going through the transaction history of each address on the blockchain to find the average price at which it acquired its coins. If this average cost basis for any holder is less than the current spot price of the asset, then the investor is assumed to be holding profits.

The indicator sums up all such addresses and finds what percentage of the total they make up for. Naturally, the investors with their cost basis higher than the current price are counted under losses instead, and those with the two being equal are considered to be just breaking even.

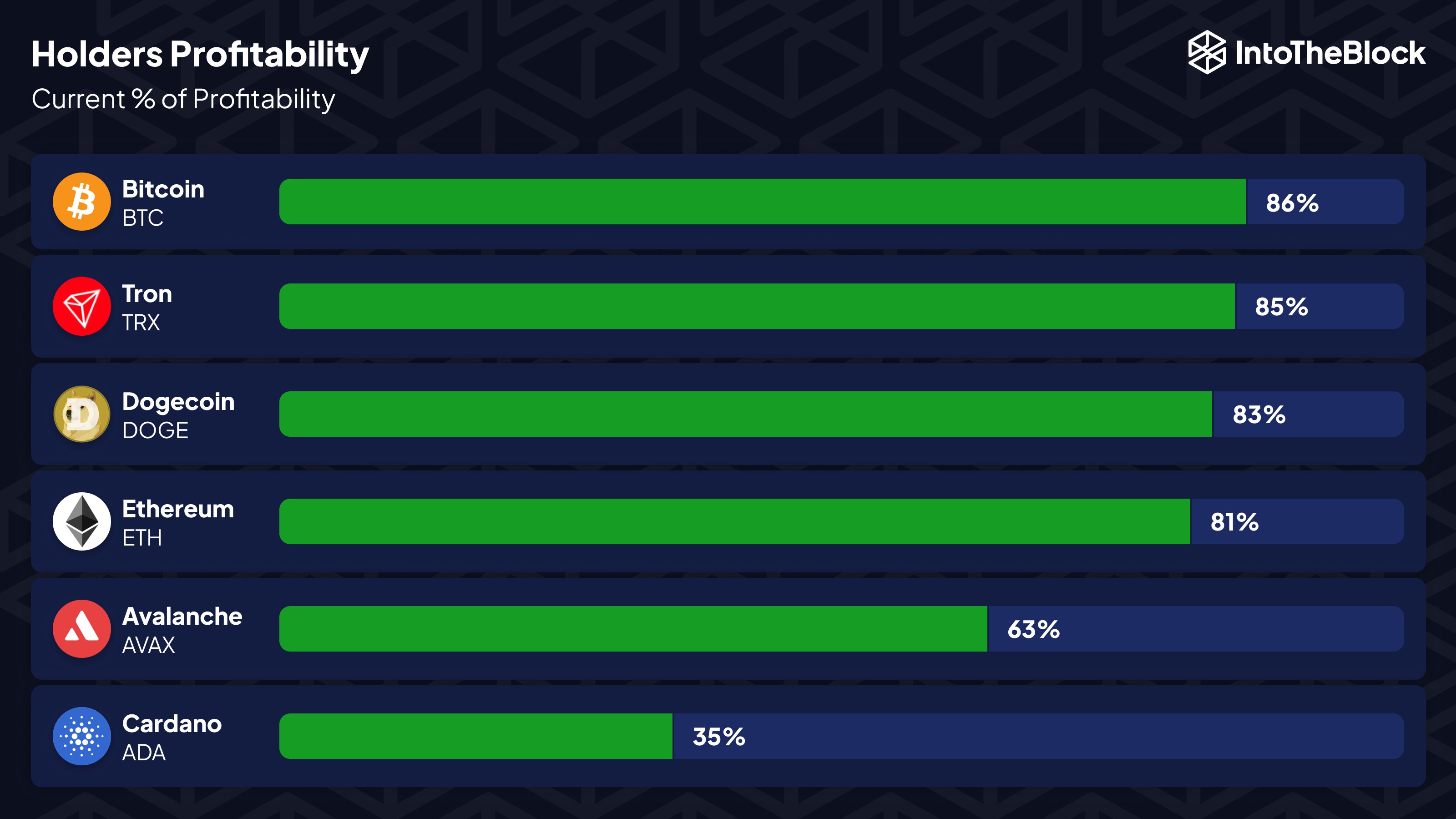

Now, here is what the holder profitability looks like across six top coins: Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), Cardano (ADA), Avalanche (AVAX), and Tron (TRX).

As the graph shows, Bitcoin is currently the number one cryptocurrency in terms of holder profitability, with 86% of its addresses in the green. Tron is second with 85%, while Dogecoin is third with 83%.

These assets have beaten Ethereum in this metric despite the asset being the second largest in the network based on the market cap. Though, at 81% profitability, ETH isn’t too far behind.

The situation looks much worse for the Avalanche and Cardano investors, with the latter network being especially dire. 63% of AVAX investors are in profit right now, so at least most of them are in the green, but the same can’t be said about ADA, as just 35% of holders float above water.

Generally, the investors in profits are more likely to participate in selling at any point, so the risk of mass selloffs can increase as holder profitability increases.

Coins like Bitcoin and Dogecoin have profitability at high levels, but this isn’t uncommon for bull markets. Profitability can stay even more extreme in such periods, so the current levels may be slightly cooled off.

Like how tops have historically been more probable to form at extreme profitability levels, bottoms can occur when a low percentage of the investors are in the green, as profit-sellers exhaust at this stage.

Going by this, Cardano’s low profitability (and also Avalanche’s, to a degree) may be a positive sign for the price, as it suggests there could be notable potential for a rebound.

BTC Price

Bitcoin has retraced the recovery it had made earlier in the week as its price has now slid down towards $63,200.