Ki Young Ju, CEO of cryptocurrency analysis firm CryptoQuant, has given an ultra-bullish prediction for Bitcoin. The crypto founder alluded to certain factors that could spark the flagship crypto’s rise to such heights.

Bitcoin Could Rise To As High As $265,000

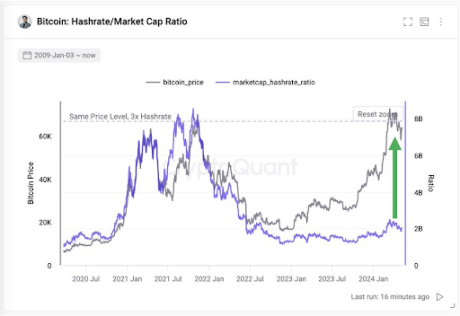

Young Ju mentioned in an X (formerly Twitter) post that “Bitcoin’s network fundamentals could support a market cap three times its current size compared to the last cyclical top.” He added that this development could help BTC rise to $265,000. The fundamental that the crypto founder was alluding to was the Hashrate/Market Cap ratio.

The accompanying chart that Young Ju shared showed that Bitcoin’s hash rate is currently more than three times what it was at the last market cycle top. Meanwhile, BTC is still at the price level it was during that period. As such, the CryptoQuant CEO believes that Bitcoin could also see a 3x increase in its price, just like the Hash rate.

Young Ju’s prediction provides a much-needed bullish outlook for Bitcoin, especially given the flagship crypto’s recent decline and talk that Bitcoin may have already attained the market top for this cycle. Tom Lee, co-founder of research firm Fundstrat, also recently shared his bullish sentiment towards BTC, stating that the crypto token will still reach $150,000 this year.

Meanwhile, similarly to Young Ju’s prediction, crypto analyst MacronautBTC had previously stated that Bitcoin could rise to $237,000. The crypto analyst made this “conservative” calculation based on BTC’s demand outpacing its supply in the long run, especially with the halving further reducing Miners’ supply.

A Rise To $265,000 Not Ambitious

Young Ju’s prediction of $265,000 for Bitcoin is far from ambitious when considering that Samson Mow, the CEO of JAN3, predicted that Bitcoin could rise to as high as $1 million this year. He explained that this unprecedented rise was possible due to the impressive demand that Bitcoin was currently enjoying.

Pseudonymous crypto analyst PlanB also echoed a similar sentiment, stating that BTC hitting $1 million is possible, although he suggested that could happen in 2025 rather than this year. He made this prediction based on the Bitcoin stock-to-flow (STF) indicator, which hints at $500,000 being the average price level for Bitcoin in this market cycle.

As such, the analyst believes that $1 million could be the market top for this bull run. Meanwhile, PlanB mentioned that Bitcoin hitting $100,000 this year was “inevitable.”

At the time of writing, Bitcoin is trading at around $61,700, down over 1% in the last 24 hours, according to data from CoinMarketCap.