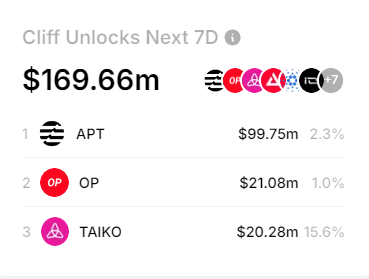

The cryptocurrency market is gearing up for a major event as Optimism (OP), Aptos (APT), and Taiko (TAIKO) prepare for token unlocks collectively valued at $169.66 million. According to data from TokenUnlocksApp, millions of dollars worth of cryptocurrencies will flood various ecosystems this week, which could further amplify the prevailing selling pressure. Of these cryptocurrencies, Aptos (APT) dominates the token unlocks, with almost $100 million worth of APT set to be unlocked in the next seven days.

Explaining The Token Unlocks

Token unlocks refer to the release of a predetermined number of tokens that were previously locked or vested during the cryptocurrency’s launch. When these tokens become available, they can be traded on the market, which often leads to increased liquidity. However, a potential downside is that a sudden surge in supply can lead to price volatility as recipients of unlocked tokens might decide to sell, causing downward pressure on prices. As such, new buyers are used as the exit liquidity for early investors, team members, or project developers who are given these unlocked tokens.

According to data from TokenUnlocksApp, this week’s crypto market activity will see a significant release of tokens across three major projects: Optimism (OP), Aptos (APT), and Taiko (TAIKO). These upcoming unlocks are particularly noteworthy because they follow a cliff unlock mechanism, where a large number of tokens are released in one go. Interestingly, these unlocks come just a week after SUI, another prominent blockchain project, unlocked 64.19 million tokens valued at approximately $106 million.

Among these three projects, Aptos stands out with the most significant unlock. A total of 11.3 million APT tokens, collectively worth approximately $99.75 million at the current price of APT, are set to be released. The second most notable unlock comes from Optimism, which will release 12.47 million OP tokens valued at around $21 million. Taiko, a project focusing on zk-Rollup technology for Ethereum scaling, will also unlock 12 million tokens with a total value estimated at $20.28 million.

What Next? Should You Buy Or Sell?

Cliff token unlocks have more profound effects on the price of cryptocurrencies than linear unlocks. Of the three ecosystems, Taiko’s unlock seems to be the most important, as a larger part of its circulating supply (15.62%) is going to be unlocked in a single event, which could dramatically influence its price action. In comparison, Aptos and Optimism will see smaller portions of their total circulating supply unlocked. Aptos is set to unlock 2.3% of its circulating supply, while Optimism will release 1% of its circulating supply.

Nonetheless, monitoring the unlocks is crucial for investors in the rest of the week. This is especially true for retail investors, as they could bear the risk of the liquidity as these tokens are unlocked. They could be used as exit liquidity once the owners of the unlocked tokens decide to sell or reduce their exposure.