Shiba Inu is making waves after wrapping up an astounding 1,000% increase in its burn rate, Shibburn data shows. This has occurred simultaneously with a nearly 7% increase in the value of the meme coin. Market observers are investigating what this may potentially mean for the future of SHIB, especially in light of the increased confidence in the cryptocurrency sector.

Over 6 Million SHIB Incinerated

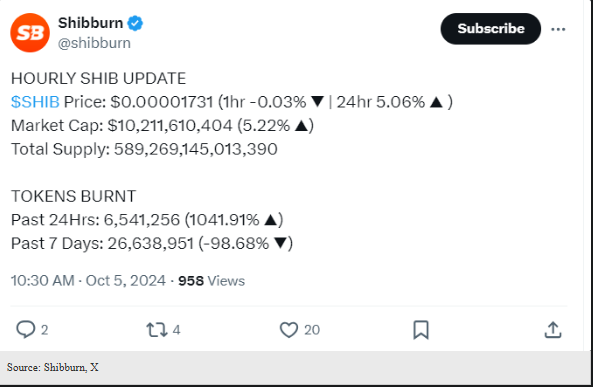

The Shiba Inu community’s increasing dedication to lower the token supply reflects in the latest burn rate. Shibburn statistics show that during just the past 24 hours, almost 6.54 million SHIB tokens were burned. Usually, this kind of supply-chain cut indicates a positive trend.

Such supply cuts sometimes point to a bullish trend. The people in the SHIB community seem to rally for this cause, hoping to juice up the price of the token. It is a good moment to buy altcoins now before the next big rise, according to analyst Alan Santana, who recently pointed out that the market is approaching its final accumulation for 2024.

#Altcoins

Shiba Inu Long-Term Bull-Market Accumulation Zone To Become Active

As we get closer and closer to 2025, the Altcoins market is preparing to enter the last accumulation phase of 2024. This will be the last chance to buy at low prices before the major 2025… pic.twitter.com/L2mPYvEyhr

— Alan Santana (@lamatrades1111) October 2, 2024

Burn Rate Increases Local Support

The last week has seen the incineration of almost 26.63 million tokens. Investors are feeling optimistic as a result of this level of activity. From the initial supply, 410.73 trillion SHIB tokens have so far been destroyed. The amount of tokens in circulation, at 583.51 trillion, is still substantial.

The SHIB community is still upbeat that the meme coin will exceed expectations and perform well in the upcoming weeks, or months. Santana’s assessment indicates that the present weak market, particularly the growing turmoil in the Middle East, may cause some disruptions. However, investors shouldn’t worry too much as cryptocurrencies can sometimes bring big surprises.

Many people are keeping a close watch on this since the Shiba Inu community is working together to limit the supply. Does the price appreciation for SHIB have anything to do with the current rush to burn? Investors hold their breath and hope for a breakout as the year 2025 approaches.

Shiba Inu Price Action

Shiba Inu currently hovers at $0.00001594 as the cryptocurrency falls 1.40% from its price a day ago and also lags by 5.40% in the past week. However, it has traded around $784 million in a 24-hour period. While it just had a massive price fluctuation, this trading volume indicates that the community is still active and keen.

Featured image from Pexels, chart from TradingView