Tracking the changes in the supply held by entities with various Bitcoin balances provides insight into investor behavior and potential price movements. Each category of holder—from individual retail investors to large institutions—plays a distinct role in the crypto ecosystem, and their collective actions can significantly influence the overall market.

Changes in the supply distribution among different wallet sizes can be a strong indicator of market sentiment. For instance, small entities accumulating BTC often suggests increased retail interest and possibly a bullish sentiment among individual investors who may view current prices as attractive for entry or investment expansion. Redistribution by larger entities could represent various strategies or responses to the market, including profit-taking, portfolio rebalancing, or reactions to regulatory or economic changes. This activity is crucial as it might represent institutional or experienced investors’ perspectives, which can be a bellwether for broader market moves.

The concentration of Bitcoin in large wallets, or its dispersal across a broader range of smaller holders, affects the liquidity and volatility of the market. A high concentration in a few wallets can lead to increased volatility if these entities decide to move large portions of their holdings. Conversely, a more distributed base of small and medium holders can enhance market stability and liquidity, as sales or purchases are less likely to impact the price drastically.

Understanding which market segments are growing or shrinking can provide insights into how external factors impact different types of investors.

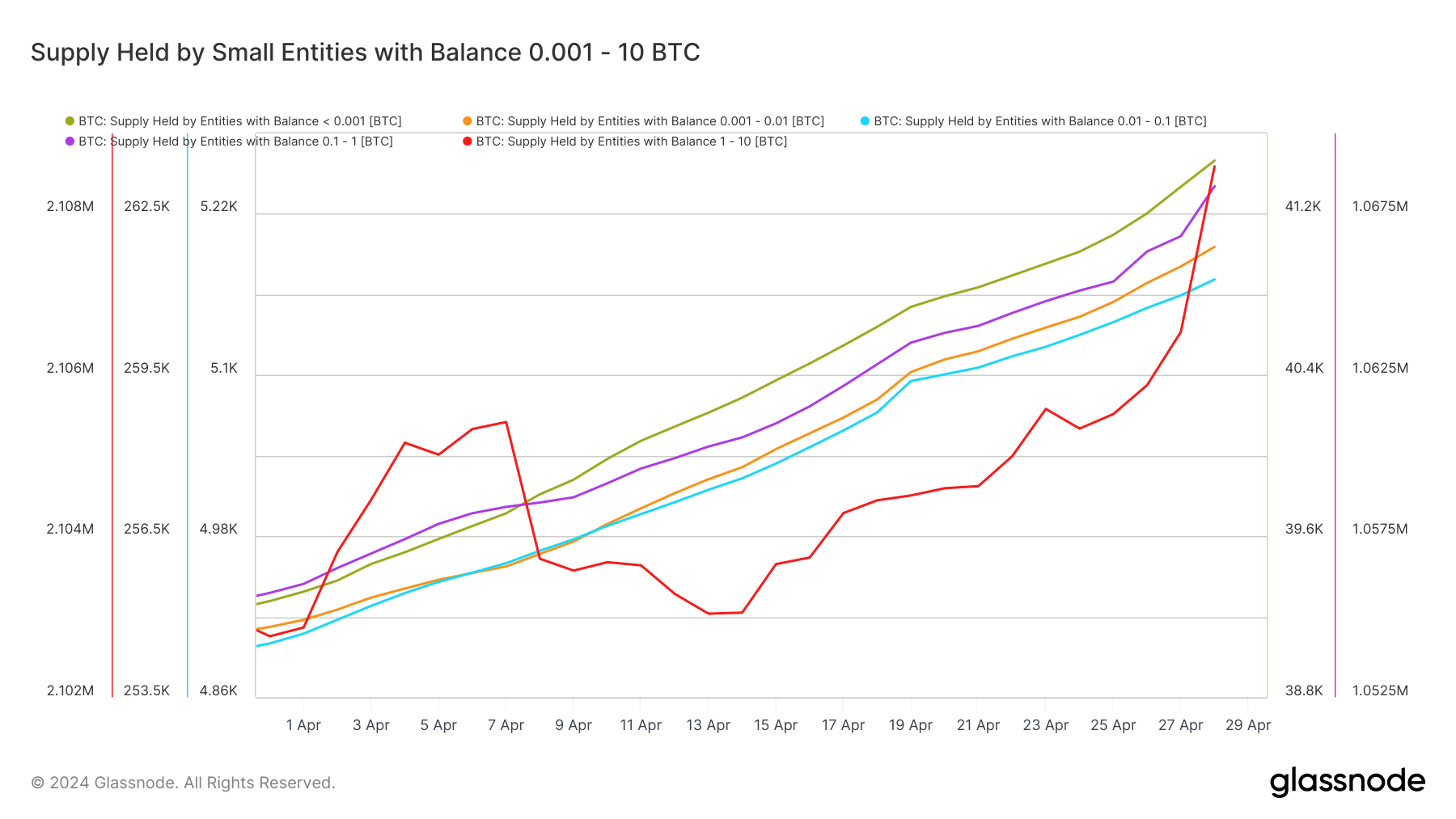

Data from Glassnode showed an increase in the supply of Bitcoin held across all categories of smaller entities, ranging from entities with a balance of less than 0.0001 BTC to balances up to 10 BTC. Entities with a balance between 0.01 – 0.1 BTC saw the largest increase in their Bitcoin holdings. This group’s supply increased from 254,503.7 BTC to 261,281.4 BTC. It represents an increase of 6,777.7 BTC, the highest absolute increase among the smaller entity groups observed over the past 30 days.

