Several investing strategies have emerged as Bitcoin and crypto continue to grow in value and expand their use cases. For many, the investing thesis focuses on Bitcoin and Ethereum, two of the biggest cryptos by market cap. Others value finding the next ‘meme coin’ ready for a bull run. But perhaps their most enduring strategy is to buy and hold, or ‘HODL.’

The investing thesis is straightforward—just buy and hold Bitcoin and wait for the crypto to appreciate. According to Glassnode, an on-chain analytics firm, Bitcoin has more holders than ever. The firm adds that Bitcoin’s illiquid supply has gradually increased in recent months, suggesting that more users are holding BTC than selling or trading it in the market.

Metrics Suggest An Increasing Number Of BTC Holders

Market data and holding signals suggest a growing number of investors, suggesting a bullish sentiment on the cryptocurrency. According to Crypto Banter, BTC’s stored supply has gradually increased over the past months. The website adds that this trend gives a ‘HODLING vibes,’ suggesting that a market rally is on the horizon.

Stored supply increasing for months = mega HODLing vibes pic.twitter.com/0Bl4WtP3Hy

— Crypto Banter (@crypto_banter) October 21, 2024

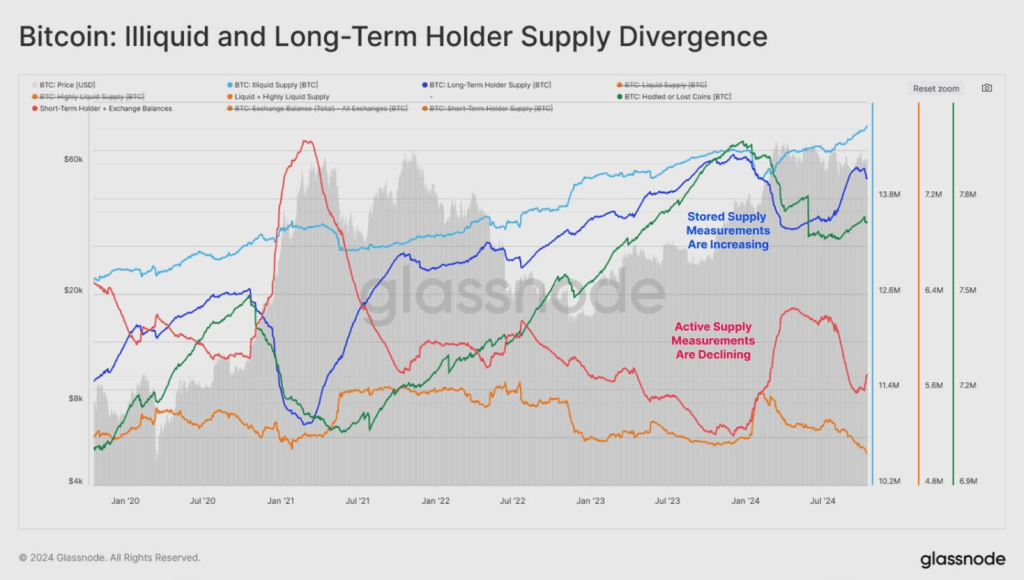

Glassnode data agrees, suggesting an increasing trend for stored supply and a declining trend for active supply. The firm’s stored supply metrics include long-term holder supply, BTC HODLed or missing coins, and the coin’s illiquid supply. On the other hand, exchange balances and short-term coin supply are considered active supply metrics.

Exchanges Report Declining Reserves

There has been a gradual but steady reduction in Bitcoin’s supply, confirming many analytics firms’ thesis. The decrease in highly liquid and liquid BTC supply started in 2024. According to Glassnode, the number of Bitcoin or lost BTCs has dipped compared to data at the start of the year.

CryptoQuant adds that centralized exchange BTC reserves are falling. At 2.64 million BTC, exchanges keep the coin around its all-time low, after a November 2023 decline. Exchange reserves typically indicate selling pressure, lowering prices. According to CryptoQuant and Glassnode, investors now prefer to buy and hold rather than trade.

Institutional Investors Helping Prop Up Bitcoin

Financial institutions and other big-time investors are growingly interested in the rising number of holders. A September River Financial research indicates that BTC use increased by 30% in one year and a stunning 587% since 2020. Based on the same analysis, institutional investors currently own about 8% of all Bitcoin available.

Many investors now see Bitcoin as a better hedge against inflation and a way to diversify assets. River Financial adds that US companies now boast over 49% in BTC holdings, valued at $19.7 billion. The increasing demand for ETFs also drives Bitcoin’s growing popularity. The current cumulative value of BTC assets stands at $66.11 billion.

Featured image from Milk Road, chart from TradingView