The post Time to buy XRP? $55 million of Asset Outflow from Exchanges appeared first on Coinpedia Fintech News

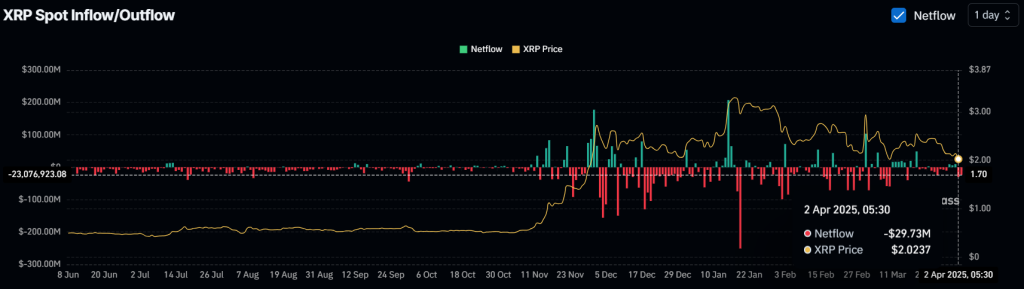

XRP, the native token of Ripple Labs, is gaining massive attention from long-term holders despite a significant sell-off in the cryptocurrency market. On April 4, 2025, data from an on-chain analytics firm revealed that exchanges have been witnessing continuous outflows, even as the asset’s price continues to decline.

$55 Million Worth of XRP Outflow

Data from Coinglass revealed that exchanges have witnessed an outflow of a significant $55 million worth of XRP tokens over the past 48 hours. This substantial outflow from exchanges indicates a sign of accumulation and further raises a concern about whether this is an ideal level to buy or not.

Current Price Momentum

At press time, XRP is trading near $2.05 and has recorded a price decline of over 5% in the past 24 hours. However, during the same period, its trading volume jumped by 95%, indicating increased market activity and explaining the asset’s outflow from exchanges.

XRP Price Action and Upcoming Levels

According to expert technical analysis, the asset has reached a key level following this massive price decline, creating a make-or-break situation for XRP. The asset’s daily chart reveals that it has formed a bearish head and shoulders pattern and is currently near the neckline.

However, this level is crucial due to its historical price momentum. Historically, whenever XRP reaches this level, it tends to show a price reversal or rebound, which might explain the recent outflows from exchanges.

However, if the current market sentiment remains unchanged and the price continues to fall, there is a strong possibility that XRP could drop by 44% to reach the $1.20 level in the future.

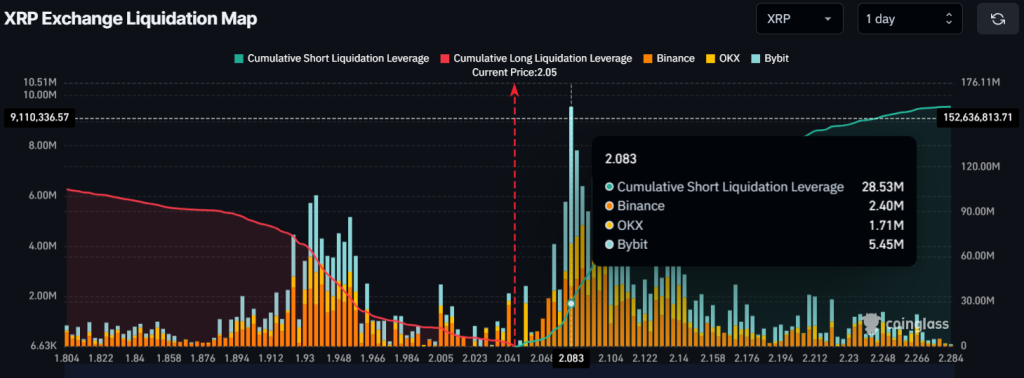

$58 Million Worth of Bullish Bet

Coinglass liquidation data shows that traders are currently bullish on XRP. At press time, the major liquidation levels or over-leveraged positions are at $2.08 on the upper side and $1.93 on the lower side. At these levels, traders have built $28 million and $58.70 million worth of short and long positions, respectively, over the past 24 hours.

These levels indicate that bulls are currently dominating the asset and are hoping that XRP’s price will not fall below the $1.93 level in the coming days.