Data shows that Bitcoin short-term holders have seen a decrease in their realized profit, a sign that their appetite for harvesting gains may be diminishing.

Bitcoin Short-Term Holders Are Realizing Much Fewer Profits Now

As explained by CryptoQuant author Axel Adler Jr in a post on X, the BTC short-term holders have been realizing much lower amounts of profits recently. The “short-term holders” (STHs) here refer to the Bitcoin investors who bought their coins within the past 155 days.

Statistically, the longer an investor holds their coins, the less likely they become to sell them. As the STHs are the new entrants in the market, they are unlikely to hold for too long.

Because of this weak resolve, the investors of this cohort tend to easily panic sell whenever something notable happens in the sector, like a rally or crash.

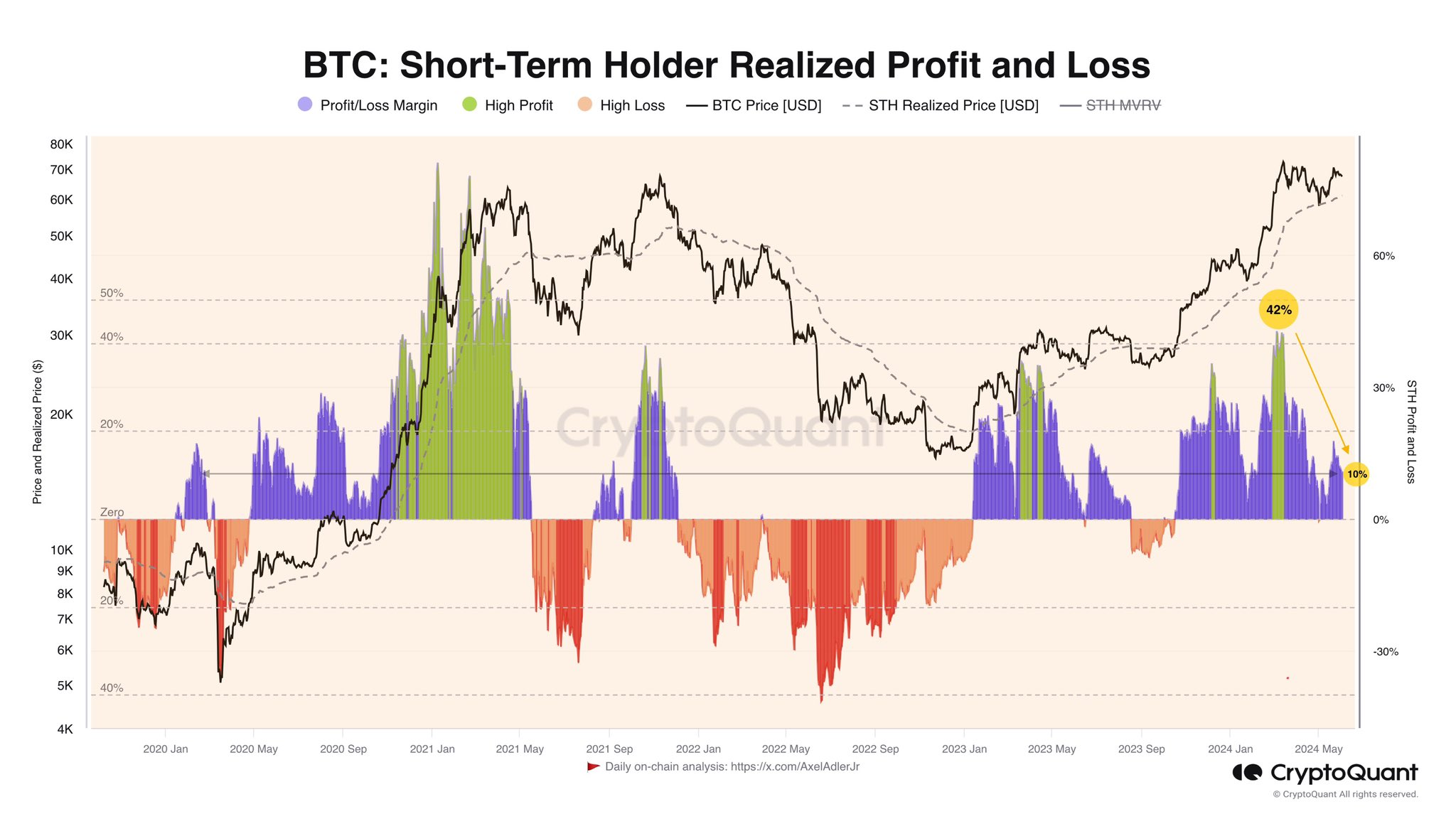

Naturally, the recent run towards the all-time high (ATH) also saw these fickle-minded holders selling. The chart below shows the trend in the “Realized Profit and Loss” indicator for this group, which tells us about the net amount of profit or loss that they have been harvesting recently.

