Polkadot, the interoperable blockchain, remains one of the largest and most popular networks in the top 20. At press time, DOT, the platform’s native currency, is 14th, ahead of Tron and the NEAR Protocol.

However, despite recent gains, it is still down 87% from all-time highs, undeniably facing a brutal market correction.

Even with this bearish sentiment, a wave of optimism is building around DOT’s future. Taking to X, one analyst thinks not only will the coin shake off weakness but will surge, rallying to over $20 in the coming months.

This confidence, the analyst said, will be primarily because of crucial developments in the broader Polkadot ecosystem.

Eyes On Polkadot 2.0, Better On-Chain Governance

Of the many, the analyst thinks the upcoming Polkadot 2.0 upgrade will be a game-changer. Already, Polkadot is interoperable and scalable. However, once the new upgrade comes into play, the platform’s developers expect the network to be more interoperable, scalable, and with better governance.

Specifically, to address scalability, they will eliminate the Parachain slot auction and introduce the concept of coretime. This feature will give developers more flexibility.

Instead of bidding and locking resources in the auction, they must purchase block space dynamically as needed. This will improve resource allocation, leading to more accessibility and efficiency.

Additionally, Polkadot developers are introducing the OpenGov system for more decentralized governance. The objective here will be to give all DOT holders a voice in decision-making, which is crucial in decentralized networks.

JAM Upgrade Proposal Passed, Will DOT Bulls Break $8?

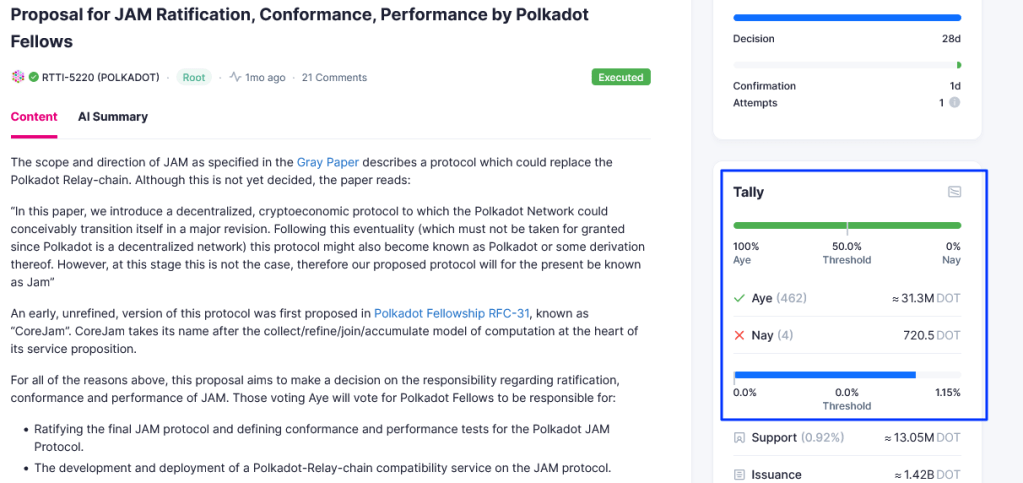

The network is also preparing for more changes. The community recently approved the Join-Accumulate Machine (JAM) chain.

The proposal, which was unanimously passed by the community, paves the way for developers to build services similar to Ethereum smart contracts directly on the Polkadot Relay Chain. Gavin Wood, the former Ethereum developer who introduced the proposal, said this would make the network more accessible.

Beyond network-related upgrades, the analyst also said that more DOT’s are being locked, which is a huge boost. Usually, with staking, coins are taken out of circulation, increasing scarcity. If more activity and the demand for DOT increases, it would positively impact the price, helping lift it from the current ranges.

As of June 3, over 1.4 billion DOT were in circulation. By the fourth week of May, over 820 million DOT had been staked. Looking at the price chart, if the coin breaks above $8, the incentive to stake and early rewards plus capital gains will increase.