A number of Dogecoin metrics have turned bullish in the last few days, showing increased interest from investors. This ranges from the meme coin’s daily derivatives trading volumes to its open interest seeing a significant increase. However, in the midst of this, the Dogecoin price has remained limp, sparking worries among investors.

Dogecoin Derivatives Volume And Open Interest See Increase

One of the major Dogecoin metrics that has seen a significant increase recently is its derivatives trading volume. The trend began on Monday when the derivatives trading volume saw a 60% uptick. However, it seems DOGE traders are far from done as the volume has almost doubled since that time.

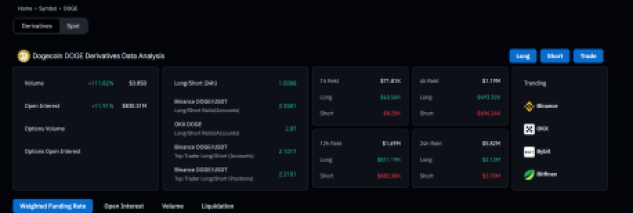

According to data from Coinglass, the Dogecoin derivatives trading volume is up 111% in the last day alone. This has pushed the derivatives trading volume to $3.85 billion, a significant increase from the $1.99 billion that was recorded on Monday.

The launch of Dogecoin futures contracts by Coinbase, the leading crypto exchange in the United States, may have something to do with this. Following the launch on April 1, 2024, the meme coin has seen increased interest in its derivatives products, which explains the increase in the volume.

However, the derivatives trading volume is not the only thing that has seen an uptick during this time. As Coinglass data shows, the Dogecoin open interest has also risen significantly during this time. It has seen an approximately 12% increase in the last day to touch above $830 million.

Despite this increase in the Dogecoin open interest, it is still a long way from its all-time high of $1.91 billion that was recorded on March 29. So, the current open interest of $830 million represents an over 50% decline from its all-time high. At the same time, the DOGE price is still struggling, showing a disconnect between the rise in metrics and the price of the meme coin.

DOGE Price Doesn’t Respond To Bullish Metrics

The Dogecoin price has remained muted during this time, even with the increased momentum. The total daily trading volume of the meme coin is up 128% in the last day. However, its price has barely moved 4%, even amid the meme coin craze sparked by the GameStop (GME) 100% rally.

DOGEs price has barely moved during this time and the resistance at $0.15 is waxing stronger. This suggests that the focus is no longer on Dogecoin during meme coin craze and rather on newer counterparts such as Solana-based GME and AMC, which have seen incredible rallies in the last day.

At the time of writing, the DOGE price is trending at $0.49, with a 3.48% increase in the last day. However, in the longer time frame, the meme coin is struggling with 5.79% and 4% losses on the weekly and monthly charts, respectively.