Bitcoin briefly shot over $70,000 yesterday before plunging below $69,000 to spot rates. While there are hints of weakness, one analyst on X notes that inflow to exchanges like Binance and OKX is subdued, meaning that users are not keen to sell despite prices tanking and failing to break $72,000.

Bitcoin Inflow To Exchanges Remain Low

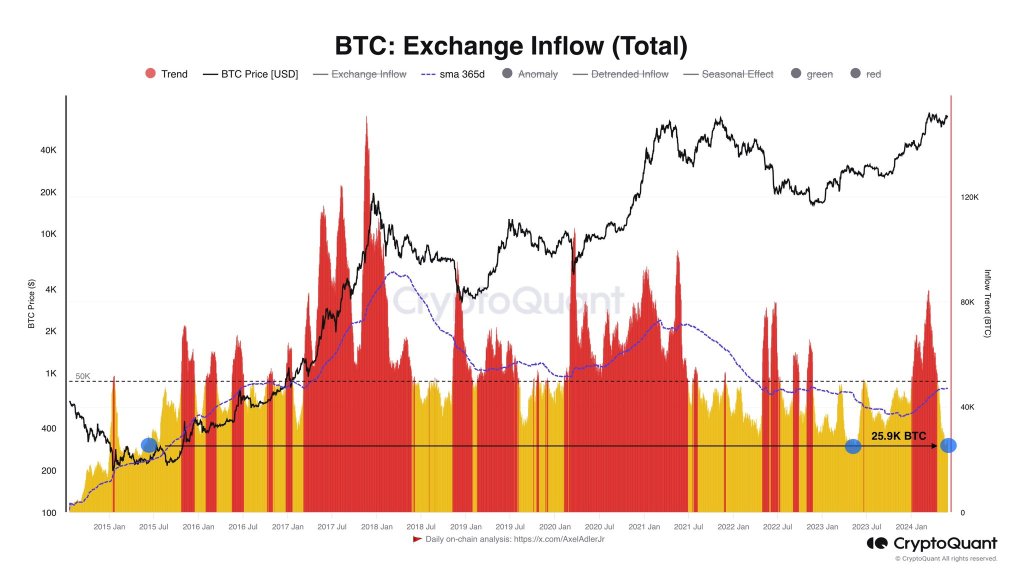

The analyst notes that exchange inflows are low at spot rates. As of May 28, exchanges received just 25.9K BTC daily. From historical exchange inflow data from CryptoQuant, the current inflow rate is at the 2016 level.

There was a sharp pick-up in momentum after 2016, but the inflow to exchanges has been shrinking since the beginning of the year. It should be noted that the United States Securities and Exchange Commission (SEC) approved nine spot Bitcoin exchange-traded funds (ETFs) around this time.

With this product in the United States, some large whales likely decided to convert their coins and hold ETFs instead. In this way, they diverted custody to an approved custodian, depending on the spot Bitcoin ETF issuer they chose.

Mt. Gox Moving BTC: How Will Prices React If They Sell?

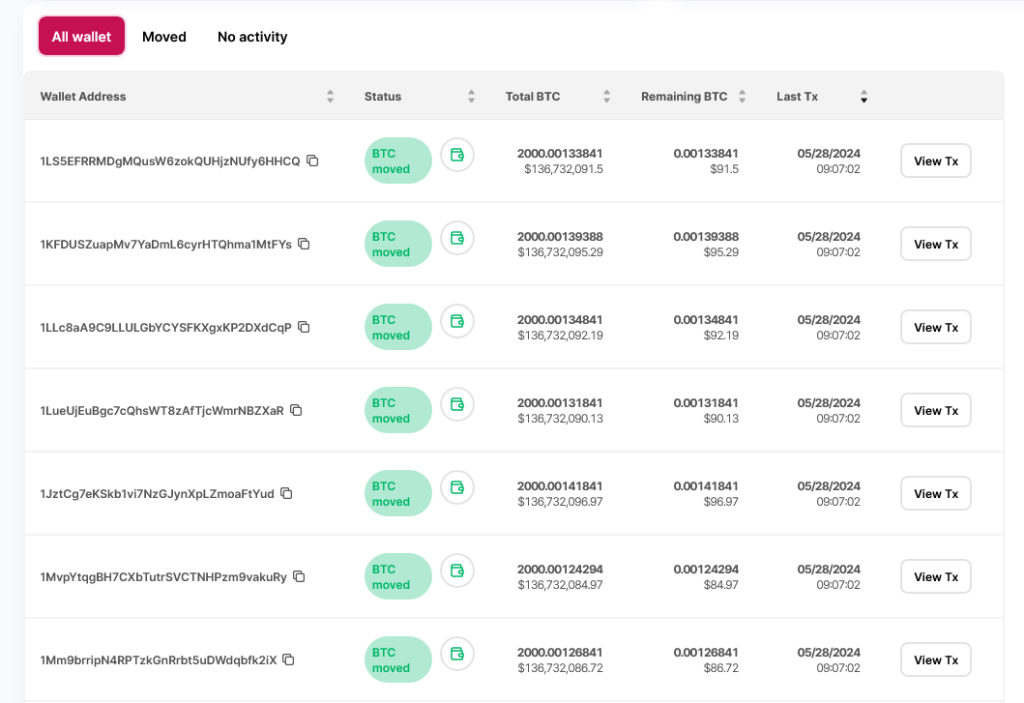

While the average inflow to exchanges is at 2016 levels, there might be changes in the coming months. On May 28, Mt. Gox, the defunct crypto exchange hacked in 2014, moved over $9.4 billion of BTC, data from Token Unlocks show.

This unexpected transfer sparked market concerns. Currently, the intention remains unknown. Still, the implications could be dire if they decide to liquidate on exchanges.

Even with this possibility, the analyst argued that BTC’s low average exchange inflow to exchanges would be a timely cushion. Should Mt.Gox creditors decide to sell, the analyst believes the market will easily absorb this sell-off despite increased initial volatility. What this means is that the price impact will be minimal.

Before being hacked and losing over 800,000 BTC, Mt. Gox was a popular Bitcoin exchange. At one point, it commanded over 70% of all global BTC trading volume. In the next few months, victims of the unfortunate hack will be compensated.