Quick Take

US ETFs

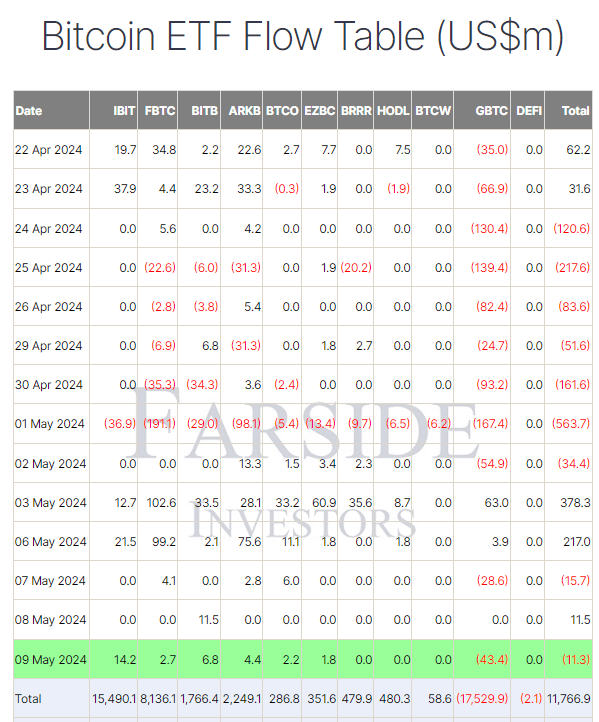

According to the latest Farside data, US Bitcoin exchange-traded funds (ETFs) experienced outflows on May 9, totaling $11.3 million. Notably, the Grayscale Bitcoin Trust (GBTC) witnessed a $43.4 million redemption, marking its largest single-day outflow since May 2. GBTC has now recorded a total of $17.5 billion in outflows.

Six different US ETFs recorded inflows, with BlackRock’s IBIT product leading with $14.2 million. IBIT has now accumulated $15.4 billion in total inflows. Additionally, the remaining three ETFs comprising the top four—Bitwise (BITB), Fidelity (FBTC), and ARK (ARKB)—also experienced inflows. In total, US ETFs have now witnessed $11.7 billion in cumulative net inflows, according to Farside data.

HK ETFs

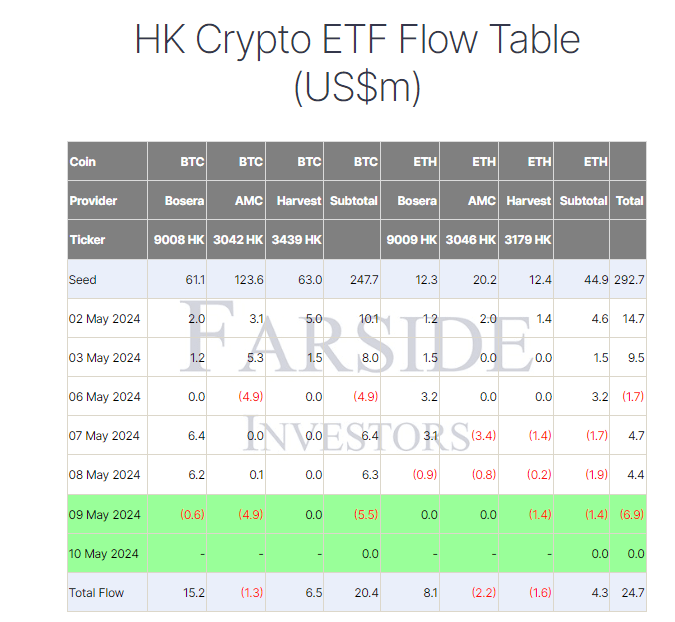

According to Farside data, the Hong Kong (HK) ETF market encountered difficulties on May 9, with Bitcoin ETFs experiencing $5.5 million in outflows and Ethereum ETFs losing $1.4 million, totaling a combined outflow of $6.9 million for the day. Nevertheless, HK’s Bitcoin and Ethereum ETFs maintain total net inflows of $20.4 million and $4.3 million, respectively, bringing the total net inflow to $24.7 million.

The post Hong Kong and US ETFs see modest outflows on mixed day appeared first on CryptoSlate.