Bitcoin is cooling off after an impressive 25% spike from May 2024 lows. Even with this cool-off, some analysts are upbeat, predicting the coin will extend gains in future sessions.

Bitcoin Finds Strong Support Between $70,180 and $70,600

In a post on X, one analyst believes Bitcoin has strong support at around $70,180 and $70,600. The analyst explained that on-chain data shows that over 450,000 addresses collectively bought over 273,000 BTC at this price range.

For this reason, the concentration of BTC holdings in this zone means the coin has strong support. If the level is to be broken, then sellers would need to make an even larger effort to break through this line, with a higher amount of BTC hitting the sell side of the equation.

On-chain analytics firm Glassnode notes that the Bitcoin market is cooling after intense selling pressure. After the strong uptick that saw the coin roar to as high as $73,800 in March 2024, prices plunged to as low as $56,500 this month. Prices have since recovered, but bulls have yet to break above all-time highs.

While capital inflows remain moderate, Glassnode adds, volatility has decreased noticeably. Still, whether this volatility will shoot higher once $72,000 is broken remains to be seen.

BTC Retraces: Will Bulls Break $72,000?

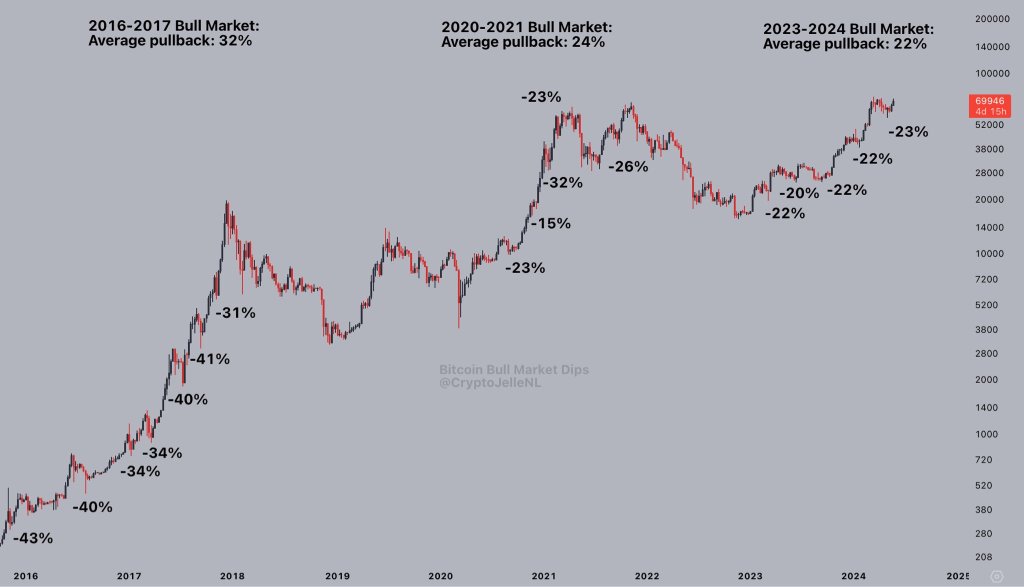

All eyes are on whether BTC bulls will shake off the current correction. In a post on X, another analyst said holders shouldn’t be worried because of this pullback and the failure of bulls to confirm the May 20 leg up.

Instead, the analyst is confident, saying pullbacks are a natural part of any bull market. The recent 23% correction, the analyst added, is an example.

What’s important is that every retracement has been from a higher position. Therefore, the next local bottom will likely be higher than the previous one, potentially reaching around $80,000.

Thus far, BTC has a strong resistance of $72,000. The bulls didn’t push through this line, even with more serious attempts in early April.

As a result, this reaction level remains important from a technical perspective. Any breakout for now would increase the probability of BTC prices floating to retest $73,800 or break higher.

In the days ahead, inflows to spot Bitcoin exchange-traded funds (ETFs) coupled with improving sentiment might spark more demand. In that likelihood, BTC bulls will find the momentum to confirm the May 20 bar and break above the local resistance.