As the crypto market exhibits signs of a burgeoning altseason, crypto analyst Alex Wacy has shared a strategic forecast with his 175,000 followers on X. Wacy predicts a selective yet explosive growth phase for altcoins, emphasizing the critical nature of asset selection and market timing.

Crypto Market Outlook And Asset Selection Strategy

Wacy’s recent thread underscores the anticipation of a massive altseason: “Only ~15% of altcoins will bring 10-100x in this hyper growth. Asset selection matters more than ever. One slip-up, and you’re out.” His analysis highlights the potentially selective nature of the upcoming market phase, suggesting significant disparities in performance among altcoins.

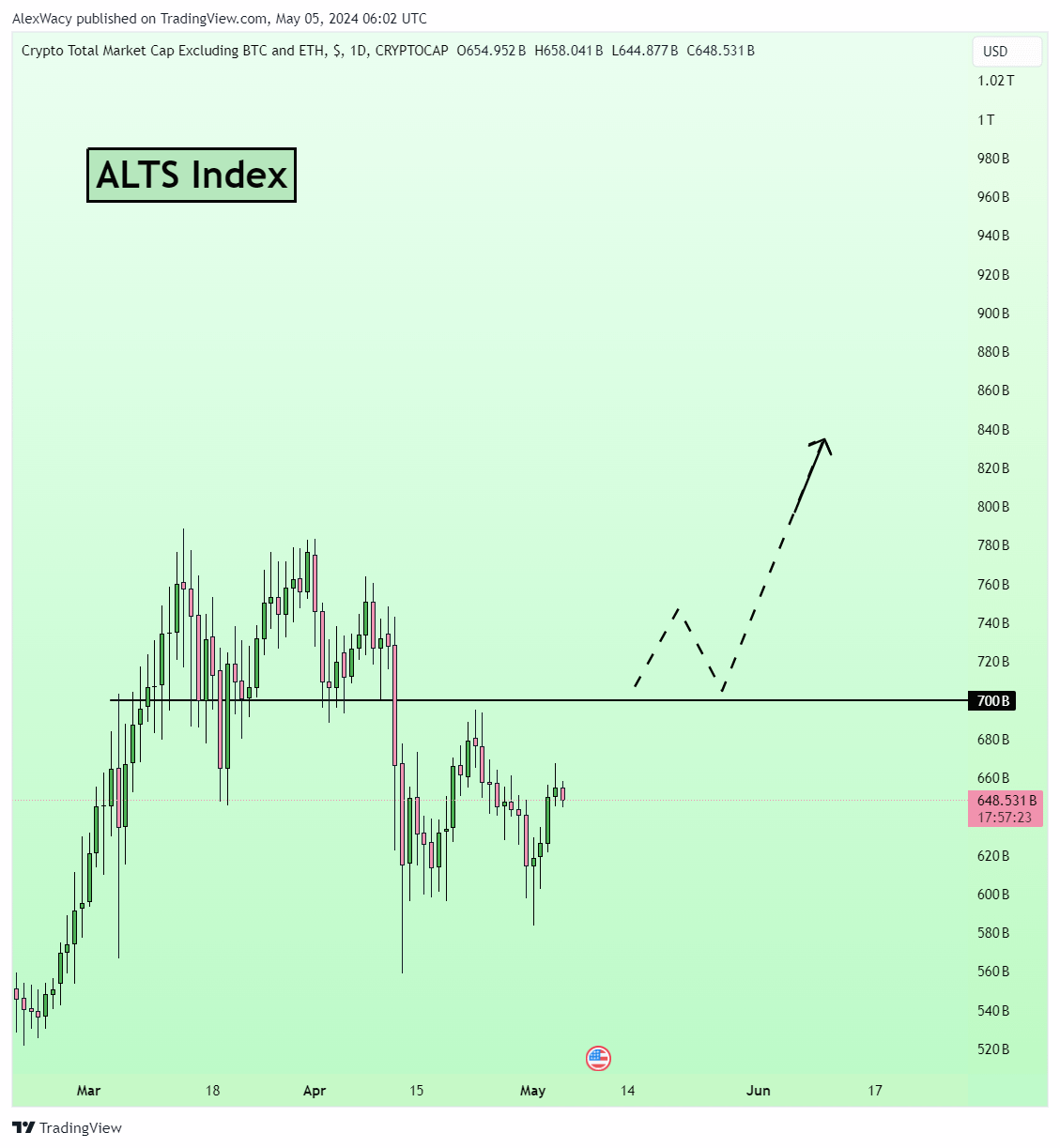

Wacy believes the market is currently undervalued and primed for a significant uptick. He suggests that the consolidation of the total altcoin market cap above $700 billion would confirm the bull trend, signaling the onset of altseason. This perspective is rooted in current market behaviors where sentiment remains largely bearish, presenting a contrarian opportunity for growth.

He categorizes the current sentiment into three types of capitulation—price, time, and growth—indicating varied investor behaviors that often precede market recoveries. The prevailing fear of further drops, according to Wacy, will likely clear out weak hands, setting the stage for a supercycle driven by Fear of Missing Out (FOMO) and subsequent strong buying activities.

