An analyst has pointed out how Arbitrum (ARB) has formed a Tom Demark (TD) Sequential buy signal on its weekly chart recently.

Arbitrum May Have Hit A Point Of Reversal According To TD Sequential

In a new post on X, analyst Ali has discussed a TD Sequential signal that Arbitrum has observed in its weekly price recently. The “TD Sequential” is an indicator in technical analysis generally used for locating probable reversal points in any asset’s price.

This indicator has two phases, the first of which is known as the “setup.” In this phase, candles of the same polarity are counted up to nine, and once these nine candles are in, the price may be assumed to have reached a possible turnaround.

Naturally, if these candles were green, the TD Sequential would suggest a potential sell signal for the asset, while if they were red, the indicator would shoot a buy signal.

Once the setup is complete, the “countdown” phase begins. The countdown works much like the setup, except that it lasts thirteen candles, not nine. The countdown’s finish leads to another likely top or bottom for the price.

Now, here is the chart shared by Ali that shows the TD Sequential signal that Arbitrum has just formed in its weekly price:

As displayed in the above graph, Arbitrum has recently completed a TD Sequential setup on its weekly price with red candles. This naturally means that, according to the indicator, the asset should likely reverse towards the upside now.

The analyst suggests that this buy signal “anticipates a one to four candlesticks rebound for ARB.” Given this pattern, how the coin’s price will develop in the coming days remains to be seen.

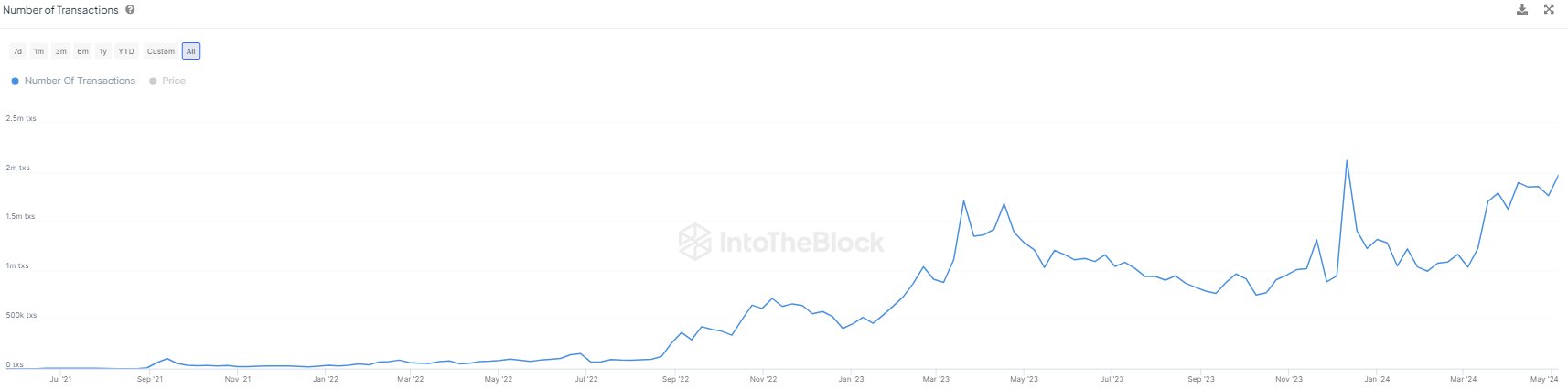

In some other news, the Arbitrum network has recently observed its transaction activity go up, as market intelligence platform IntoTheBlock has pointed out in an X post.

The chart shows that the number of transactions on Arbitrum has been increasing in the last couple of months. Back in early March, the network’s average transfer count stood at around 1 million, but recently, it has crossed the 2 million mark.

A high transaction count is generally a sign that traders are interested in the asset. This could lead to more volatility for the coin’s price, although its direction can go either way.

ARB Price

At the time of writing, Arbitrum is trading around $1.01, down almost 2% over the past seven days.