SUI has been trading with impressive strength since setting a local low around $1.71 just over two weeks ago. Since Monday, SUI has gained more than 79% in value, reflecting a surge in bullish sentiment and positioning itself as one of the standout performers in the current market environment.

However, risks remain elevated as tensions between the US and China continue to escalate, creating uncertainty across financial markets. Trade conflicts and geopolitical friction could still weigh heavily on risk assets if conditions worsen.

Top analyst Kaleo shared an analysis highlighting that SUI is gaining strength against Bitcoin, marking one of the first times in recent months that an altcoin shows significant relative performance compared to BTC. This strength is notable as most altcoins have struggled to outperform Bitcoin in a market dominated by caution and defensive positioning.

The next few days will be critical in determining whether SUI can sustain its breakout or if a period of consolidation will follow.

SUI Leads Layer-1 Blockchains as Momentum Builds

SUI has positioned itself as one of the leading Layer-1 (L1) blockchains during the recent market rally. A Layer-1 blockchain refers to a base blockchain network, such as Bitcoin or Ethereum, that processes and finalizes transactions without relying on another external chain. These networks operate independently with their own security protocols, native tokens, and decentralized validators, forming the backbone of the broader crypto ecosystem.

Over the past two weeks, SUI has shown remarkable strength, significantly outperforming many other assets. If the market enters a sustained bullish phase for altcoins, SUI is likely to continue leading the pack, thanks to its recent resilience and strong relative performance. However, the environment remains extremely high risk. Some analysts are warning that current levels across crypto and equities could trigger a sharp market-wide retrace if sentiment shifts.

Kaleo’s recent analysis on X suggests that SUI’s strength against Bitcoin is a particularly encouraging sign. He notes that SUI might be one of the first major L1s to hit new all-time highs during this bounce, reflecting strong underlying demand.

The next week will be critical; US equities are now testing major resistance zones, and uncertainty around the ongoing US-China trade conflict continues to weigh heavily on global markets. How financial markets react over the coming days will likely influence whether SUI can extend its rally or enters a period of consolidation alongside broader risk assets.

SUI Battles Key Levels As Bulls Push Forward

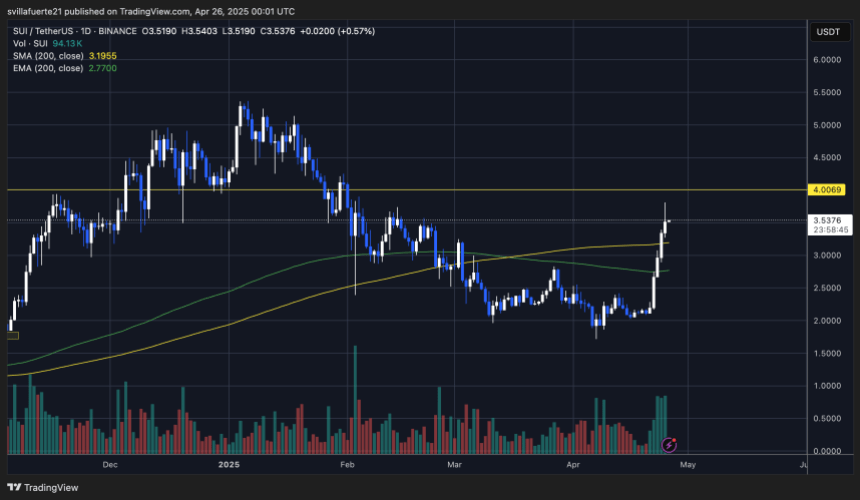

SUI is currently trading at $3.53 after several days of aggressive buying pressure that has propelled the price higher. The bullish momentum has been impressive, positioning SUI as one of the strongest-performing Layer-1 blockchains in the market. However, for this momentum to sustain, bulls must defend critical levels.

The most important short-term level is $3.20, which aligns closely with the 200-day moving average (MA). Maintaining price action above this zone would confirm a bullish market structure and offer a solid foundation for further gains. If SUI manages to hold above the 200-day MA, it would signal strong underlying demand and reinforce bullish sentiment around the asset.

For a continuation of this aggressive uptrend, the key challenge lies at the $4.00 mark. Reclaiming and consolidating above this resistance would open the path toward a potential new all-time high (ATH), especially if momentum remains strong across the broader crypto market.

Featured image from Dall-E, chart from TradingView