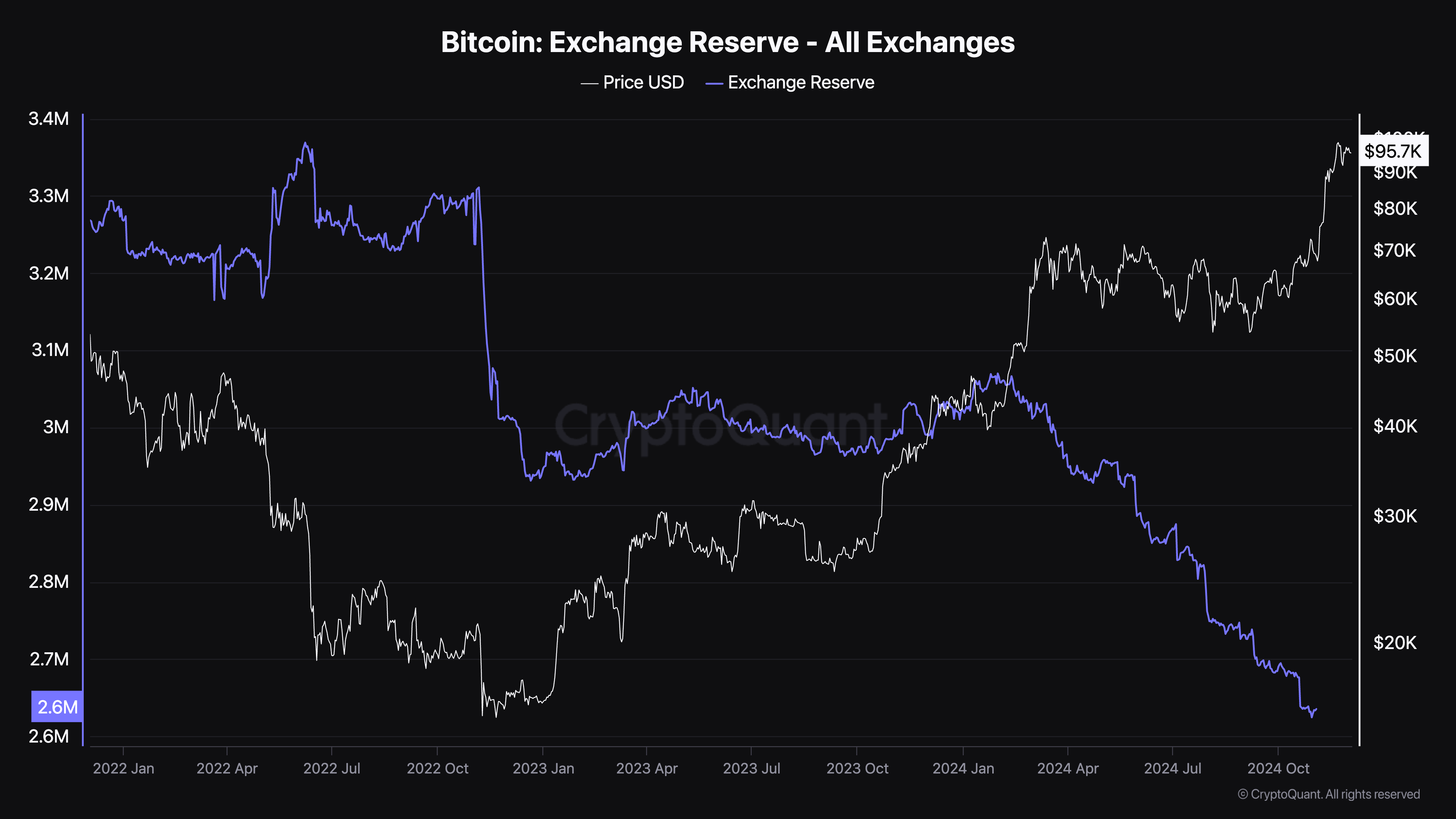

According to data from CryptoQuant, Bitcoin (BTC) reserves on cryptocurrency exchanges have dropped to a multi-year low. This decline coincides with the ongoing bull market, which has pushed the digital asset’s price closer to the $100,000 mark. This significant decline could have major implications for the asset’s supply-demand dynamics.

