The post Bitcoin Whale Profits $4.7M from 50 BTC Mined 15 Years Ago appeared first on Coinpedia Fintech News

A Bitcoin whale just woke up, moving 50 BTC mined over 15 years ago, now worth nearly $4.7 million, showcasing the incredible 93 million percent profit. Meanwhile, whales are piling into Bitcoin again, signaling strong market confidence and pushing prices to new highs.

Bitcoin Whales Break 15-Year Silence with $5M Transaction

A long-dormant Bitcoin whale woke up, drawing attention from across the crypto space. According to The Bitcoin Historian, a wallet holding 50 BTC mined 15 years ago has moved its funds.

These coins, originally mined in 2010 when the price of 1 BTC was below $0.10, have now profited by an astonishing 93,460,500%.

Overall, the value of 50 BTC was less than $5. Today, with Bitcoin trading above $94,000, the same holdings are now worth nearly $4.7 million.

A similar case unfolded in November 2024, a BTC holder earned a massive profit of 150 million percent, when he sold his 2,000 BTC holdings, originally worth just $120, for approximately $179 million.

Are Whales buying Bitcoin Right Now?

According to Santiment data, Bitcoin whales (wallets holding between 10 to 10,000 BTC) have added 19,255 BTC in just one week. This brings their total holdings to an all-time high of 13.47 million BTC. At the same time, Bitcoin’s price jumped by 11.2%, reaching $94,430.89.

This pattern shows that when these large investors buy more BTC, it often leads to a rise in price. Their buying reduces the supply available in the market, which can push prices higher.

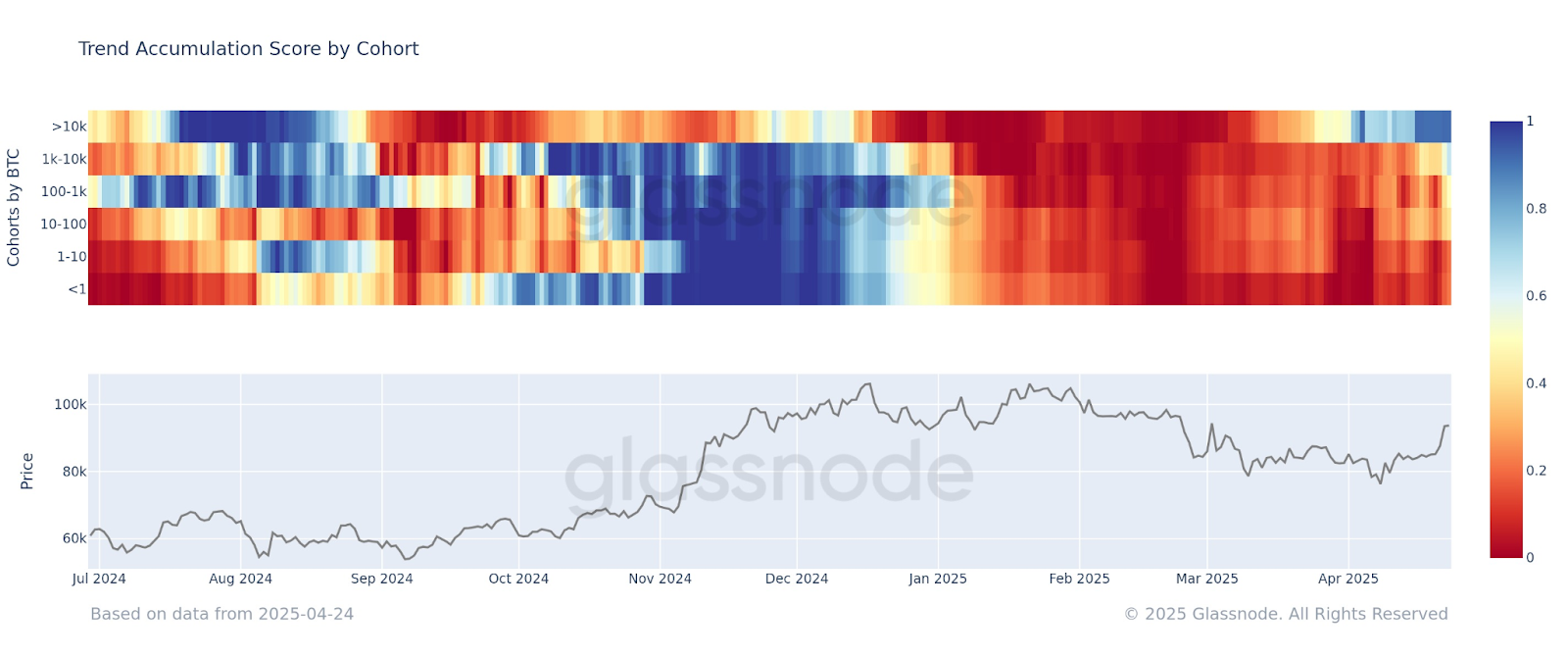

Glassnode’s latest data shows that large Bitcoin holders are buying more during the recent price rise. Wallets with over 10,000 BTC are in heavy buying mode, while those holding 1,000 to 10,000 BTC are not far behind. Even mid-sized wallets with 100 to 1,000 BTC are starting to increase their holdings. This overall buying trend suggests strong confidence in the market and expectations of further growth.

Bitcoin's value has jumped +11.2%, and this has once again coincided with key whales & sharks adding on to their already enormous bags. Wallets holding 10-10K

Bitcoin's value has jumped +11.2%, and this has once again coincided with key whales & sharks adding on to their already enormous bags. Wallets holding 10-10K