Quick Take

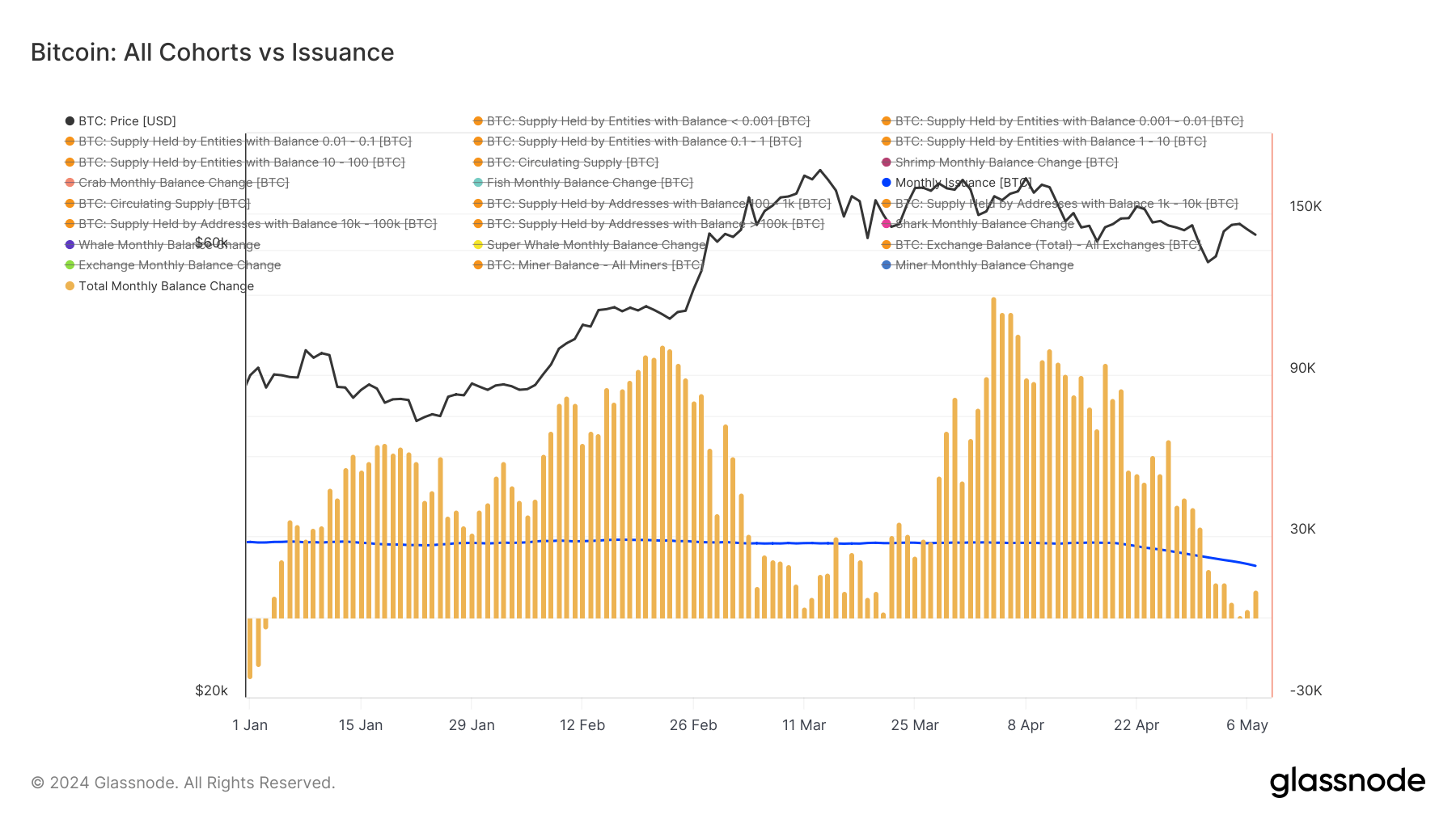

Over the past 30 days, entities across all cohorts have accumulated just over 10,000 BTC. This rate of accumulation has not kept up with the approximately 19,000 BTC issued during that same timeframe.

Before the halving, Bitcoin’s monthly issuance stood at 27,000 BTC but reduced to 13,500 BTC after the halving. However, looking at the data for the last 30 days, we can see that the monthly issuance has averaged roughly 19,000 BTC.

The monthly accumulation has been below the monthly issuance rate since May 1, when Bitcoin hit a local low of under $57,000. This lack of strong demand shows that we could see the upward price pressure wane in the coming days and weeks.

A similar scenario took place when Bitcoin reached its all-time high (ATH) in March. Between March 3 and March 22, accumulation did not keep up with issuance, and prices retreated shortly after.

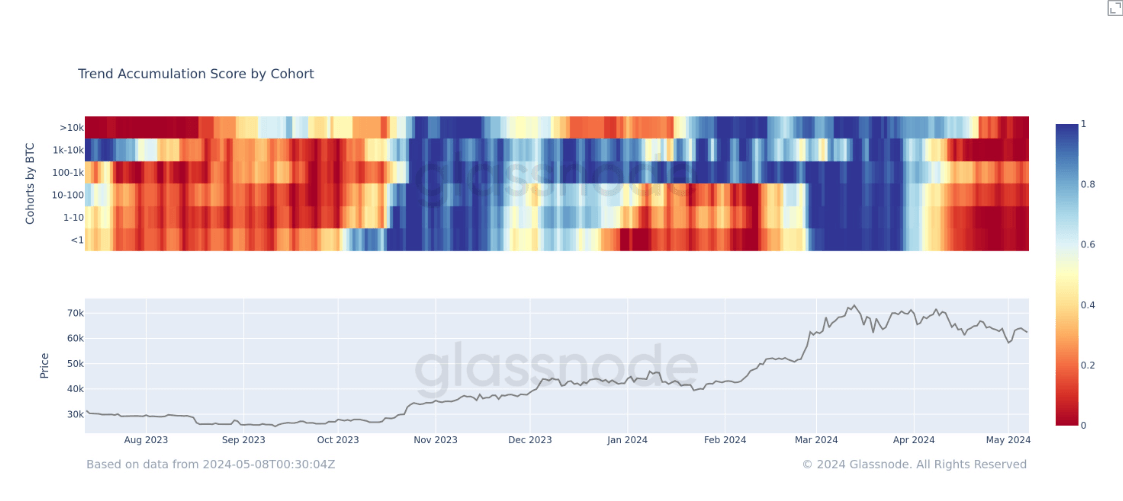

The accumulation trend score by cohort assesses the quantity of coins cohorts have accumulated over the past 15 days, employing a slightly different moving average that bolsters a similar narrative. Following the intense accumulation until March, which propelled BTC to its ATH, all cohorts began selling off their assets shortly after. The severe distribution has persisted since, with the latest data from March showing no signs of change.

The convergence of these on-chain indicators—tepid accumulation compared to issuance and distribution across cohorts—suggests further short-term headwinds for Bitcoin.

The post Bitcoin accumulation fails to keep pace with issuance appeared first on CryptoSlate.