Top 6 Altcoins With The Most Potential

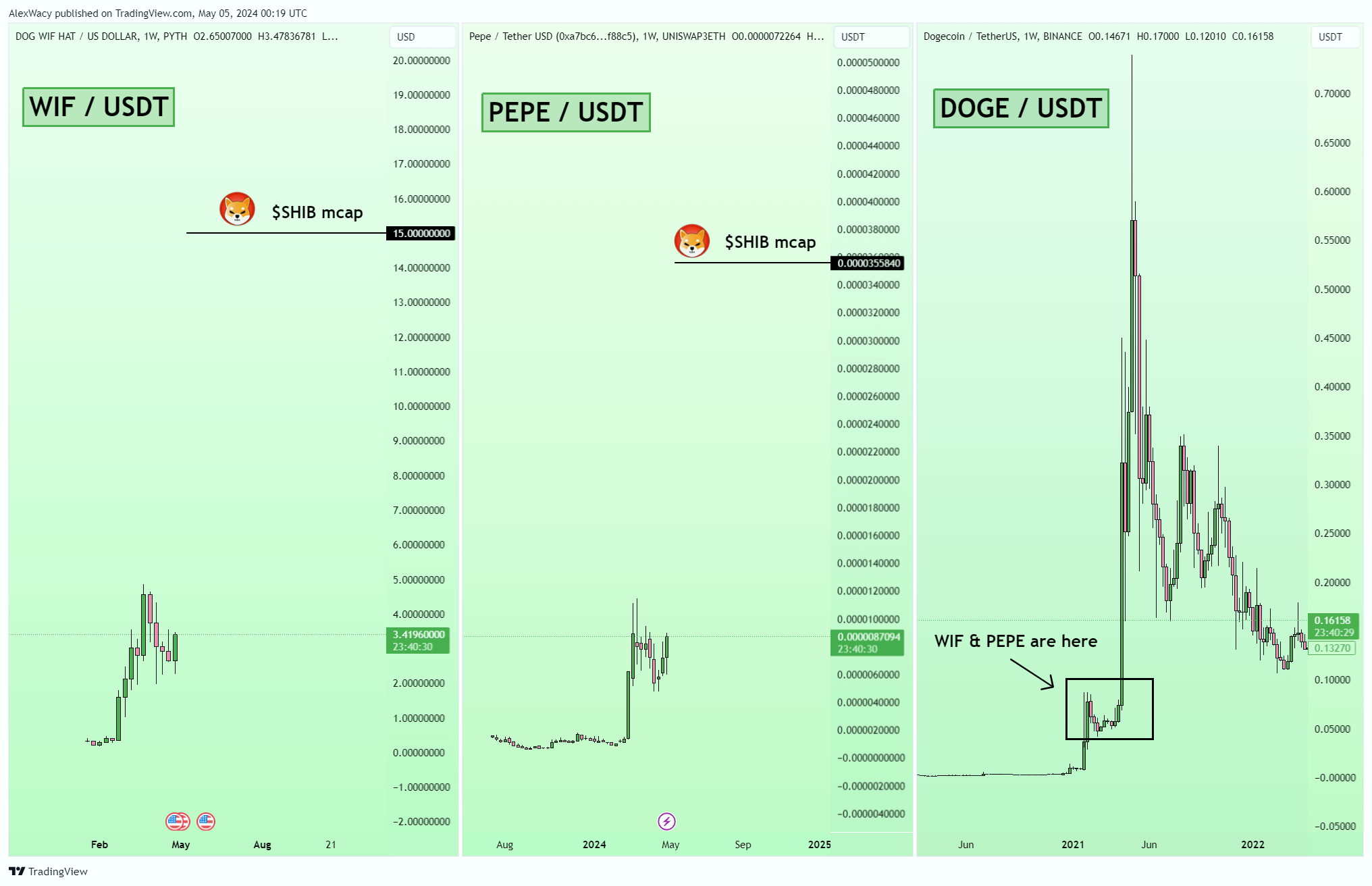

#1 And #2: WIF as well as PEPE are the memecoins highlighted by Wacy as potential early movers in the anticipated altseason. “Look at WIF and PEPE, structurally similar to DOGE during its meteoric rise. These coins have cultivated a community and meme appeal that could very well parallel SHIB’s market cap in the previous cycle,” Wacy asserts. He notes that PEPE appears particularly poised for a breakout, whereas WIF, though currently weaker, has the potential for quick shifts in market sentiment.

#3 Ondo Finance (ONDO): This Real World Asset (RWA) focused coin is characterized by its robust buy support during price dips. Wacy sees ONDO as an undervalued asset with a significant upside. “ONDO has a resilient buy floor; even slight retractions to around $0.64 could offer lucrative entry points ahead of substantial upward trajectories,” he advises. His first target is the $1.62 price zone.

#4 Arweave (AR): Known for its decentralized data storage solutions, Arweave is praised by Wacy for its strong market structure and resilience during downturns. Moreover, Arweave is building AO, a decentralized computer network which can be run from anywhere. “Arweave isn’t just storage; it’s a foundational technology in a decentralized future. A consolidation above $49 would likely be the catalyst for an explosive growth phase,” he predicts.

#5 Echelon (PRIME): Wacy discusses PRIME’s multifaceted ecosystem, which encompasses a trading card game and an AI-powered game, both of which are gaining traction. “Echelon stands at the confluence of gaming and blockchain technology, attracting a broad audience with its innovative gameplay and decentralized features,” he remarks. From a technical analysis perspective, the PRIME price is near a favorable buying zone from $14.97 to $17.5. “Hoping that altcoins are already entering the altseason, would like to see a V-shaped reversal,” Wacy states.

