On-chain data shows PEPE whales have moved large amounts of the memecoin during the past day. Here’s where these tokens have been heading.

PEPE Whales Have Been Active On The Network Today

According to data from the cryptocurrency transaction tracker service Whale Alert, two large PEPE transactions have occurred in the space of a few hours during the past day. Both of these moves are of a scale that’s typically associated to the whales, humongous entities that can carry some influence in the market thanks to their ability to make such large transfers.

Because of their position on the network, their moves can be worth watching, as they may end up reflecting on the price of the cryptocurrency. As for how exactly the asset may be impacted by the transfers of these investors can come down to what they intended to achieve with the moves.

It can be hard to say about any exact motive, but the details of the transactions on the blockhain can sometimes provide hints about the context surrounding it.

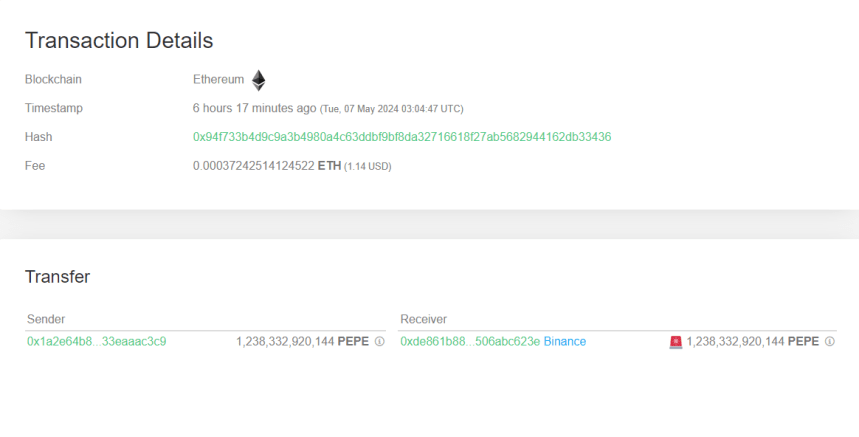

Below are the details of the first PEPE whale transfer from the past day:

As is visible, the sending address in the case of this PEPE whale transaction was an unknown wallet, meaning that it was unattached to any known centralized platform like an exchange. Such wallets are usually the investors’ personal, self-custodial addresses.

The receiving address, on the other hand, does have a platform affiliated to it: the cryptocurrency exchange Binance. Thus, it would appear that the whale moved 1,238,332,920,144 PEPE (worth over $10.5 million at the time the transfer went through) from their personal wallet to the custody of the exchange.

Transfers of this type are known as exchange inflows. The investors make exchange inflows whenever they want to make use of one of the services that these platforms provide, which can include selling. As such, exchange inflows can end up being bearish for the price.

If the whale, in the current case, indeed made the deposit to sell, then PEPE could naturally be negatively impacted, given the large scale of the transaction. Fortunately for the investors of the meme coin, though, the second transaction from today is actually the exact opposite of this transfer; it’s an exchange outflow.

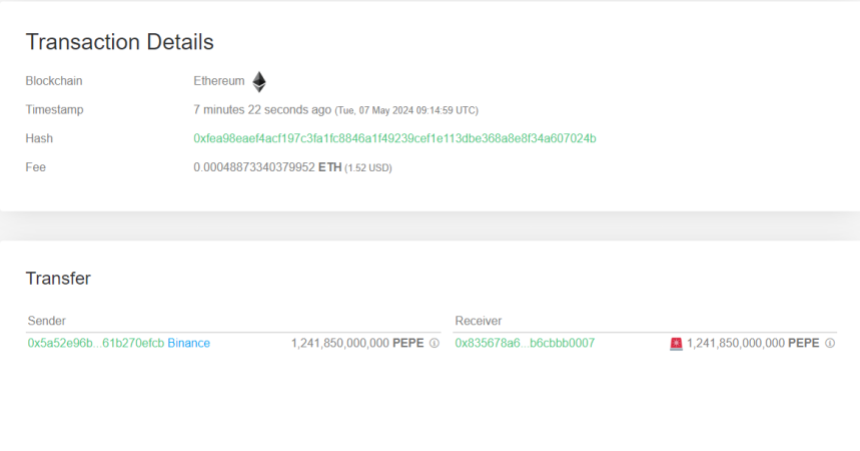

As displayed above, this PEPE whale moved coins from Binance to an unknown wallet through this transaction. Investors generally transfer to personal addresses when they plan to hold in the long term, as it’s safer to do so outside the custody of central entities. Thus, it’s possible this whale plans to HODL these coins.

Interestingly, the amount involved in this move, 1,241,850,000,000 PEPE ($10.5 million), is quite similar to the exchange inflow. Given that the same exchange is also involved in both, it’s possible that the same whale may in fact be responsible for the both of them.

Though, since the addresses don’t quite match, it’s still uncertain. Either way, the fact that an equal-sized exchange outflow has occurred mere hours after should be able to balance out any bearish effects arising out of the inflow, at least in theory.

PEPE Price

At the time of writing, PEPE is floating around the $0.000008445479 mark, up more than 21% over the past week.