The post Cardano (ADA) Price Prediction for April 5 appeared first on Coinpedia Fintech News

ADA, Cardano’s native token, remains stable after a major shift in market sentiment following Treasury Secretary Scott Bessent’s bold statement. The ADA price is holding steady near a key support level of $0.635, keeping it in a make-or-break zone.

Current Price Momentum

At press time, ADA is trading near $0.657 and has recorded a modest 0.50% uptick over the past 24 hours. However, during the same period, the asset’s trading volume jumped by 10%, indicating heightened participation from traders and investors compared to the previous day.

Cardano (ADA) Price Action and Upcoming Levels

With its ongoing consolidation between $0.635 and $0.682, ADA’s price remains near the key support level of $0.635, where it has held for the past week. According to expert technical analysis, the price is expected to remain in this narrow range until it breaks out or breaks down from the consolidation.

Based on historical patterns, if the ADA price breaches the upper boundary of the zone and closes a daily candle above $0.69, it could soar by 20% to reach the $0.85 mark in the future. On the other hand, if ADA breaches the lower boundary of the zone, its price could crash, potentially dropping by 25% to 28% and reaching its key support at $0.45.

This price analysis of ADA shows that the current consolidation is playing a key role in determining ADA’s upcoming levels.

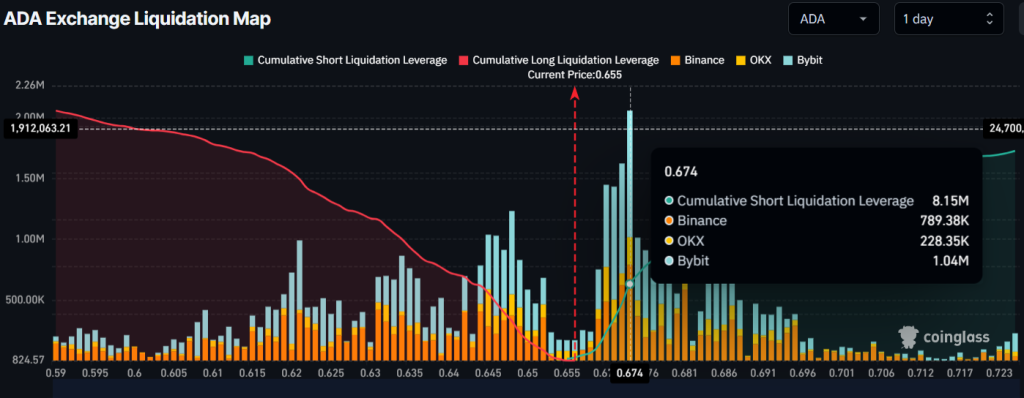

$8.15 Million Worth of Bearish Bet

Looking at ADA’s market structure, traders appear to be strongly betting on the short side, according to the on-chain analytics firm Coinglass.

Data reveals that traders are currently over-leveraged at $0.648 on the lower side, where they have built $4.21 million worth of long positions. Meanwhile, $0.674 is another over-leveraged level on the upper side, where traders have built $8.15 million worth of short positions.

These over-leveraged positions reflect the current market sentiment, which appears to be bearish, but a clearer picture will only emerge once the consolidation phase breaks.