Investor Confidence Increasing In Bitcoin?

During a bull market, Bitcoin reserves on exchanges increase as long-term holders (LTH) and short-term holders (STH) transfer their holdings to trading platforms to take profits. However, the current bull market is breaking this trend, as BTC exchange reserves dwindle.

Data from Cryptoquant indicates that over 171,000 BTC have been withdrawn from crypto exchanges since pro-crypto Republican candidate Donald Trump won the November US presidential election. The high amount of BTC being withdrawn from exchanges suggests that holders are likely moving their holdings to cold wallets, signaling long-term confidence in BTC.

According to the chart below, BTC exchange reserves witnessed a sharp decline starting in November 2022 – falling from 3.33 million BTC on November 5, to 2.93 million BTC on December 21.

Another notable drop began in February 2024, likely in anticipation of the Bitcoin halving in April and the ensuing supply scarcity of the digitally-programmed asset. During this period, reserves decreased from 3.05 million BTC to 2.63 million BTC by October 30 – a decline of 13.77% over eight months.

Exchange reserves stand at just 2.46 million BTC, the lowest level in years. This ongoing decline hints at a potential supply crunch for Bitcoin, which could propel its price upward in the coming months.

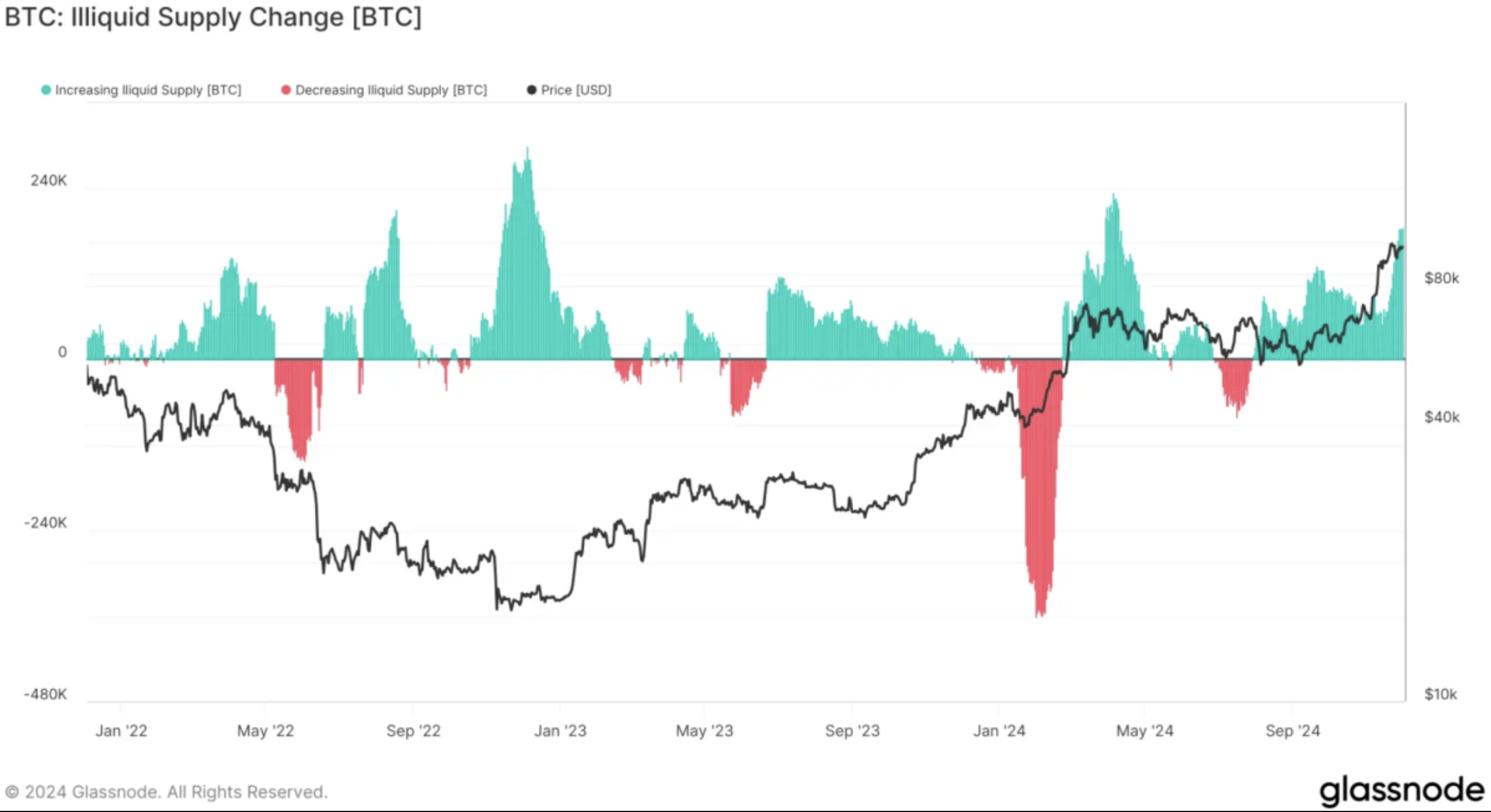

BTC Illiquid Supply Continues To Grow

Another data point that supports the long-term holding hypothesis for BTC is Glassnode’s illiquid supply metric. The chart shared below shows that the digital asset’s illiquid supply has grown by 185,000 BTC in the past 30 days.

Notably, the illiquid supply now accounts for approximately 14.8 million BTC, representing nearly three-fourths of the current circulating supply of 19.8 million BTC. If this trend continues, Bitcoin’s price could experience a significant surge due to supply scarcity. However, this could also introduce heightened volatility.

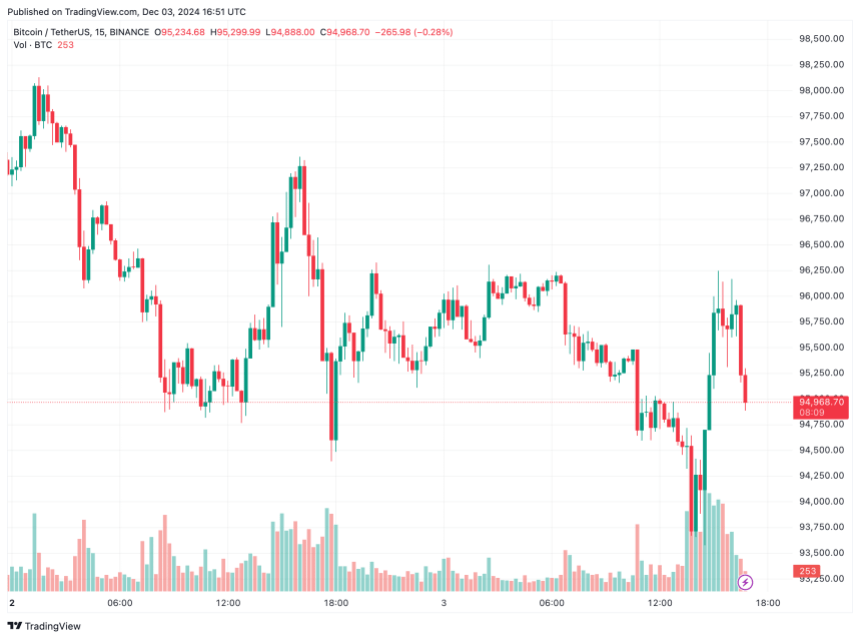

While the decline in exchange reserves and rising illiquid supply are long-term bullish indicators for Bitcoin, short-term price movements could see a brief correction. According to crypto analyst Ali Martinez, BTC has formed a head-and-shoulder pattern on the hourly chart, which may trigger a sell-off that can push the asset’s price to $90,000.

That said, another seasoned crypto analyst, Rekt Capital, said that after briefly touching the $98,000 price level, BTC has already entered the parabolic phase of the rally. BTC trades at $94,968 at press time, down 1.4% in the past 24 hours.