On-chain data shows Ethereum has notably outpaced Bitcoin in terms of adoption during the last three months, a sign that could be positive for ETH.

Ethereum Has Seen Its Holder Count Go Up By 3.3% In Last Three Months

According to data from the on-chain analytics firm Santiment, Ethereum has continued to separate itself from Bitcoin in its growth of the Total Amount of Holders. The Total Amount of Holders here refers to an indicator that, as its name suggests, keeps track of the total number of addresses on a given network that is carrying some non-zero balance.

When the value of this metric goes up, it means new addresses with balance are popping up on the blockchain. Such a trend may arise when new investors join the market and old ones who had sold earlier reinvest.

The indicator also registers an increase when existing investors divide their holdings into multiple wallets, perhaps as a measure of privacy. In general, all three of these are at play whenever the metric rises, so some net adoption can be assumed to be taking place, which can be bullish for the asset.

On the other hand, the indicator going down implies some holders have decided to clear out their wallets, potentially to completely get away from the cryptocurrency at least in the short term.

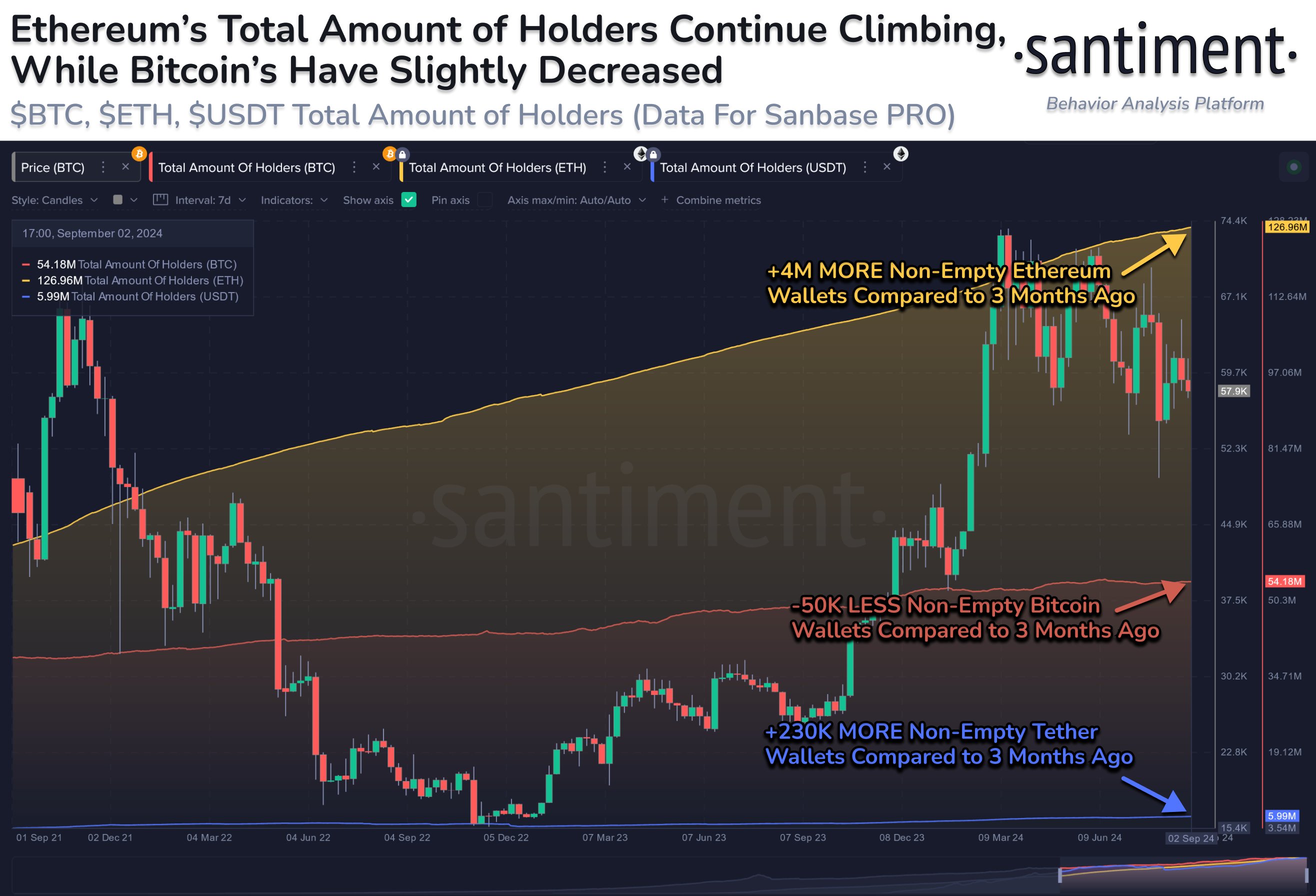

Now, here is a chart that shows the trend in the Total Amount of Holders for the top three coins in the sector, Bitcoin (BTC), Ethereum (ETH), and Tether (USDT), over the past few years:

As displayed in the above graph, the Total Amount of Holders for Ethereum has been riding an uptrend during the last few years, with this momentum continuing in the last three months as 4 million more holders have showed up on the network.

In contrast to ETH’s growth, BTC has seen its Total Amount of Holders almost show a sideways trajectory since 2021. In the last three months, the number one cryptocurrency has actually outright seen a decline in its user base, with 50,000 addresses emptying themselves out.

Following the latest increase, Ethereum now boasts almost 127 million holders, while the metric stands at just 54 million for Bitcoin, meaning that the latter doesn’t even have half as many holders as the former.

The number one stablecoin, USDT, currently has 6 million addresses holding a balance, which represents an increase of around 230,000 compared to three months ago.

BTC’s Total Amount of Holders trend would imply the coin may have hit a roadblock in its adoption, while ETH has continued to attract new users, likely because of the rich ecosystem that it hosts.

ETH Price

At the time of writing, Ethereum is floating around $2,400, down more than 4% over the last 24 hours.