On Thursday, April 3, United States President Donald Trump announced new trade tariffs on goods from different countries, with some Asian nations facing even steeper fees. While the US financial markets reacted negatively to this economic action, the crypto and Bitcoin markets have been able to withstand the global macroeconomic pressure.

Bitcoin Price Overview

According to data from CoinGecko, the price of Bitcoin has barely made any significant move over the last seven days. However, this piece of data does not tell the entire story, as the premier cryptocurrency made a play for the $87,000 mark on Wednesday, April 2, before recently falling back to around $84,000.

The price of Bitcoin is being closely watched by market participants and speculators, especially considering the underwhelming performance of the US equities market over the past two days. This recent development suggests that the world’s largest cryptocurrency might be decorrelating from the traditional markets.

As of this writing, the premier cryptocurrency stands at around $84,000, reflecting an over 2% increase in the past 24 hours. This single-day performance might bode well for what is to come over the weekend, especially as the Bitcoin price has not particularly impressed at the latter end of each week so far in 2025.

Is A BTC Price Bounce On The Horizon?

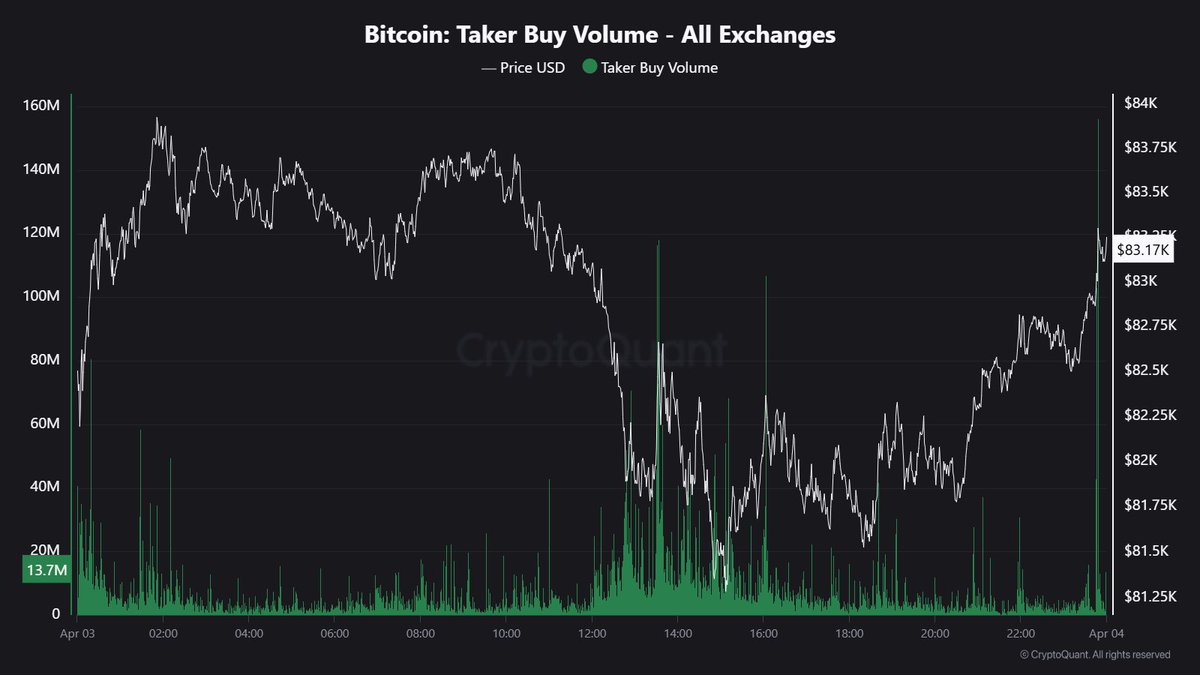

In a new post on the X platform, crypto analyst Maartunn revealed that the Bitcoin bulls might be on the move again. This on-chain observation is based on changes in the Taker Buy Volume, a metric that measures the total volume of buy orders filled by takers in perpetual swaps of a specific cryptocurrency.

In the crypto trading context, a taker refers to a market participant who places an order matched with an existing order on the order book. Hence, the Taker Buy Volume indicates the total amount of a cryptocurrency (BTC, in this scenario) purchased by these market participants within a specific period.

Maartunn mentioned in his post that the “taker buyers” are beginning to step into the market, with the buy volume surpassing a significant milestone. According to the on-chain analyst, the Bitcoin Taker Buy Volume on all centralized exchanges recently crossed 100 million BTC to around 101.18 million BTC.

Historically, notable upticks in the Taker Buy Volume have often preceded a bullish surge in the price of Bitcoin. Going by this trend, Maartunn urged to watch out for the BTC price action over the next few days.