Quick Take

Bitcoin equities such as MicroStrategy (MSTR) and Bitcoin miners are exhibiting a stronger correlation with the Nasdaq than with Bitcoin itself, depending on the time frame.

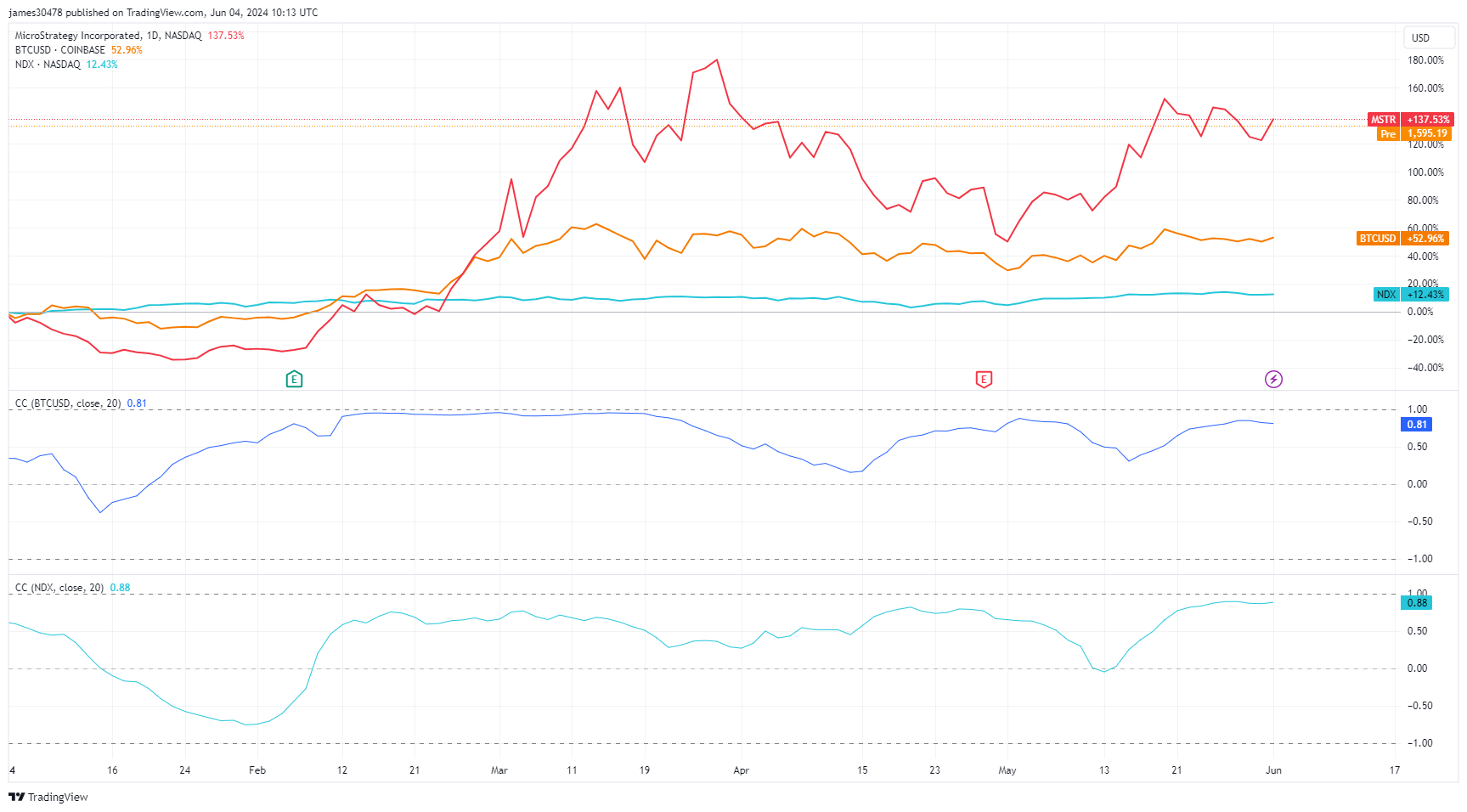

On a year-to-date (YTD) basis, while Bitcoin is up 53% and the Nasdaq has gained over 12%, MSTR has surged a remarkable 138%. Interestingly, during this YTD period, MSTR has a correlation of 0.88 with the Nasdaq and 0.81 with Bitcoin.

The correlation dynamics get stronger when considering different time frames. Over the past six months, MSTR’s correlation with the Nasdaq stands at 0.85, while its correlation with Bitcoin is just 0.15. The trend has become even more pronounced over the last three months, with MSTR’s correlation with the Nasdaq reaching 0.90 and its correlation with Bitcoin dropping to 0.74, according to TradingView data.