This significant increase could indicate a growing confidence among what might be considered “casual” investors—individuals who are not just dipping their toes in the Bitcoin market but are potentially using it as a minor yet meaningful component of their crypto holdings. The increase across all of these entities indicates they are accumulating. With Bitcoin’s price dropping from $73,000 to $63,000 over the past month, the timing supports the notion that these investors are buying the dip, likely viewing lower prices as an attractive entry point. This behavior is characteristic of retail investors and smaller market participants who may perceive long-term value at lower price points.

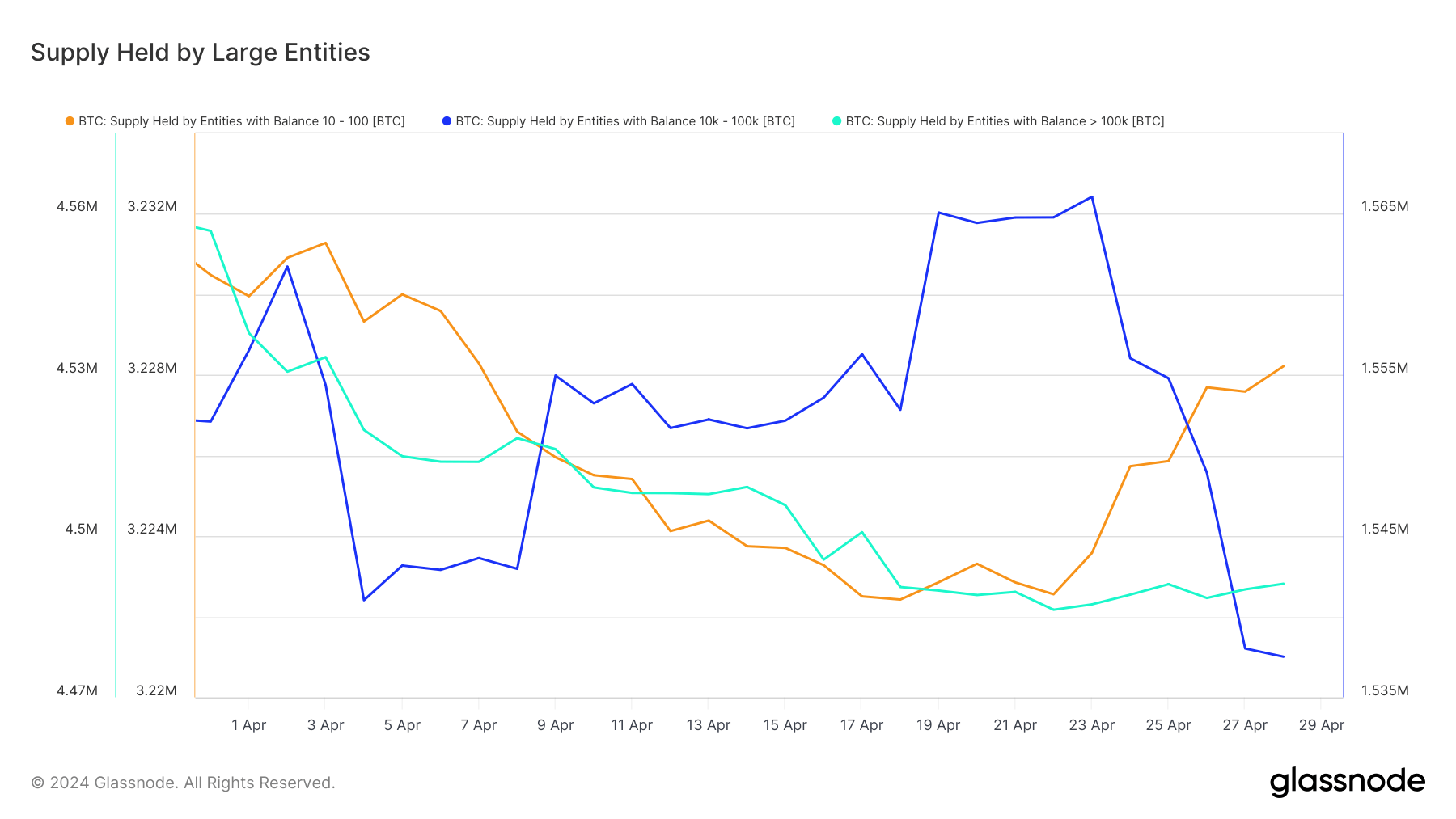

Conversely, larger entities showed mixed changes in their balances, with most showing decreases over the past 30 days.

The reduction in holdings among the largest entities could be attributed to several factors, including the selling pressures from ETF outflows, notably from products like GBTC, and miners selling their holdings to realize profits or cover operational costs amidst a lower-price environment. The movement in large balances aligns with institutional behavior, where adjustments in holdings can be strategic or a response to market conditions.

The post Small Bitcoin holders are accumulating even as prices fall appeared first on CryptoSlate.