The Bitcoin price action has been quite outstanding going into the weekend, reflecting the positive market climate over the past week. According to blockchain analytics firm Santiment, here’s how different groups of investors and market participants are reacting to the recent bullish momentum and how it could impact price over the coming weeks.

Can BTC Reach A New 6-Figure High?

In a recent post on the X platform, Santiment revealed that there has been a positive shift in the mood of Bitcoin investors in the crypto market. This burst of optimism came on the back of the premier cryptocurrency’s run to above the $95,000 level for the first time since February 2025.

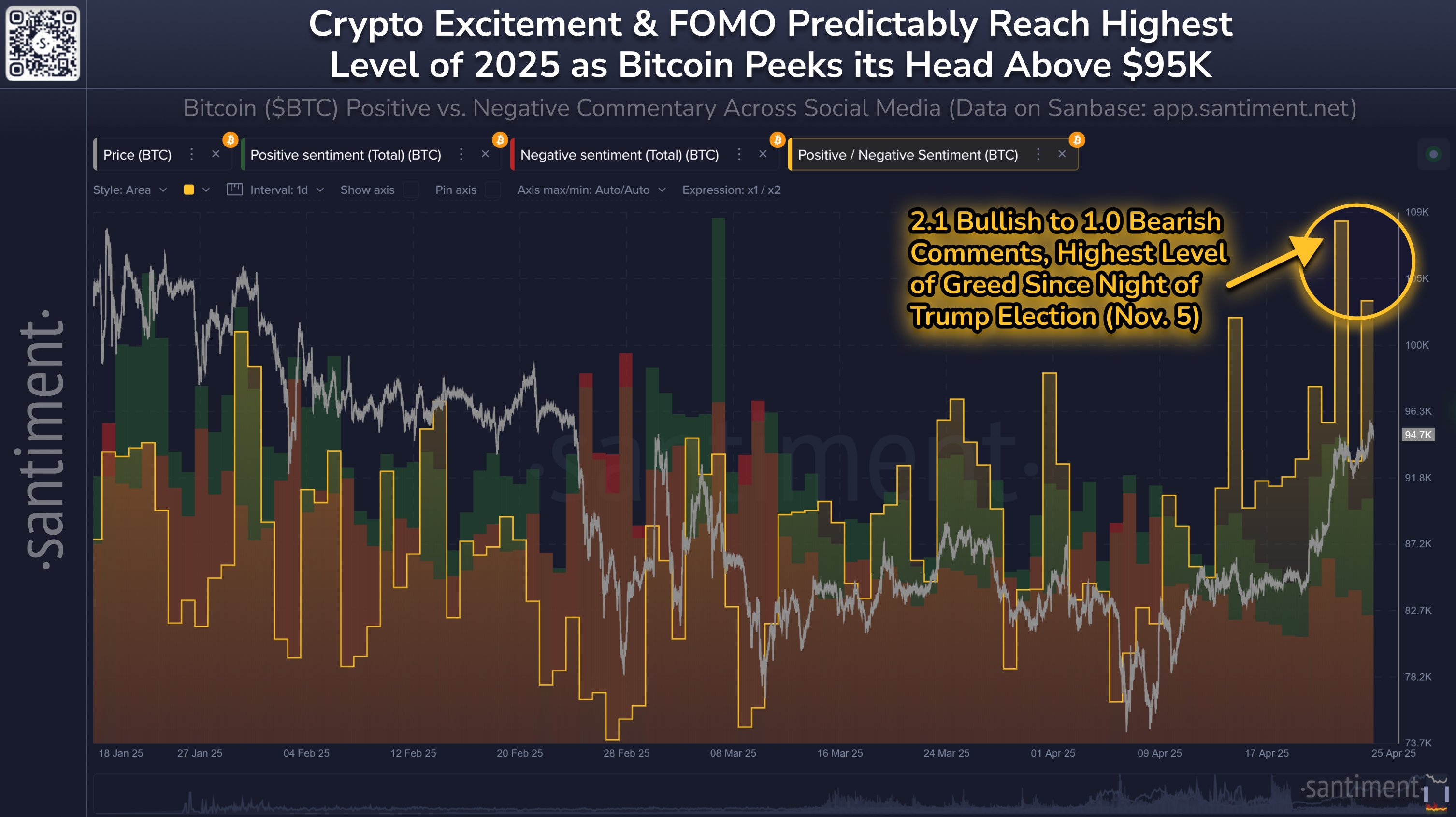

Santiment shared that the excitement and FOMO (fear of missing out) in the Bitcoin market are predictably at their highest level in 2025. Specifically, the level of greed across various social media platforms appears to be climbing significantly, reaching its highest level since the election of Donald Trump as US President.

On-chain data from Santiment shows that the ratio of positive commentary to negative commentary about the Bitcoin price is 2.1 bullish posts to 1.0 bearish posts, reflecting the optimistic and greedy state of the market. As a result, the analytics firm expects the flagship cryptocurrency to be quiet over this weekend.

This sluggish and potentially negative price action over this weekend is connected to the retail traders who are likely to book profits around the current price. However, if the retail investors continue to sell their assets, Santiment noted that the whales (large investors) might mop up the sold coins.

According to the blockchain firm, the buying activity of the whales could be bullish for the Bitcoin price, pushing the market leader toward a six-figure valuation. “If they sell here because they think we are seeing a top, whales would likely scoop up those coins and potentially push Bitcoin above $100K in the next 1-2 weeks,” the post read.

Furthermore, Santiment postulates that the likelihood of reaching a local top around the current price depends on the investor sentiment (the crypto crowd’s level of fear and greed) or the decoupling of Bitcoin from the US equities market. Hence, paying attention to sentiment-related metrics could help provide insight into the next move for the Bitcoin price.

Bitcoin Price At A Glance

As of this writing, the price of BTC stands at around $94,546, reflecting an over 1.5% increase in the past 24 hours.