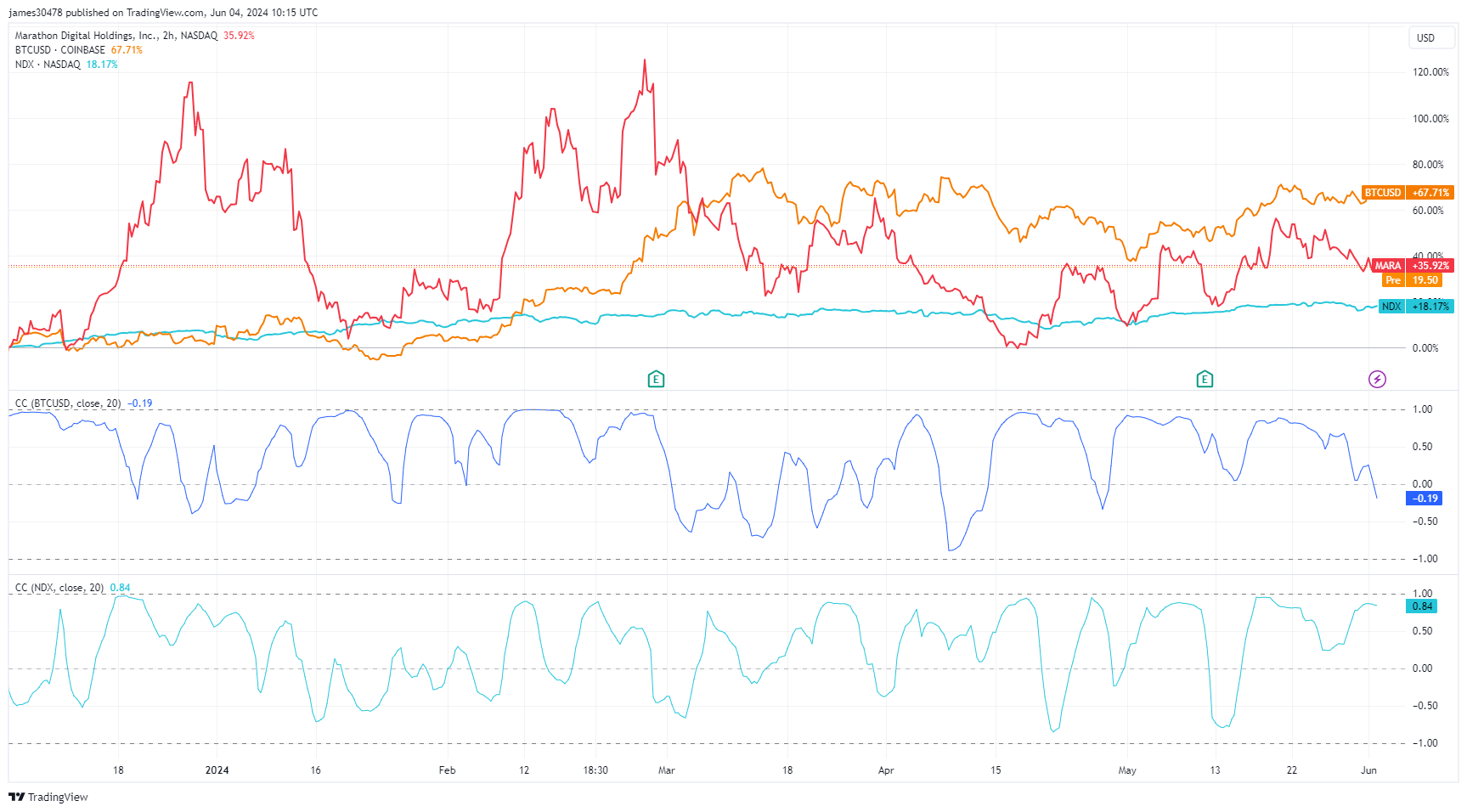

A similar pattern emerges for Marathon Digital Holdings, the largest publicly traded Bitcoin miner. While it’s down 15% YTD, its correlation with the Nasdaq over the past six months is 0.84, compared to -0.19 with Bitcoin.

This trend suggests that traditional finance is treating these Bitcoin equities more like conventional equities than as proxies for Bitcoin itself, especially over shorter time horizons.

The post Bitcoin equities shift: MicroStrategy and miners show higher Nasdaq correlation appeared first on CryptoSlate.