The post BlackRock Hits $11.5 Trillion: Here’s How They Did It! appeared first on Coinpedia Fintech News

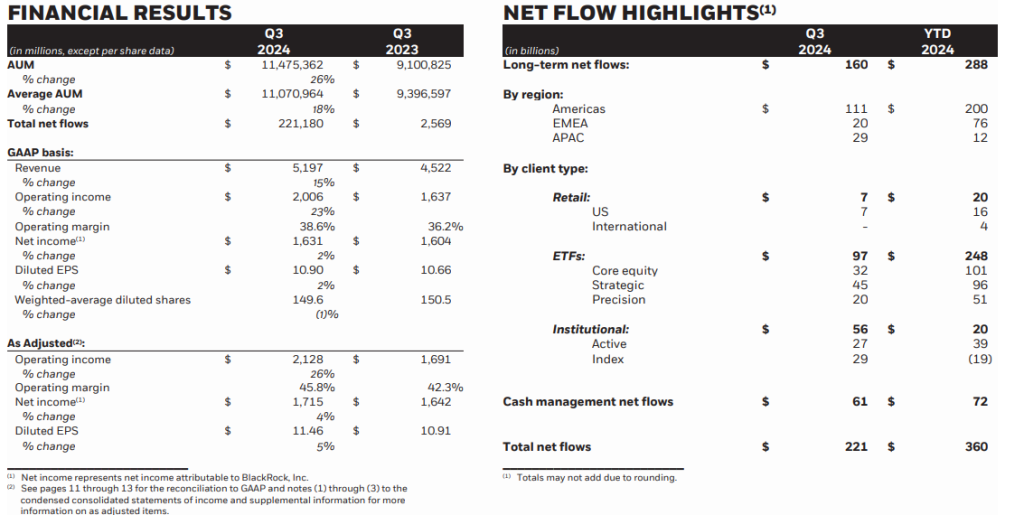

BlackRock, a multinational investment company confirmed on friday that it has hit a record of $11.5 trillion in assets under management. This big achievement shows their smart strategies and how investors trust them. But how did they do it? Let’s take a closer look.

Big Boost from ETFs and Market Gains

BlackRock’s growth came from its exchange-traded funds (ETFs). Investors poured $97.41 billion into these funds. In total, they attracted $221 billion in new money during the quarter. That’s huge! Investors love their traditional and alternative investment options.

The stock markets also helped. After a sell-off in August, the markets bounced back. This rise boosted BlackRock’s assets from $10.65 trillion in the second quarter to $11.5 trillion. Strong markets, especially in the U.S., kept investors confident, leading to more inflows.

Growth in Private Markets and Infrastructure

BlackRock in its move to enter the private market acquired Global Infrastructure Partners for $12.5 billion. This deal added over $100 billion in private assets, helping them get even bigger. Their CEO, Larry Fink, said these steps are key for their future, especially with new tech and AI playing a big role. By the end of 2024, BlackRock will also buy Preqin, a private markets data company, for $3.2 billion. This will help BlackRock manage risks better and make smart decisions in private markets.

What’s Next for BlackRock?

Even with this record growth, BlackRock’s profit didn’t rise as much. Their net income went up to $1.63 billion, but that’s only a small jump from $1.6 billion last year. Still, their stock has risen 18% this year, though it’s behind the S&P 500, which gained 21%.

BlackRock is planning to focus more on private credit and other high-return investments. With their recent buys and focus on private markets, they’re set to keep growing. $11.5 trillion isn’t just a number for BlackRock. It’s proof they’re staying strong, adapting, and leading in a changing market.