ZkSNACKs, developer of privacy-preserving Bitcoin wallet Wasabi Wallet, has announced that users from the United States will be blocked from accessing its products and platforms until further notice. This move has sparked interesting discussions and speculations in the crypto community, with many debating its connection to the recent arrest of Samourai Wallet’s founders.

Why Did Wasabi Wallet Block US Users?

On Saturday, April 27, zkSNACKs revealed via a blog post that citizens and residents of the United States will be barred from visiting its websites and using the Wasabi Wallet indefinitely. The software company will also disable other services and products, such as APIs and RPC interfaces.

The statement read:

“U.S.” refers to “United States” and includes the several states of the United States and related territories. If you are a United States Citizen or United States Resident, you are not allowed to visit any sites aforementioned, download Wasabi Wallet or use the Wasabi Wallet coinjoin feature. This includes if you are a U.S. permanent resident or if you are an individual that holds a U.S. passport.

In the blog post, zkSNACKs highlighted “recent announcements” by the US authorities as its primary reason for this decision. While it is difficult to pinpoint the exact announcement the company was referring to, their exit from the US markets is believed to have been provoked by the recent arrest of founders of privacy-focused Samourai Wallet.

As reported by Bitcoinist, the co-founders of Samourai Wallet, Keonne Rodriguez and William Lonergan Hill, were arrested by US law enforcement for allegedly running an unlicensed money-transmitting business and conspiracy to commit money laundering. The duo were charged for facilitating the laundering of over $100 million in criminal proceeds, including funds from the Silk Road and Hydra Market.

Consensys, creator of the MetaMask wallet, has also faced regulatory scrutiny from the United States Securities and Exchange Commission (SEC) in recent weeks. The financial watchdog seems to be targeting specific wallet features in MetaMask, such as its swap and staking functionalities.

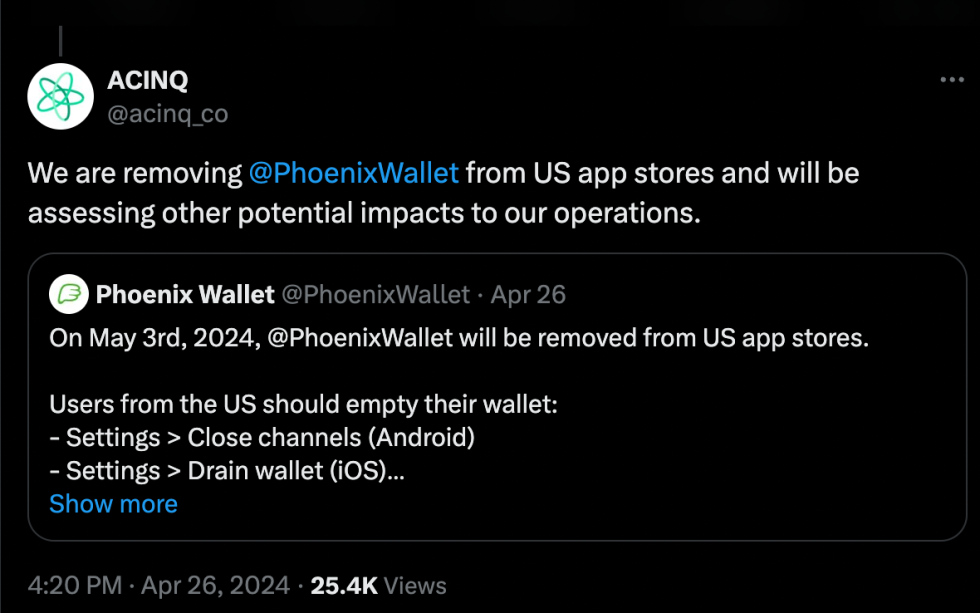

Phoenix Wallet Leaves The US Market

ACINQ’s Phoenix Wallet also recently disclosed its plans to exit the US market by the following month. The wallet provider told users in the United States to remove their assets and drain their wallets before May 3rd, 2023.

ACINQ wrote in a post on X:

Recent announcements from US authorities cast a doubt on whether self-custodial wallet providers, Lightning service providers, or even Lightning nodes could be considered Money Services Businesses and be regulated as such.

The exodus of these self-custody crypto wallets and projects from the United States only further highlights the regulatory challenges and instability surrounding the cryptocurrency industry and privacy-enhancing technologies.