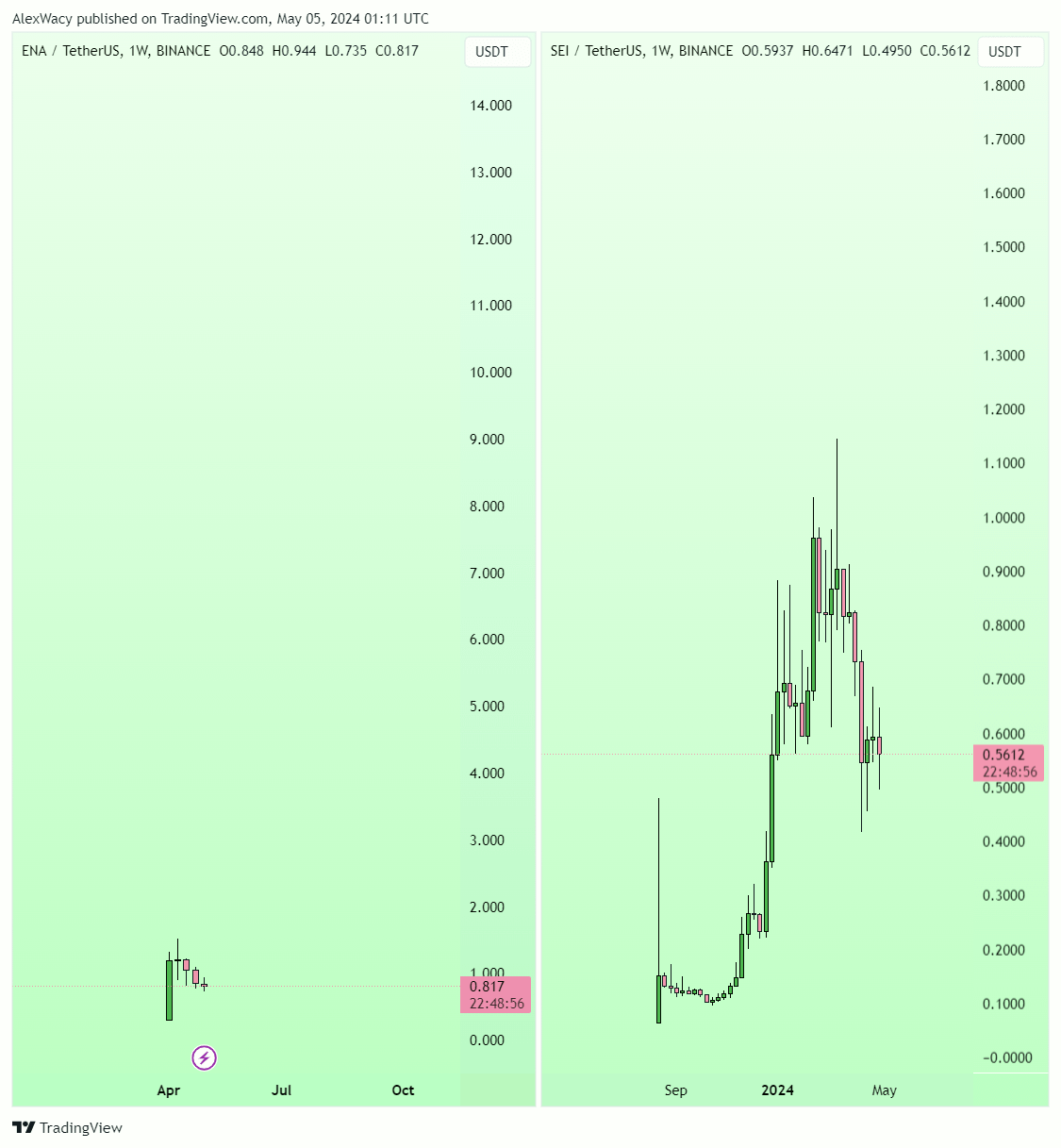

#6 Ethena (ENA): This synthetic dollar protocol offers an alternative to traditional banking and is poised for growth. “Ethena’s pattern on the weekly charts typically precedes major price movements. With the next major unlock event slated for April 2025, the buildup could be substantial,” Wacy explains. He likens ENA’s current price trajectory with the one of SEI.

Strategic Profit-Taking

Wacy also provides strategic advice on profit-taking, anticipating that the altcoin market index, TOTAL3, could ascend to between $2 trillion and $2.3 trillion during the altseason. He suggests considering partial profit-taking once the market reaches approximately $1.6 trillion. His rationale is based on historical patterns where many investors fall prey to greed, resulting in substantial losses.

The analyst further advises preparing a profit-taking strategy in advance, advocating for the reservation of 10-15% of positions for potential further growth beyond initial targets. He warns that the last surge in a growth phase often triggers excessive greed, suggesting that recognizing such signals could be crucial for timely exits before the onset of bear market conditions.

At press time, WIF traded at $3.58.