US Space Force Major Jason Lowery has made a bold assertion regarding Bitcoin, describing it as a potential weapon system and emphasizing its strategic importance for national security. Lowery, who is also a national defense fellow at MIT, has been vocal about the need for the US military to prioritize the investigation and integration of proof-of-work systems like Bitcoin. He argues that Bitcoin’s proof-of-work consensus mechanism could serve as a significant deterrent against cyberattacks, likening it to traditional military assets that deter physical attacks.

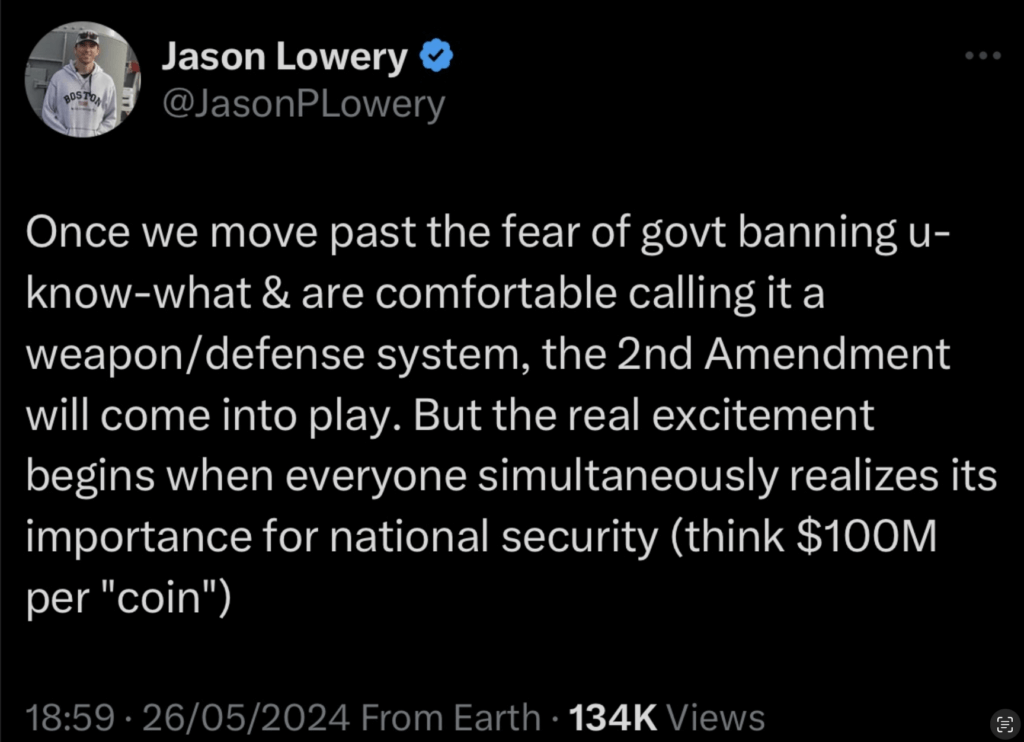

In a now-deleted X post, Lowery suggested that once the public overcomes the fear of government bans on Bitcoin and recognizes it as a defense system, the implications for national security will become clear. He speculated that this realization could drive the value of Bitcoin to $100 million per coin. Lowery’s perspective is rooted in his belief that Bitcoin can transform the global electric power grid into a massive, physically costly computer, or “macrochip,” which can physically constrain malicious actors and safeguard data traversing the internet. This, he claims, could kickstart a cybersecurity revolution and help the US maintain its position as a global superpower.

“Once we move past the fear of govt banning u-know-what & are comfortable calling it a weapon/defense system, the 2nd Amendment will come into play. But the real excitement begins when everyone simultaneously realizes its importance for national security (think $100M per “coin”)”

Lowery’s views are detailed in his book Softwar: A Novel Theory on Power Projection and the National Strategic Significance of Bitcoin, which explores Bitcoin’s potential as a tool for national security and power projection within the digital realm. However, the book was reportedly removed from circulation and the MIT library for undisclosed reasons, adding a layer of intrigue to his assertions. As of May 2024, the book is available again on Amazon.co.uk in self-published format.

Lowery’s advocacy for Bitcoin extends to urging the US Department of Defense to formally investigate the national strategic importance of proof-of-work systems. He has argued that Bitcoin’s consensus mechanism could deter adversaries from cyberattacks due to the high physical costs associated with maintaining the network, similar to how military assets deter physical attacks.

Lowery’s views have significant broader implications, especially as the US grapples with the strategic value of Bitcoin and crypto amid increasing regulatory scrutiny. His stance contrasts with the current regulatory approach, which has been more focused on litigation and control rather than support and integration of digital assets.

The post US major predicts Bitcoin recognition as a weapon system as catalyst for $100 million price target appeared first on CryptoSlate.