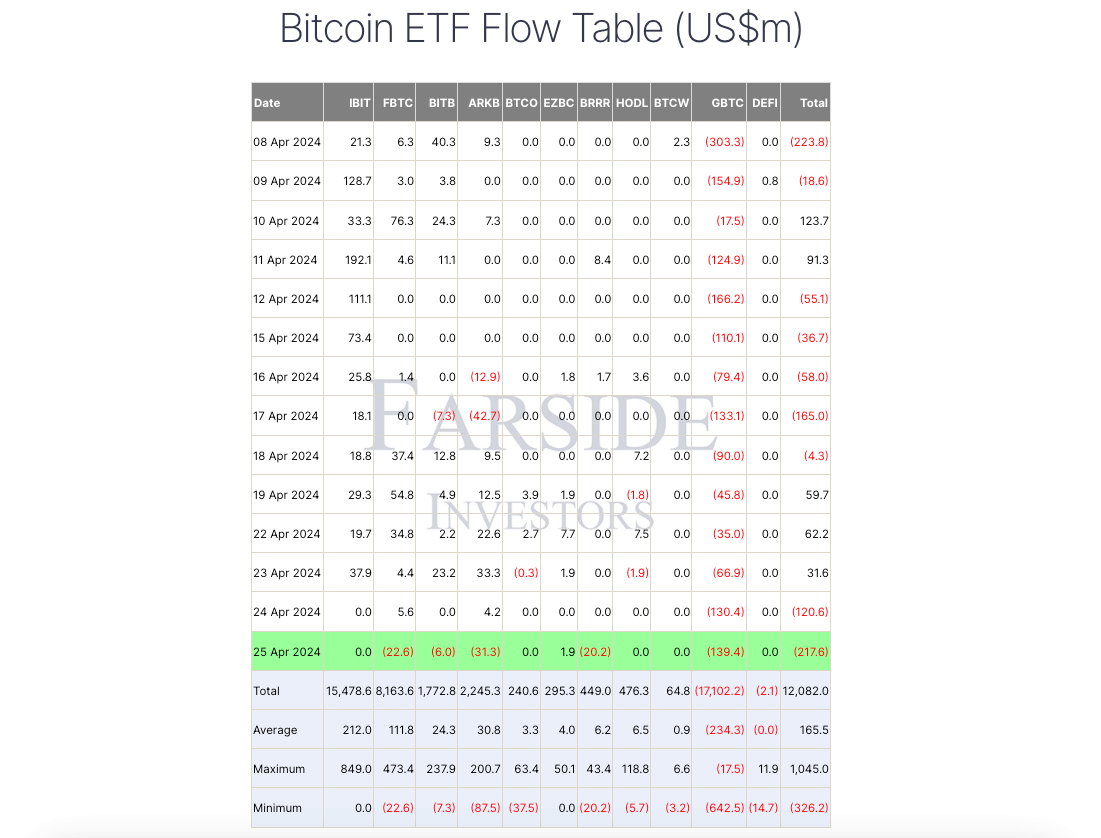

Investor interest in spot Bitcoin exchange-traded funds (ETFs) appears to be waning, with outflows totaling $218 million in the past day.

According to data from Farside Investors, BlackRock’s IBIT Bitcoin ETF experienced its second consecutive day of zero flows, while Fidelity’s FBTC saw its first daily net outflow, totaling $23 million.

Other US Bitcoin funds experienced notable daily outflows. Grayscale GBTC fund continued its outflow trend, losing $139.37 million, while $31.34 million exited Ark Invest and 21Shares’ ARKB fund. Additionally, Valkyrie’s fund experienced $20.16 million in outflows, and Bitwise saw a negative flow of $6 million.

In contrast, Franklin Templeton’s EZBC emerged as the only fund with daily net inflows, attracting $1.87 million.

Despite these significant outflows, net inflows into the ETFs have surpassed $12 billion since their launch in January.

Why are Bitcoin ETFs seeing outflows?

Earlier in the week, James Butterfill, CoinShares’ Head of Research, explained that these outflows signal waning interest among ETP/ETF investors, fueled by speculations about potential delays in rate cuts by the Federal Reserve.

Meanwhile, some market experts noted that the slowdown was necessary for the market to take a breather. Bloomberg Senior ETF analyst Eric Balchunas reported that Fidelity’s FBTC and BlackRock’s IBIT had broken records for the highest net assets within the first 72 days of launch.

He said:

“The league of own-ness of IBIT, FBTC et al shows how overheated it all was, a breather was overdue to be honest.”

Fidelity FBTC and BlackRock IBIT are particularly noteworthy as they are market leaders, collectively managing over $27 billion in assets.

However, there’s anticipation surrounding Morgan Stanley’s reported plan to allow its 15,000 brokers to recommend spot Bitcoin ETFs to clients, which could potentially reignite interest in the market.

The post Investor exodus from Bitcoin ETFs as BlackRock and Fidelity see significant outflows appeared first on CryptoSlate.