Render is on the move. Price statistics show that the coin is on an uptrend, rising by 50% in the last week due to surging trading volume.

The uptick is primarily due to increased whale interest, which appears to be accumulating, moving RNDR from exchanges. At the same time, bulls are finding tailwinds following Apple’s decision to leverage Render in its Octane X rendering software.

Whales Accumulating RNDR, Token Moved From Binance

Lookonchain data on May 8 shows that the RNDR leg up follows massive token withdrawals from Binance, one of the leading crypto exchanges. The analytics provider notes that one address, 0x15CF, withdrew 748,898 RNDR tokens (worth approximately $5.3 million) from Binance between April 30 and May.

Of note, Lookonchain analysts note, is that the address boasts of a remarkable track record with RNDR. The whale has profited on RNDR in six out of seven trades, raking over $3.5 million in profits.

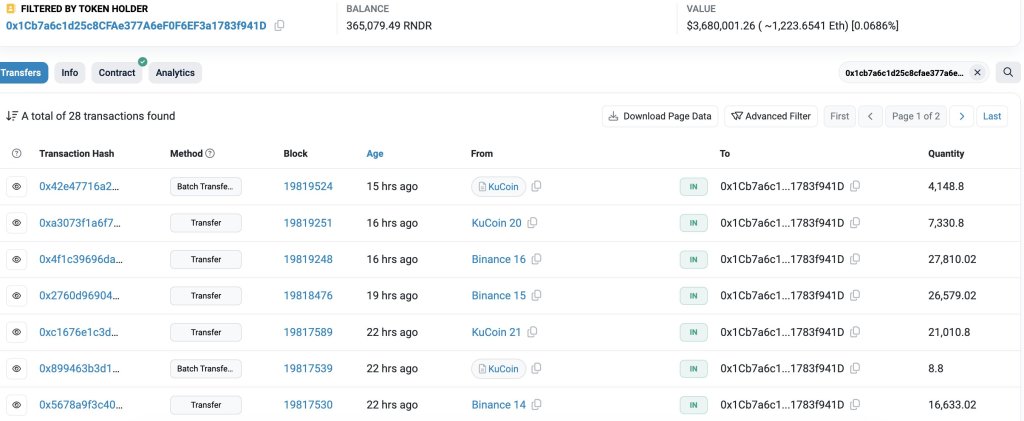

Besides this, other withdrawals include 364,586 RNDR (worth over $3.68 million) by 0x1Cb7, who has previously made $480,000 on RNDR. Additionally, another transfer of 181,922 RNDR ( worth over $1.81 million) by 0xCA9C from Binance.

Usually, transfers from centralized exchanges to external, non-custodial protocols or wallets are seen as bullish. This is because on Binance, for instance, RNDR or any other token holder can swap the token for another or cash, essentially liquidating and increasing supply.

This is harder on non-custodial protocols because liquidity is challenging due to the absence of other crypto or fiat ramps.

Apple Integration Boosts Demand

RNDR prices also rose following news that Apple would feature Render Network in its Octane X software. Octane X is a GPU renderer for macOS users. In a keynote, Apple said this software will empower artists with high rendering capabilities.

Most importantly for RNDR holders, Apple content creators will leverage Render’s decentralized computing power whenever they need to process complex scenes and high-definition animations. By tapping into Render, artists will benefit from faster rendering times and lower costs typically incurred when producing high-quality videos or 3D modeling.

On Apple’s side, integrating Render and easing activity on its iCloud services helps reduce server workload, boosting efficiency. Additionally, analysts said developers might gain access to Render via Apple’s developer tools. Subsequently, they can create more demanding models or files without expensive hardware.

At spot rates, RNDR prices are firm, extending gains. It is up 50% from May lows as bulls target March highs of $13.