The post MakerDAO (MKR) Defies Market Trend, Poised for 50% Surge appeared first on Coinpedia Fintech News

In this bearish market trend, where major assets are struggling to gain momentum, MakerDAO (MKR) has outperformed major cryptocurrencies and defied the market trend. As of today, February 18, 2025, MKR has gained 7% in the past 24 hours, topping the crypto market and showing signs of a potential price rebound.

MakerDAO (MKR) Current Price

MKR is currently trading near $1,065, and during the same period, it has attracted interest and confidence from traders and investors, resulting in a 10% increase in trading volume. This impressive price surge amid bearish market sentiment appears to be shifting MKR’s sentiment from a downtrend to an uptrend.

MKR Price Action and Upcoming Level

According to expert technical analysis, MKR has been moving in a downtrend, following a descending channel price action pattern. However, with the recent upside momentum, the price is on the verge of breaking out of this descending pattern.

Based on the recent price momentum and historical patterns, if MKR breaches this pattern and closes a daily candle above the $1,070 level, there is a strong possibility it could soar by 50% to reach the $1,600 level in the future.

During the rally, MKR may face slight resistance near $1,100, as the 200 Exponential Moving Average (EMA) on the daily time frame currently lies near that level.

Bearish On-Chain Metrics

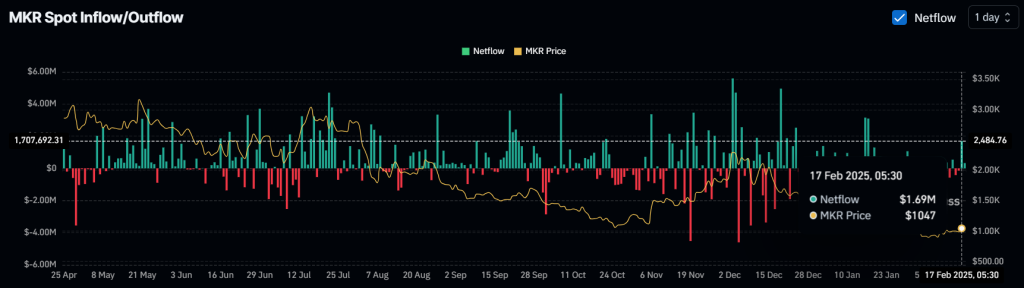

Following this bullish price action and recent price jump, investors and long-term holders have started dumping MKR tokens, as reported by the on-chain analytics firm Coinglass.

Data from the spot inflow/outflow reveals that exchanges have witnessed an inflow of $1.85 million worth of MKR tokens in the past 24 hours, which suggests a potential sell-off. Such inflows of assets from wallets to exchanges are often seen as a sign of a potential price drop and increased selling pressure.

When combining these on-chain metrics with the technical analysis, it appears that the asset is bullish. However, as the price soars, it might have given those who purchased during the recent dip the opportunity to dump their holdings for profit booking.