Quick Take

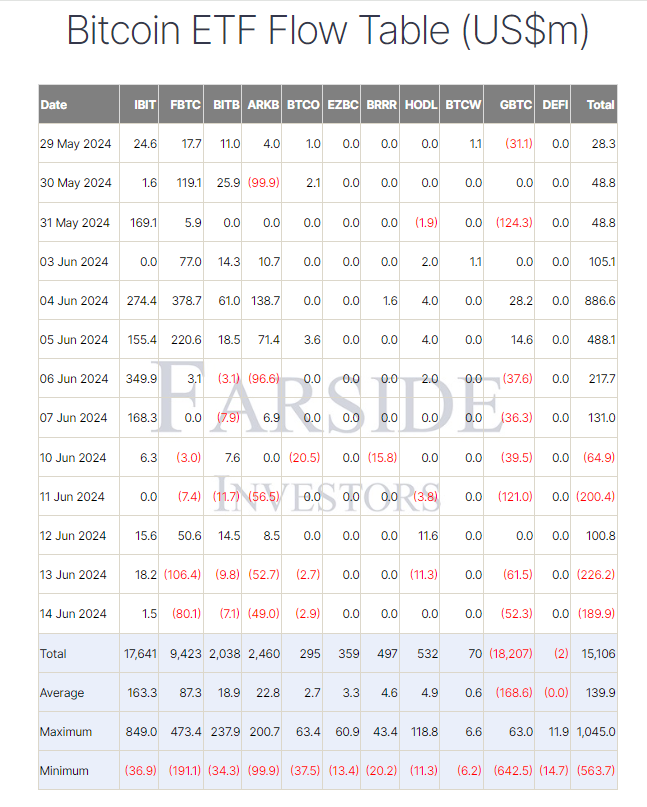

Since June 10, Bitcoin has experienced a notable decline, dropping from approximately $72,000 to as low as $65,200. This drop coincides with significant activity in Bitcoin exchange-traded funds (ETFs), which have seen around $580.6 million in outflows, according to Farside data.

This starkly contrasts the previous record-setting 19 consecutive trading days of inflows, amounting to roughly $4 billion, which coincided with Bitcoin’s price from around $60,000 to $72,000 between May 13 and June 7.

The recent outflows represent approximately 4.3% of the total inflows, aligning with a roughly 10% correction in Bitcoin’s price.

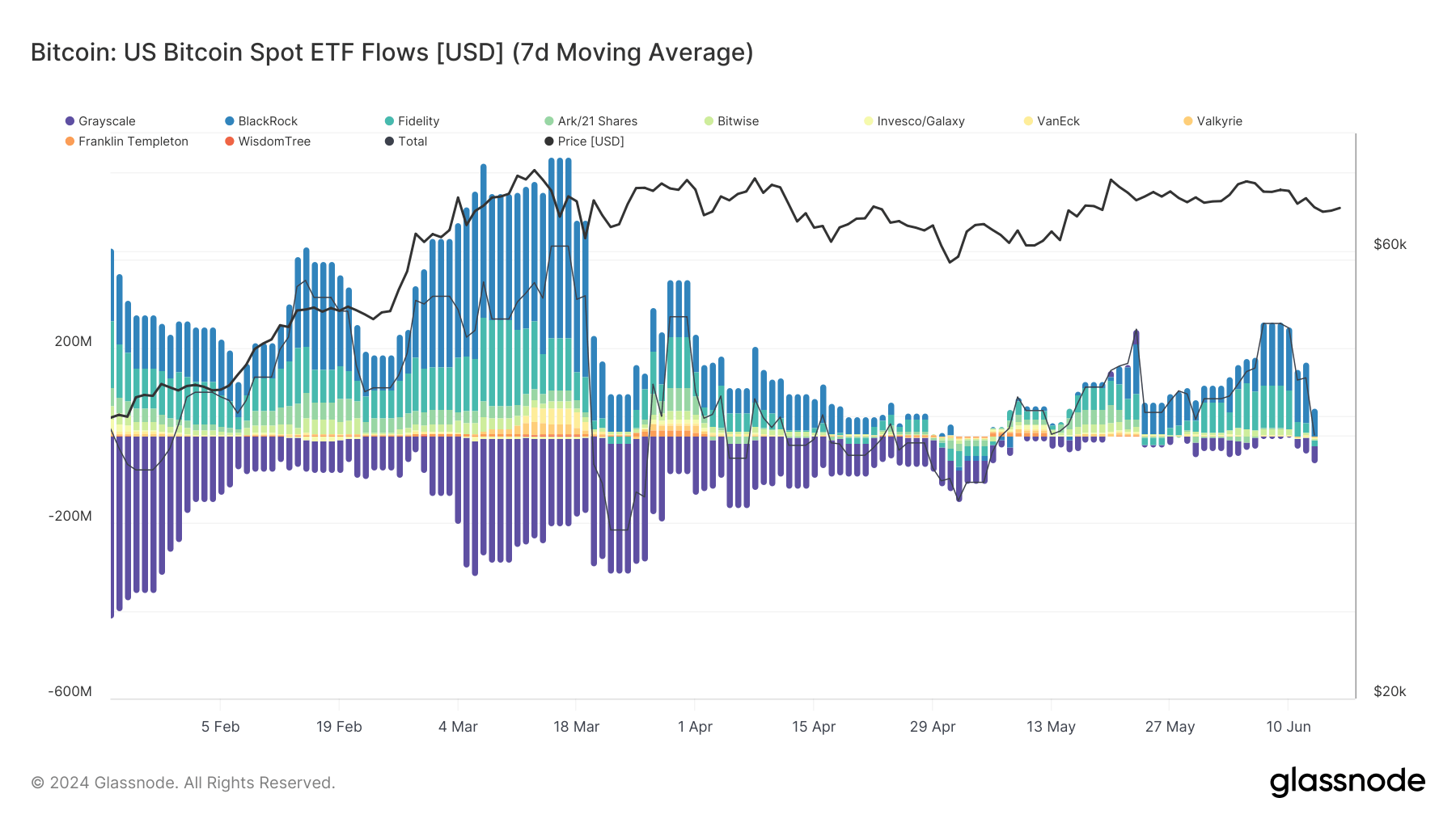

This discrepancy has led to questions about why Bitcoin’s price didn’t rise despite the substantial inflows. One plausible explanation is the “basis trade,” a strategy employed by hedge funds and investors.

