The post Solana (SOL) Poised to Hit $145 Level, Here’s Why appeared first on Coinpedia Fintech News

SOL, the native token of the Solana blockchain, seems to be shifting its bearish market sentiment after a notable price decline over the past few days. On April 4, 2025, following Treasury Secretary Scott Bessent’s bold statement that “Bitcoin is becoming a store of value,” the overall crypto market showed an impressive upside rally.

Current Price Momentum

Amid this, SOL has registered a price surge of over 8% in the past 24 hours and is currently trading near $123. During the same period, its trading volume dropped by 9%; however, it seems to be recovering as the market continues to maintain the upside rally following Bessent’s statement.

This upside momentum was recorded when SOL’s price was retesting its crucial support level of $114.

Solana (SOL) Technical Analysis and Upcoming Levels

According to expert technical analysis, SOL appears to be forming a bullish double-bottom price action pattern on the daily time frame. However, the pattern is not yet complete, as the daily chart currently shows a single leg with two bottoms at the key horizontal support level of $114.

In addition to the bullish price action pattern, SOL’s daily chart has also formed a bullish divergence, indicating that the asset is poised for a massive upside rally.

Based on the recent price action and historical momentum, if SOL’s price remains above the $114 level, there is a strong possibility it could soar by 18% to reach the $144.5 level — or even higher in the future.

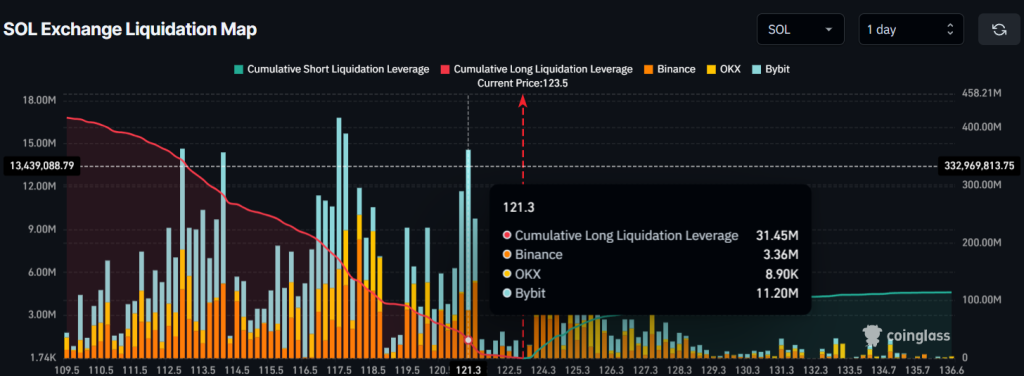

Major Liquidation Levels

This shift in sentiment and the strength of SOL’s upside momentum are putting $11.5 million worth of short positions at risk of liquidation, as reported by the on-chain analytics firm Coinglass.

Data reveals that traders are currently over-leveraged, with key levels at $121.3 on the lower side and $124.1 on the upper side, holding $31.45 million and $11.50 million worth of long and short positions, respectively.

While examining the on-chain metrics, it appears that the bulls are back and currently dominating the asset.