Some cryptocurrency enthusiasts are making eye-catching predictions about XRP. They suggest that buying just 1,000 tokens could set investors up for life by the end of this decade.

Online Influencers Push Optimistic XRP Price Targets

Based on social media comments, XRP supporter Duefe recently asserted that holding 1,000 coins could be sufficient to gain “a joyful and free life” by 2029. This is a remarkable prediction based on prices now. Based on today’s price of $2.17 per token, 1,000 XRP would be worth $2,170.

For this modest investment to equal $1 million – a figure many believe is required for early retirement – every XRP would have to reach $1,000. This kind of expansion would necessitate a price increase of more than 45,900% from where they are today.

1000 XRP is enough for a joyful and free life.

Just hold until 2029.$XRP

— Duefe (@cryptoshab) April 14, 2025

Other voices within the XRP universe concur. Edo Farina, one of the best-known advocates, has gone so far as labeling the choice to not hold a minimum of 1,000 XRP as “insanity,” according to reports from within the crypto space.

Not owning at LEAST 1,000 $XRP is the definition of insanity.

Full Video: https://t.co/hWuxKcPx6E pic.twitter.com/j05yZ4ei6Q

— EDO FARINA 🅧 XRP (@edward_farina) March 17, 2025

Wallet Data Shows Limited Distribution

Statistics from the XRP Rich List indicate that a mere 230,500 wallets now hold between 500 and 1,000 units. Of the 6.38 million total wallets out there, only 10% (approximately 638,000) have 2,500 tokens or more.

These statistics indicate that if such astronomical price rises did happen, the wealth would be in the hands of a relatively small number of early adopters.

Price Projections Differ Considerably Among Experts

Not every prediction sets its sights as high as $1,000 per token. Some estimate XRP could hit at least $25 by 2029. Although this is well below the $1,000 it would take to convert 1,000 XRP into $1 million, it would still be a return of about 1,000% above today’s price.

Others think the $1,000 price could be achieved, but within a longer timeframe of around a decade.

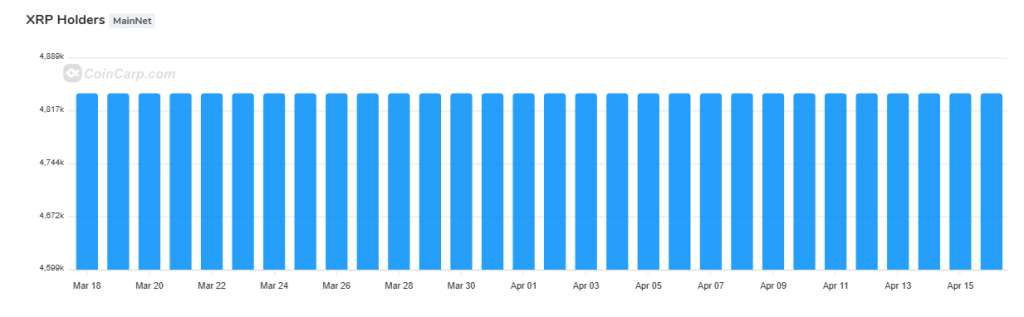

XRP Holder Count Steady At 4.81 Million Over The Past Month

Meanwhile, the count of XRP holders on the mainnet has been incredibly stable between March 18 and April 15, staying close to the 4.81 million mark based on data from CoinCarp. The stability indicates that investor sentiment for XRP has been stable, with no indication of large-scale accumulation or large-scale exits.

In the face of market uncertainty or price oscillations in the same time frame, holders of XRP seem to be holding steady, perhaps indicative of faith in the long-term value of the token or a wait-and-see attitude among retail and institutional players alike. Data also indicates a more mature base of holders who are not responding irrationally to short-term price swings.

Featured image from Pexels, chart from TradingView