As is visible in the graph, the Bitcoin STH Realized Profit and Loss metric spiked to highly positive levels when the rally towards the ATH price occurred. More particularly, the indicator’s value hit the 42% mark at the peak of this profit-taking spree.

Since then, as the cryptocurrency price has struggled, the indicator’s value has dropped to just the 10%. As the analyst notes,

The realized profit of short-term holders has fallen by 32%, signaling a lack of investor desire to lock in profits at current levels, essentially anticipating further growth.

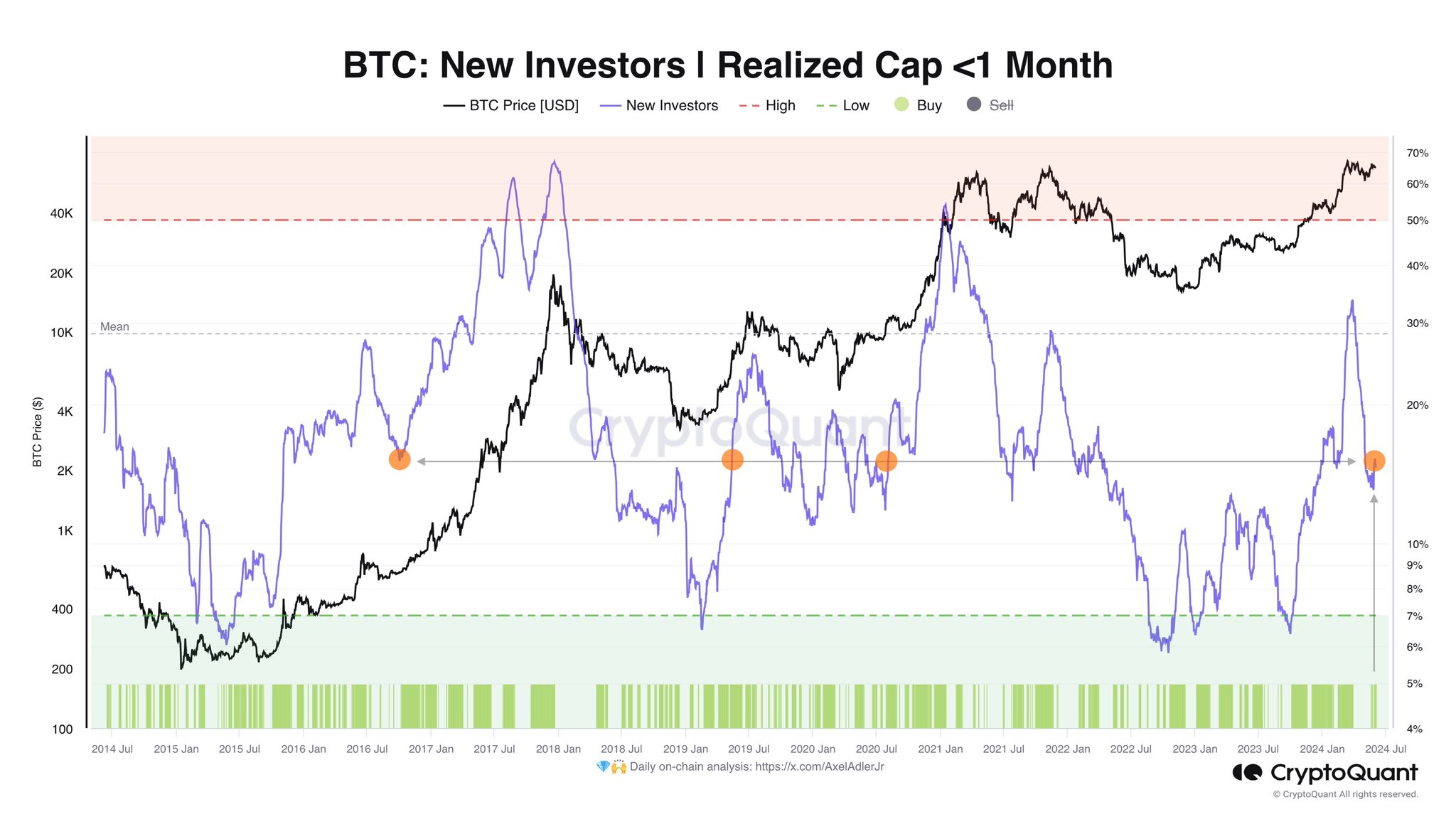

This development is potentially not the only positive one for Bitcoin recently. As Axel pointed out in another X post, the Realized Cap of the investors holding for less than a month has been on the rise.

The “Realized Cap” here basically refers to the total amount of capital that the investors have used to purchase the asset, as determined by data available on the blockchain.

As the chart below shows, this metric had earlier been declining for these young investors, even among the STHs, suggesting that fresh interest in the asset had been waning.

The Realized Cap for this cohort has recently found a reversal, a potential sign that some new demand is now flowing into the cryptocurrency.

BTC Price

At the time of writing, Bitcoin is trading at around $69,200, down over 1% in the past seven days.