Bitcoin is currently trading above $93,000, showing strength after weeks of volatility and consolidation. The latest breakout suggests bulls are gaining control, with momentum leaning toward a continued push higher. However, macroeconomic uncertainty continues to cloud market sentiment, with analysts split on what’s next. Some believe this marks the beginning of a recovery phase, while others warn that the worst of the correction may still lie ahead.

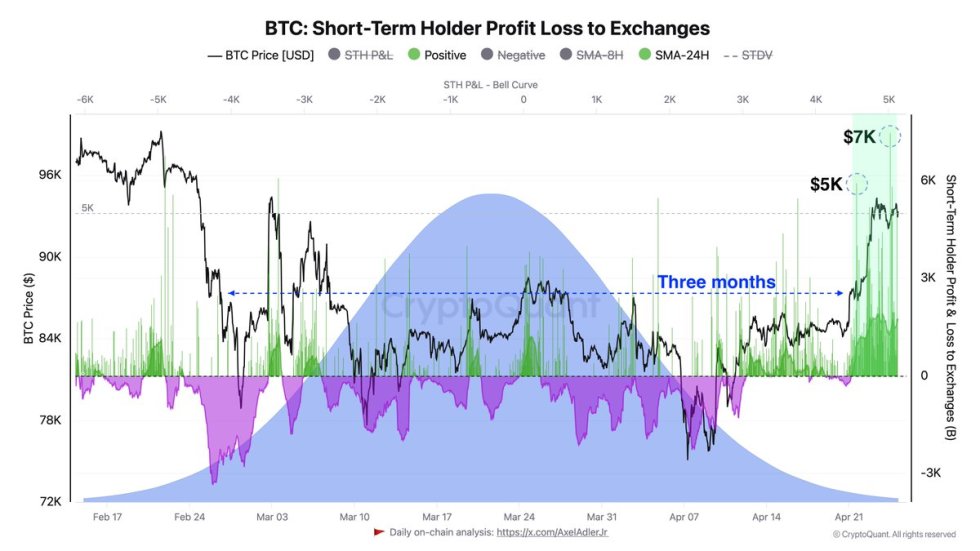

Adding to the mixed signals, new data from CryptoQuant reveals that short-term holders—those who have been underwater for the past three months—are now actively selling their coins. This wave of profit-taking appears to have temporarily stalled Bitcoin’s upward trajectory, acting as resistance just as bulls attempt to reclaim the $95K–$100K zone. Historically, this type of selling activity from short-term holders tends to occur during moments of fragile optimism, potentially slowing growth until stronger conviction returns.

For now, all eyes remain on Bitcoin’s ability to maintain support above $90K and push decisively through the $95K level. Whether the current momentum translates into a full recovery or meets another hurdle may depend on broader economic developments and how much more selling pressure short-term holders bring to the table.

Bitcoin Investors Eye $100K Amid Geopolitical Tensions

Bitcoin is currently trading 14% below its all-time high, but bullish momentum is building as the price steadily approaches the $100,000 psychological level. After recovering from recent lows, market sentiment has improved—yet risks remain. The ongoing trade war between the US and China, fueled by rising tariffs and mounting economic pressure, continues to rattle global financial markets. If left unresolved, the conflict could strain supply chains and increase volatility, making investors cautious in both traditional and crypto markets.

Despite these headwinds, there’s optimism that a diplomatic resolution could restore investor confidence and spark a broader financial recovery. Bitcoin, often seen as a macro hedge, could benefit significantly from such a shift.

Top analyst Axel Adler shared timely insights on X, noting that short-term holders—those who were holding at a loss over the past three months—have recently begun selling their positions. This activity has temporarily slowed Bitcoin’s growth. However, Adler points out that exchange demand has fully absorbed this sell-off over the past three days, signaling continued strong market interest.

The $96,000 level remains a key barrier. It represents the average entry price of short-term holders with coins aged 3–6 months, making it a crucial resistance zone. A clean break above this level would likely trigger further upside and pave the way toward new all-time highs.

BTC Price Outlook: Key Levels To Watch

Bitcoin is currently trading at $93,700 as bulls attempt to reclaim the $95,000 resistance level and extend the recent rally. After gaining over 25% since early April, momentum remains strong, and traders are watching closely to see if BTC can maintain its trajectory toward the $100K milestone. However, despite this optimism, some analysts are cautioning that a healthy pullback may be in order before further upside.

Technical indicators show that a retracement to the $89K–$91K range could provide the support needed to fuel another leg higher. If BTC holds above the $92K mark, analysts believe the chances of a breakout above $95K become increasingly likely, as this level serves as a key barrier to unlocking new highs.

Conversely, if BTC fails to defend $92K, a deeper correction could be triggered, potentially taking price back toward the 200-day moving average near $88,000—a level that has historically acted as a dynamic support zone during periods of consolidation. For now, bulls remain in control, but short-term price action around $92K–$95K will likely determine whether Bitcoin is ready to accelerate or cool off.

Featured image from Dall-E, chart from TradingView