The altcoin market has been one of the most-affected segments of the crypto industry by the uncertainty that has clouded the global financial markets in the past few months. For instance, Dogecoin — the largest meme coin by market capitalization — lost over 55% of its value in the first quarter of 2025.

However, things seem to be looking up for the DOGE token, as its price jumped by nearly 15% in the past week. According to the latest on-chain observation, this recent rally might just be the beginning of another leg up for the meme coin over the coming weeks.

Is A Sustained Bull Run On The Cards For DOGE?

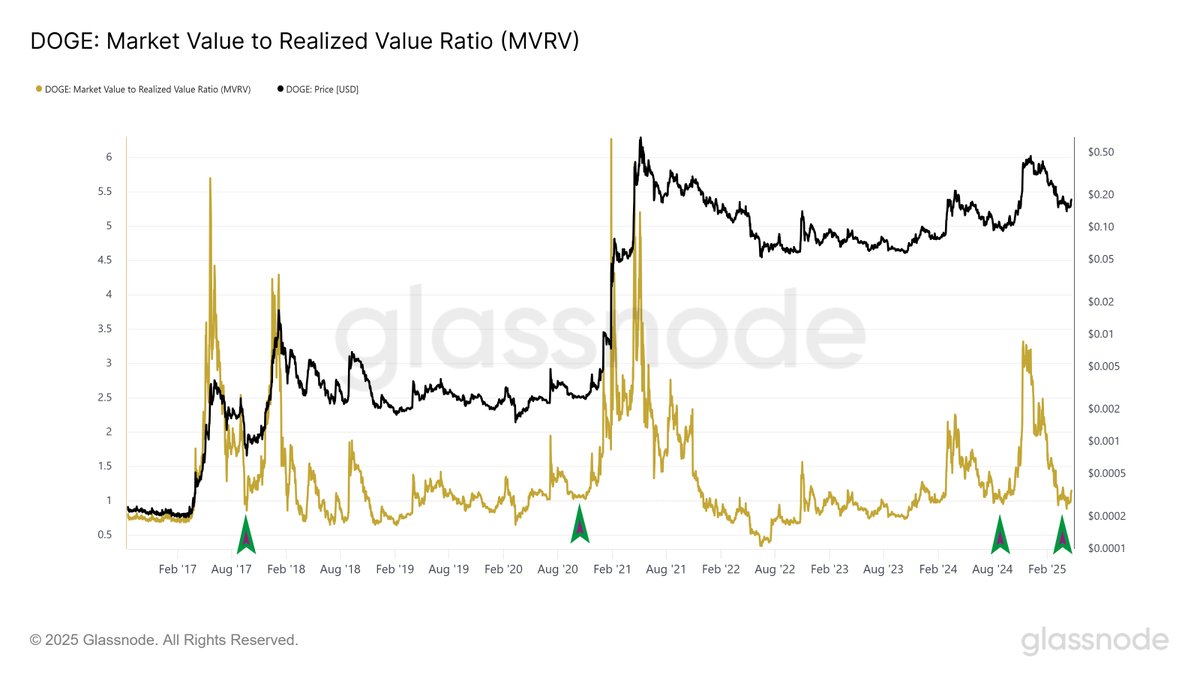

In an April 26 post on the X platform, pseudonymous crypto analyst Cryptollica posited that the price of Dogecoin could be gearing up for an extended bullish period over the next few weeks. This projection is based on the changes in the MVRV metric, which tracks the ratio of a coin’s market cap to its realized cap.

The MVRV ratio basically tells how much value the investors hold (the market cap) against the value they put in (the realized cap). Hence, when the value of this metric is greater than 1, it means that more investors are in profit at the moment. Meanwhile, a less-than-one value implies that most of the market is in the red.

As such, a high MVRV ratio is generally viewed as a price top signal because investors show more propensity to offload their assets when they are in profit. On the flip side, when the metric is below the “1” threshold, it suggests that the market might be bottoming out.

As observed in the chart above, the Dogecoin MVRV ratio seems to be thickening in and around the “1” threshold level. Besides its on-chain significance, this level has proven pivotal in certain trend reversals seen in the past, with the DOGE price bouncing back to a new local high each time the MVRV ratio persists around this mark.

The price of Dogecoin surged by 1,900% and 2,200% in August 2017 and August 2020, respectively, when the MVRV ratio was at its current level. The last time it was around this level in August 2024, the DOGE price rallied by more than 400% to surpass $0.5.

Going by the historical precedent, there is a likelihood that the DOGE price could be preparing for a significant upward movement. Considering the improving market climate, a sustained bullish run might not seem completely out of the question anymore at this point.

Dogecoin Price At A Glance

After briefly touching the $0.19 mark in the early hours of Saturday, April 19, the DOGE price appears to have cooled off. As of this writing, the price of DOGE is hovering around $0.18, reflecting a 0.3% decline in the past 24 hours.