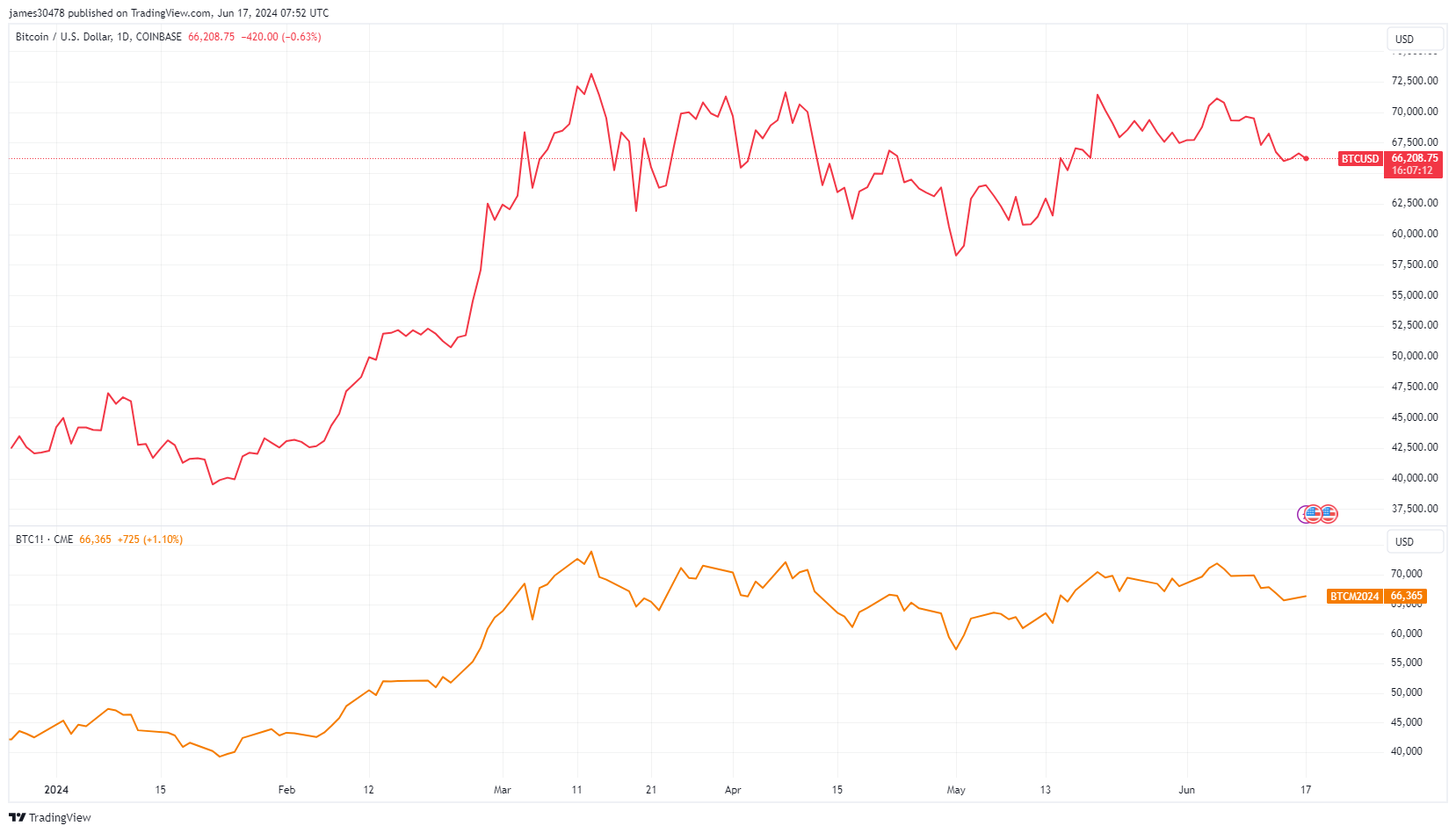

In this strategy, investors go long on the underlying spot ETF products and short the futures market, creating a net-neutral trade that protects them regardless of whether the price goes up or down. Investors focus on the spread between the spot price and the futures price, as this differential determines the profitability of the basis trade.

This approach is influenced by the current positive funding rates, which are around 6%, according to Coinglass. Traders are willing to incur higher costs to leverage long positions in Bitcoin, often using calendar futures on the CME. These futures, trading at a premium to the spot price, can be rolled over through a process known as “rolling forward.” The CME defines this as exiting an expiring futures contract while simultaneously entering a new one with a later expiration date, thus extending the position without interruption.

By shorting the futures market while being long on the spot market, traders create a hedge that mitigates price movements, resulting in the observed “suppression” of Bitcoin’s price.

The rolling forward strategy allows traders to maintain exposure to Bitcoin without closing their positions at contract expiration. Consequently, the Bitcoin price is less sensitive to Bitcoin inflows despite significant flows, offering a potential explanation for why it hasn’t reached new all-time highs following the $4 billion influx.

The post Bitcoin price reflects basis trade dynamics, not suppression appeared first on CryptoSlate.