Investors in Dogecoin were sent mixed signals this week after market analysts disclosed forecasts regarding the future price action of the meme cryptocurrency. Some predict a spectacular rally, while others forecast a sharp decline before there can be any rally.

Analyst Predicts 500% Price Jump Based On Chart Pattern

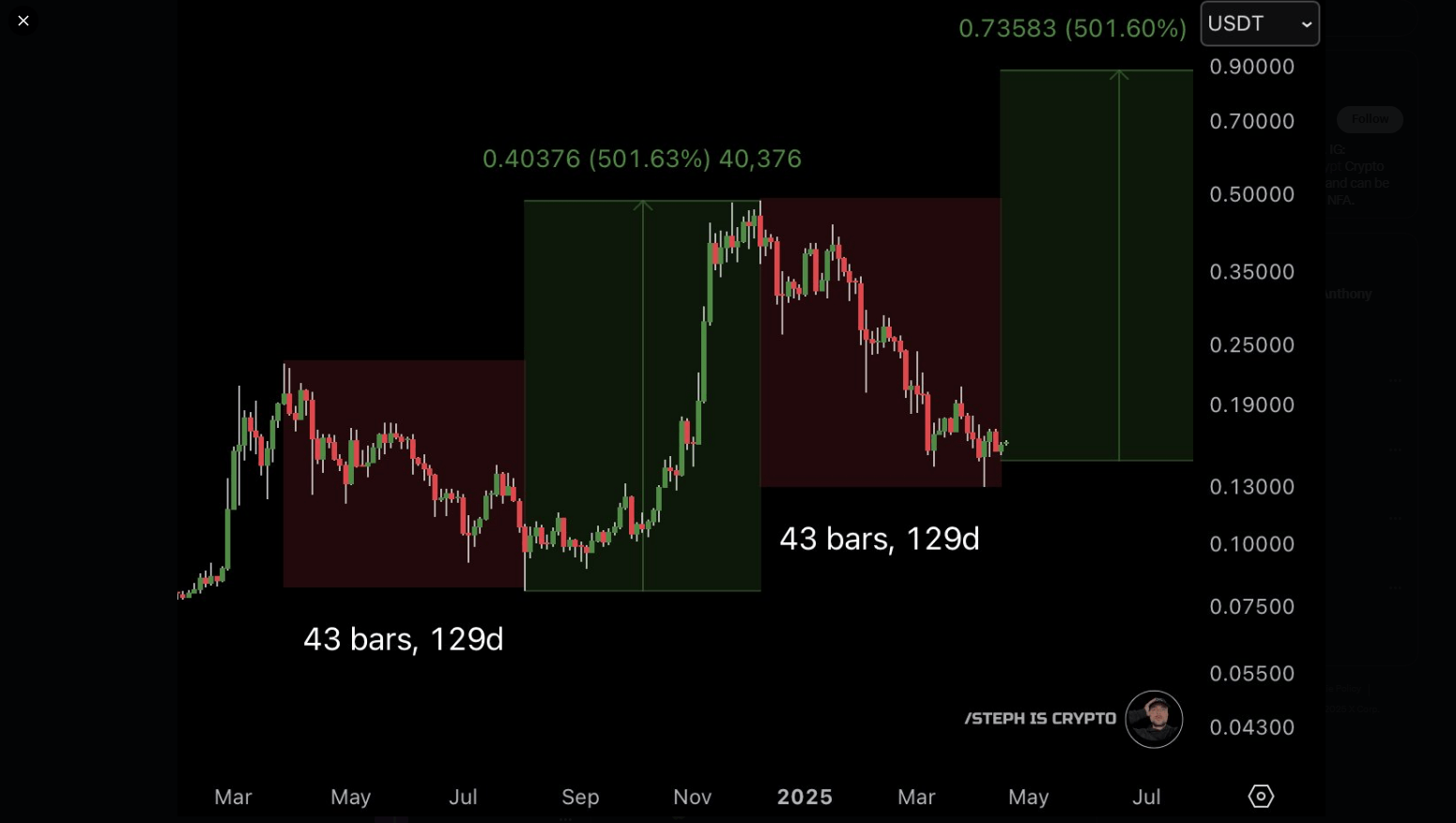

From crypto commentator “Steph is Crypto,” Dogecoin looks primed for an epic price surge in excess of 500%. That’s the estimate based on a chart pattern seen before a preceding market cycle during which Dogecoin surged 501% after trending down in the last few weeks.

“Bottom signal flashing,” Steph tweeted on social media site X, implying that the same pattern is developing again following another 129-day downtrend. If this trend holds, Dogecoin will rise as much as $0.73583 within the next few weeks.

SIGNAL:$DOGE BOTTOM SIGNAL FLASHING.

PREPARE FOR +500% IN THE NEXT WEEKS! #DOGECOIN pic.twitter.com/qGI9Sea4ZJ

— STEPH IS CRYPTO (@Steph_iscrypto) April 19, 2025

The Drop Before Reversal

Not everyone agrees with this optimistic view, though. An alternative prediction from SwallowAcademy on TradingView is that Dogecoin may first see a dramatic fall before it can go up. Their study of the price action of Dogecoin relative to Tether (USDT) indicates a possible 40% drop to the $0.09 support level.

SwallowAcademy’s analysis observes that following a brush with close to $0.23 earlier this year, Dogecoin dropped to $0.09 before rising above $0.45.

The analyst foresees the same trend happening, with a sharp drop followed by a four times jump that might ultimately retest the $0.45 level. When this report was made, Dogecoin was trading above $0.15.

Short-Term Trader Numbers Spike

Market intelligence company IntoTheBlock’s data shows dramatic shifts in the behavior of Dogecoin holders. Long-term holders who owned the cryptocurrency for more than a year fell by 2.67% last month. Medium-term holders (one to 12 months) fell by nearly 12%.

Meanwhile, short-term traders with holding time of less than one month rose by over 100%. This radical movement toward short-term speculation might signify greater price volatility since these traders will respond rapidly to changes in the market.

Large Investor Activity Shows Massive Increase

Perhaps the most dramatic statistics come from monitoring large holder transactions. Large holder inflows increased by over 5% in the last week, as reported by IntoTheBlock. On a longer term basis, these inflows were up 324% in the last 30 days.

This increase in whale activity indicates significant investors may be setting themselves up for future price action even though daily trading continues to be dominated by smaller, short-term traders.

Featured image from Unsplash, chart from TradingView