Bitcoin bulls may soon be back in business. According to Willy Woo, an on-chain analyst, market data shows that urgent “market sells” responsible for forcing the coin from all-time highs are now falling. This development may prop up prices, preventing further sell-offs.

Bitcoin Selling Pressure Easing

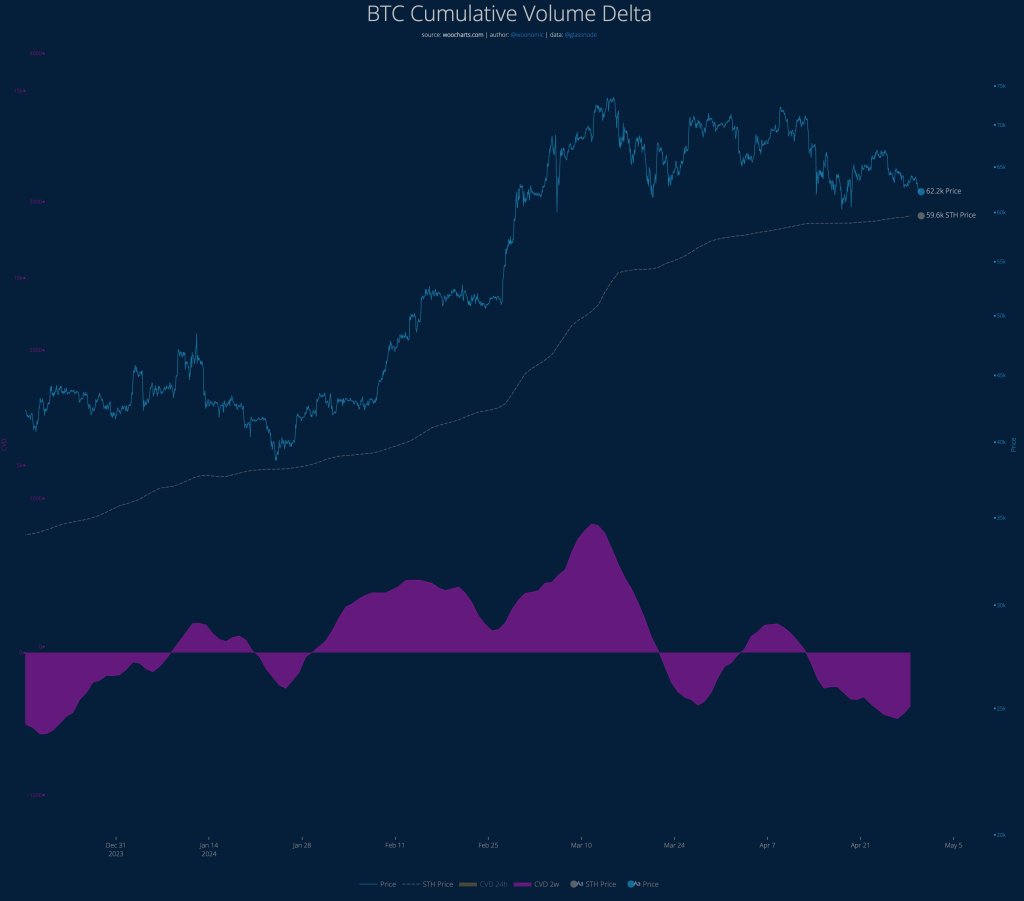

This preview is due to falling Cumulative Volume Delta (CVD) data, an on-chain indicator that can also track market sentiment. Specifically, it tracks buying and selling aggression from market participants. Now that CVD is dropping, Woo says more BTC holders are likely willing to weather the storm. Their decision may directly support prices.

Woo adds that BTC must reject selling pressure and end the current short-term weakness as things stand. As on-chain data shows, BTC should stay above $59,600. The CVD lie has historically separated bullish and bearish zones.

Based on this, BTC should remain above the $60,000 round number for the uptrend to be sustained. If not, and bears take over, pressing prices lower below the CVD level could signal the beginning of a new bear regime.

Thus far, BTC is under immense selling pressure, shaving approximately 15% from all-time highs. The coin has support at around the $60,000 and $61,000 zone, moving inside a range. Resistance is at an all-time high of around $74,000 on the upper end.

Based on this preview, any losses below $60,000, as Woo notes, would likely see BTC dump. The coin might drop to $53,000 in the short term, torching stop losses and fueling the sell-off.

Will Hong Kong Spot ETF Launch Lift Prices?

Whether BTC bulls will flow back depends mostly on institutional involvement in the days to come. Following the approval of spot Bitcoin exchange-traded funds (ETFs) in January, prices spiked higher, breaking previous all-time highs.

Institutional involvement has been vital. However, inflows have slowed down, especially in the last two weeks of April. Analysts are now looking at the launch of spot Bitcoin ETFs in Hong Kong on April 30.

In a recent interview, Zhu Haokang, the Head of Digital Asset Management in Hong Kong, is bullish. Haokang expects trading volume to eclipse those seen in the United States. The executive says the product is unique, allowing for a physical subscription that’s more attractive for BTC miners. Moreover, it is global, drawing interest from Singapore and the Middle East investors.