Bitcoin’s price is rising presently, showcasing the potential for further upside growth. However, optimism and confidence in the largest cryptocurrency asset might be gradually decreasing as long-term holders’ balances have fallen sharply in the past few days.

Are Long-term Holders Of Bitcoin Losing Faith In The Asset?

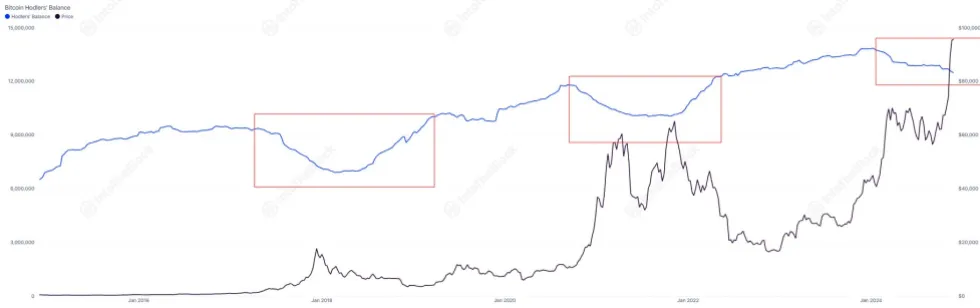

Recent reports show a shift in investors’ sentiment due to Bitcoin’s long-term holders’ balances dropping to a new low in years. Leading market intelligence and advanced DeFi platform IntoTheBlock shared the development on the X (formerly Twitter) platform, prompting speculation about the reasons for the current dumping activity.

This negative pattern points to heightened profit-taking or strategic repositioning as the price of Bitcoin fluctuates constantly. It is important to note that the steep decline in long-term holdings may impact market dynamics, possibly influencing BTC’s price stability and indicating a change in the attitude of seasoned investors.

According to IntoTheBlock, with a steady decrease in their holdings, the long-term Bitcoin holders currently own about 12.45 million BTC, marking its lowest level since July 2022, which reflects reduced confidence in the digital asset among old investors.

Also, the platform highlighted that this sharp decline is less significant than in past cycles. Unlike past cycles, whereby the long-term holders‘ balances fell by 15% and 26% in 2021 and 2017, respectively, this cycle has seen a decline of 9.8%, indicating less impact on the asset’s value than previous ones.

Since a drop in long-term holder balances has been observed to influence Bitcoin’s momentum over time, the development is now being closely watched in order to determine the short-term trajectory of BTC’s price and wider market ramifications.

Kyle Doops, a technical analyst and host of the Crypto Banter show, also pointed out a shift among long-term Bitcoin holders as they continue to distribute large amounts of the digital asset in light of price fluctuations.

The expert noted that there has been a substantial outflow of over 507,000 BTC from long-term holders since September. However, this massive outflow is much less than the 934,000 BTC that was sold during the rally to the previous all-time high in March this year. Given that this cautious selling suggests growing faith in Bitcoin’s future potential, Kyle Doops claims the bulls may just be getting started.

Bullish Sentiment Building Up For BTC

After a sudden drop on Tuesday to the critical $93,000 threshold, a level that has proven to be challenging for bulls, BTC has regained its upward strength, triggering a rebound to the $96,000 mark once more. This quick rebound reflects its resiliency in periods of waning market performance.

With a nearly 2% increase in the last 24 hours, Bitcoin is presently trading at $96,638, demonstrating signs of more gains. Furthermore, bullish sentiment seems to be developing toward BTC as its market cap and trading volume are slowly rising, recording 1.23% and 1.66% increases, respectively, in the past day.